Answered step by step

Verified Expert Solution

Question

1 Approved Answer

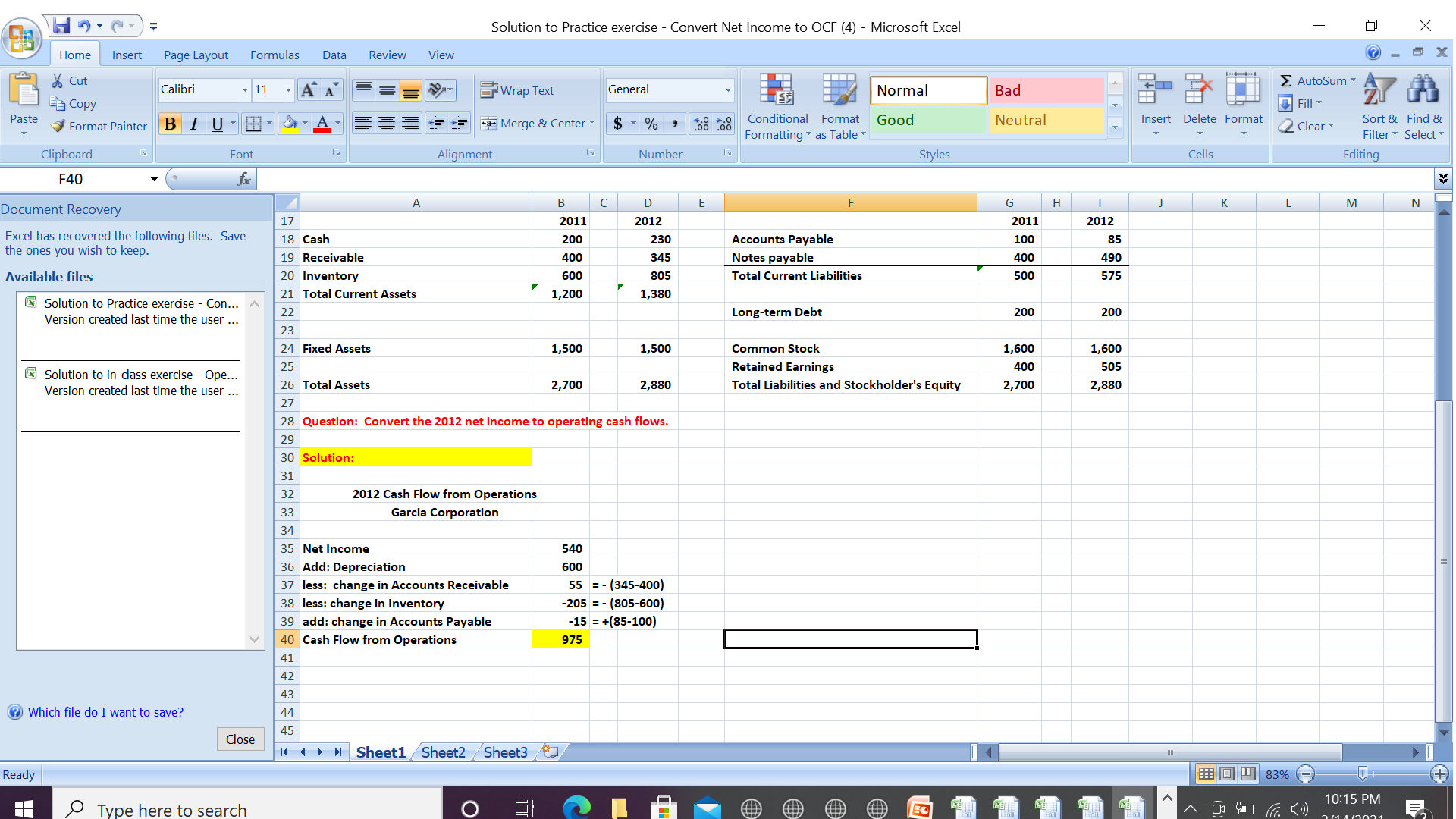

which of the net working capital adjustments has the largest cash effect on 2012 operating cash flows in terms ofabsolute magnitude(can have positive or negative

which of the net working capital adjustments has the largest cash effect on 2012 operating cash flows in terms ofabsolute magnitude(can have positive or negative cash effect)? positive or negative effect on operating cash flows?

