Answered step by step

Verified Expert Solution

Question

1 Approved Answer

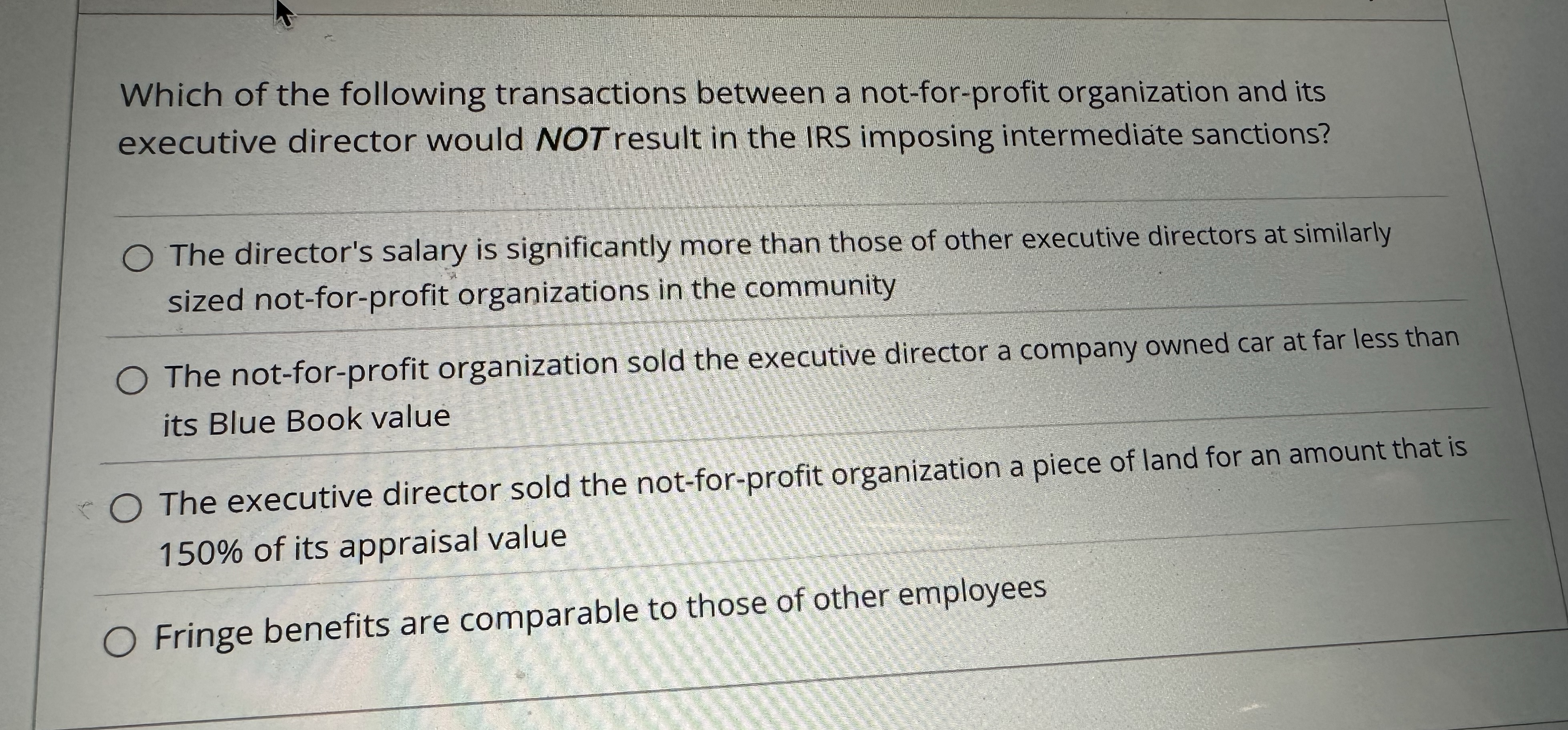

Which of the following transactions between a not - for - profit organization and its executive director would NOT result in the IRS imposing intermediate

Which of the following transactions between a notforprofit organization and its

executive director would NOT result in the IRS imposing intermediate sanctions?

The director's salary is significantly more than those of other executive directors at similarly

sized notforprofit organizations in the community

The notforprofit organization sold the executive director a company owned car at far less than

its Blue Book value

The executive director sold the notforprofit organization a piece of land for an amount that is

of its appraisal value

Fringe benefits are comparable to those of other employees

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started