Question

Which of the following statements is/are correct? O a. securities with a zero beta have zero required rate of return O b. a portfolio

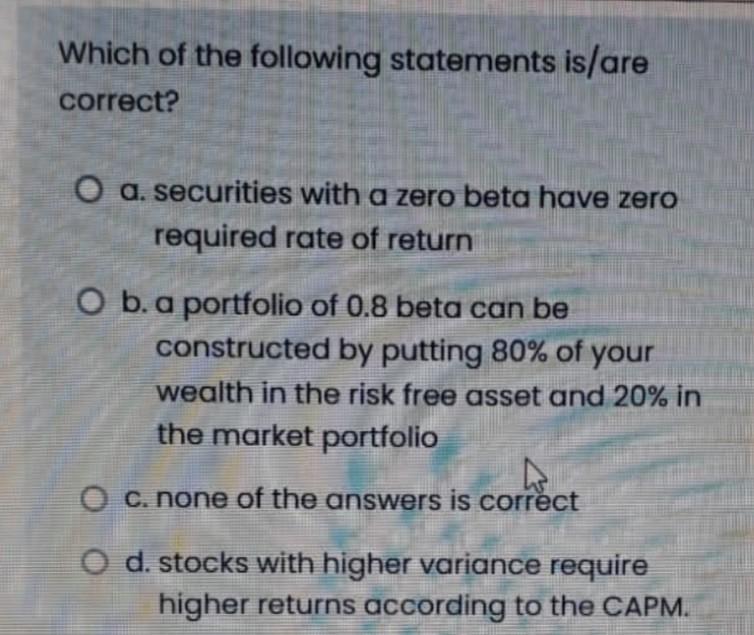

Which of the following statements is/are correct? O a. securities with a zero beta have zero required rate of return O b. a portfolio of 0.8 beta can be constructed by putting 80% of your wealth in the risk free asset and 20% in the market portfolio O c. none of the answers is correct O d. stocks with higher variance require higher returns according to the CAPM.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below Out of the statements providedthe follo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Equity Asset Valuation

Authors: Jerald E. Pinto, Elaine Henry, Thomas R. Robinson, John D. Stowe, Abby Cohen

2nd Edition

470571439, 470571438, 9781118364123 , 978-0470571439

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App