Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Which of the following statements provide relevant information for a taxpayer to use when working out the most appropriate transfer pricing method? Select all that

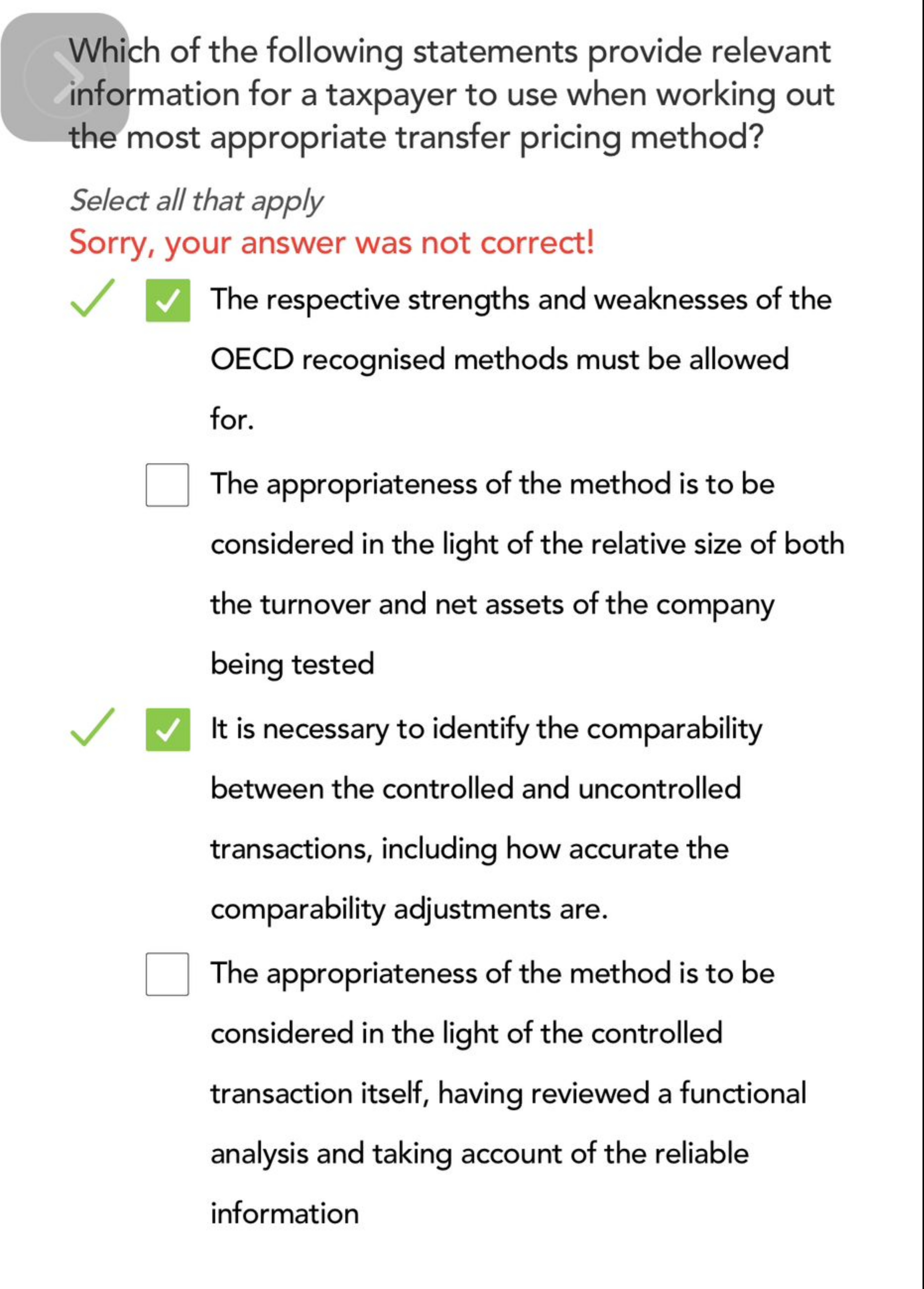

Which of the following statements provide relevant

information for a taxpayer to use when working out

the most appropriate transfer pricing method?

Select all that apply

Sorry, your answer was not correct!

The respective strengths and weaknesses of the

OECD recognised methods must be allowed

for.

The appropriateness of the method is to be

considered in the light of the relative size of both

the turnover and net assets of the company

being tested

It is necessary to identify the comparability

between the controlled and uncontrolled

transactions, including how accurate the

comparability adjustments are.

The appropriateness of the method is to be

considered in the light of the controlled

transaction itself, having reviewed a functional

analysis and taking account of the reliable

information

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started