Answers:change in Inventory, positive

change in Accounts Receivable, negative

change in Accounts Receivable, positive

change in Inventory, negative

Solution to Practice exercise - Convert Net Income to OCF (4) - Microsoft Excel A B C 2011 200 19 Receivable 400 20 Inventory 600 Home Insert Page Layout Formulas Data Review View Cut Calibri 11 A A Wrap Text General Normal Bad Copy Paste K Format Painter Clipboard F40 Document Recovery Excel has recovered the following files. Save the ones you wish to keep. Available files 17 18 Cash BIU - - Font fx + Merge & Center $ - % Conditional Format Formatting as Table Good Neutral Insert Delete Format Alignment F Number Styles Cells AutoSum Fill Clear Sort & Find & Filter Select Editing V D E F G H J K L M N 2012 2011 2012 230 Accounts Payable 100 85 345 Notes payable 400 490 805 Total Current Liabilities 500 575 21 Total Current Assets 1,200 1,380 Solution to Practice exercise - Con... Version created last time the user. 22 Long-term Debt 200 200 23 24 Fixed Assets 25 1,500 1,500 Common Stock 1,600 1,600 Retained Earnings 400 505 Solution to in-class exercise - Ope... Version created last time the user ... 26 Total Assets 2,700 2,880 Total Liabilities and Stockholder's Equity 2,700 2,880 27 28 Question: Convert the 2012 net income to operating cash flows. 29 30 Solution: 31 32 33 34 2012 Cash Flow from Operations 35 Net Income Garcia Corporation 36 Add: Depreciation 540 600 55 37 less: change in Accounts Receivable 38 less: change in Inventory 39 add: change in Accounts Payable 40 Cash Flow from Operations (345-400) -205 = (805-600) -15 = +(85-100) 975 41 42 43 Which file do I want to save? 44 45 Close K Sheet1 Sheet2 Sheet3 Ready Type here to search O HD EC 83% 10:15 PM 2. 4 Solution to Practice exercise - Convert Net Income to OCF (4) - Microsoft Excel A B C 2011 200 19 Receivable 400 20 Inventory 600 Home Insert Page Layout Formulas Data Review View Cut Calibri 11 A A Wrap Text General Normal Bad Copy Paste K Format Painter Clipboard F40 Document Recovery Excel has recovered the following files. Save the ones you wish to keep. Available files 17 18 Cash BIU - - Font fx + Merge & Center $ - % Conditional Format Formatting as Table Good Neutral Insert Delete Format Alignment F Number Styles Cells AutoSum Fill Clear Sort & Find & Filter Select Editing V D E F G H J K L M N 2012 2011 2012 230 Accounts Payable 100 85 345 Notes payable 400 490 805 Total Current Liabilities 500 575 21 Total Current Assets 1,200 1,380 Solution to Practice exercise - Con... Version created last time the user. 22 Long-term Debt 200 200 23 24 Fixed Assets 25 1,500 1,500 Common Stock 1,600 1,600 Retained Earnings 400 505 Solution to in-class exercise - Ope... Version created last time the user ... 26 Total Assets 2,700 2,880 Total Liabilities and Stockholder's Equity 2,700 2,880 27 28 Question: Convert the 2012 net income to operating cash flows. 29 30 Solution: 31 32 33 34 2012 Cash Flow from Operations 35 Net Income Garcia Corporation 36 Add: Depreciation 540 600 55 37 less: change in Accounts Receivable 38 less: change in Inventory 39 add: change in Accounts Payable 40 Cash Flow from Operations (345-400) -205 = (805-600) -15 = +(85-100) 975 41 42 43 Which file do I want to save? 44 45 Close K Sheet1 Sheet2 Sheet3 Ready Type here to search O HD EC 83% 10:15 PM 2. 4

Step by Step Solution

★★★★★

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below The ne...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started