Answered step by step

Verified Expert Solution

Question

1 Approved Answer

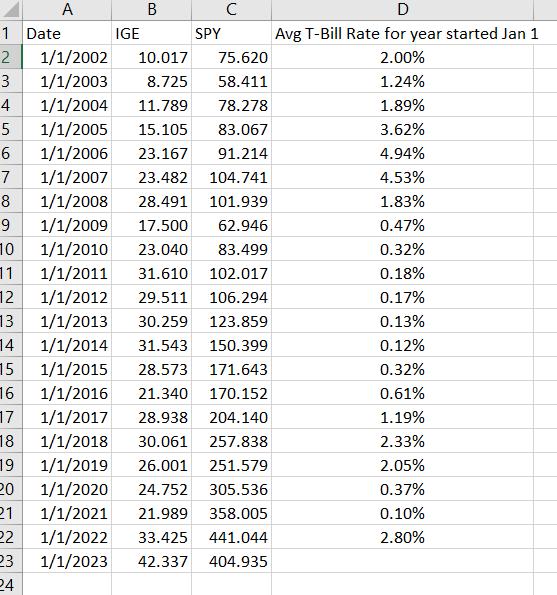

Which of the two portfolios provided the best risk-reward trade-off (highest Share Ratio) over the past 20 years? You likely noticed that in several years

Which of the two portfolios provided the best risk-reward trade-off (highest Share Ratio) over the past 20 years?

You likely noticed that in several years where SPY does well IGE does not. Imagine that you invested $1000 in each of them at the beginning of 2002. Based on the return earned by each investment, in each year, calculate the value of your combined investments at each point in time. Did this 50/50 investment allocation strategy offer a better trade-off than the best choice from?

A IGE B SPY 1 Date 2 1/1/2002 10.017 75.620 3 1/1/2003 8.725 58.411 4 1/1/2004 11.789 78.278 5 1/1/2005 15.105 83.067 6 1/1/2006 23.167 91.214 7 1/1/2007 23.482 104.741 8 1/1/2008 28.491 101.939 9 1/1/2009 17.500 62.946 10 1/1/2010 23.040 83.499 11 1/1/2011 31.610 102.017 12 1/1/2012 29.511 106.294 13 1/1/2013 30.259 123.859 14 1/1/2014 31.543 150.399 15 1/1/2015 28.573 171.643 16 1/1/2016 21.340 170.152 204.140 17 1/1/2017 28.938 18 1/1/2018 30.061 257.838 19 1/1/2019 26.001 251.579 20 1/1/2020 24.752 305.536 21 1/1/2021 21.989 358.005 22 1/1/2022 33.425 441.044 23 1/1/2023 42.337 404.935 24 D Avg T-Bill Rate for year started Jan 1 2.00% 1.24% 1.89% 3.62% 4.94% 4.53% 1.83% 0.47% 0.32% 0.18% 0.17% 0.13% 0.12% 0.32% 0.61% 1.19% 2.33% 2.05% 0.37% 0.10% 2.80%

Step by Step Solution

★★★★★

3.50 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

To determine which portfolio provided the best riskreward tradeoff over the past 20 years we can calculate the Sharpe Ratio for each portfolio The Sha...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started