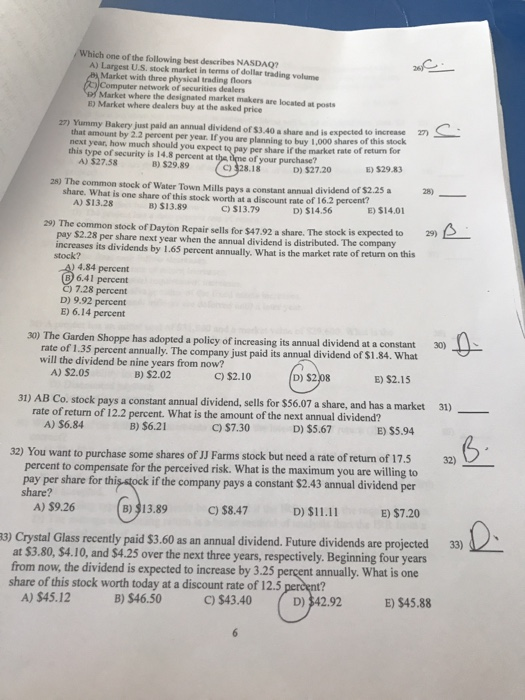

Which one of the following best describes NASDAQ A) Largest U.S. stock market in terms of dollar trading volume Market with three physical trading floors network of securities dealers Market where the designated market makers are located at posts E) Market where dealers buy at the asked price 27) Yummy Bakery just paid an annual dividend of S3.40 a share and is expected to increase that amount by 2.2 percent per year. If you are planning to buy 1,000 shares o next year, how much should you expect to pay per share if the market rate this type of security is 14.8 percent at A) $27.58 shares of this stock of your B) $29.89 E) $29.83 D) $27.20 28) The common stock of Water Town Mills pays a constant annual div share. What is one share of this stock worth at a discount rate of 16.2 percent? A) $13.28 idend of $2.25 a B) $13.89 E) $14.01 D) $14.56 C) $13.79 29) The common stock of Dayton Repair sells for $47.92 a share. The stock is expected to S2.28 per share next year when the annual dividend is distributed. The company 29) increases its dividends by 1.65 percent annually. What is the market rate of return on stock? 4.84 percent 6.41 percent ) 7.28 percent D) 9.92 percent E) 6.14 percent Garden Shoppe has adopted a policy of increasing its annual dividend at a constant rate of 1.35 percent annually. The c will the dividend be nine years from now? A) $2.05 30) ompany just paid its annual dividend of $1.84. What B) $2.02 C) $2.10 D) $2 E) S2.15 31) AB Co. stock pays a constant annual dividend, sells for $56.07 a share, and has a market rate of return of 12.2 percent. What is the amount of the next annual dividend? A) $6.84 31) B) $6.21 D) $5.67 C) $7.30 E) $5.94 32) You want to purchase some shares of JJ Farms stock but need a rate of return of 17.5 percent to compensate for the perceived risk. What is the maximum you are willing to pay per share for this-stock conm share? A) $9.26 32) k if the company pays a constant $2.43 annual dividend per B) $13.89 D) $11.11 E) $7.20 C) $8.47 3) Crystal Glass recently paid $3.60 as an annual dividend. Future dividends are projected at $3.80, S4.10, and $4.25 over the next three years, respectively. Beginning four years from now, the dividend is expected to increase by 3.25 percent annually. share of this stock worth today at a discount rate of 12.5 A) S45.12 33) t? C) $43.40 B) $46.50 E) $45.88