Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Which one of the following is the agreed - upon exchange rate that is to be used when currencies are exchanged at some point in

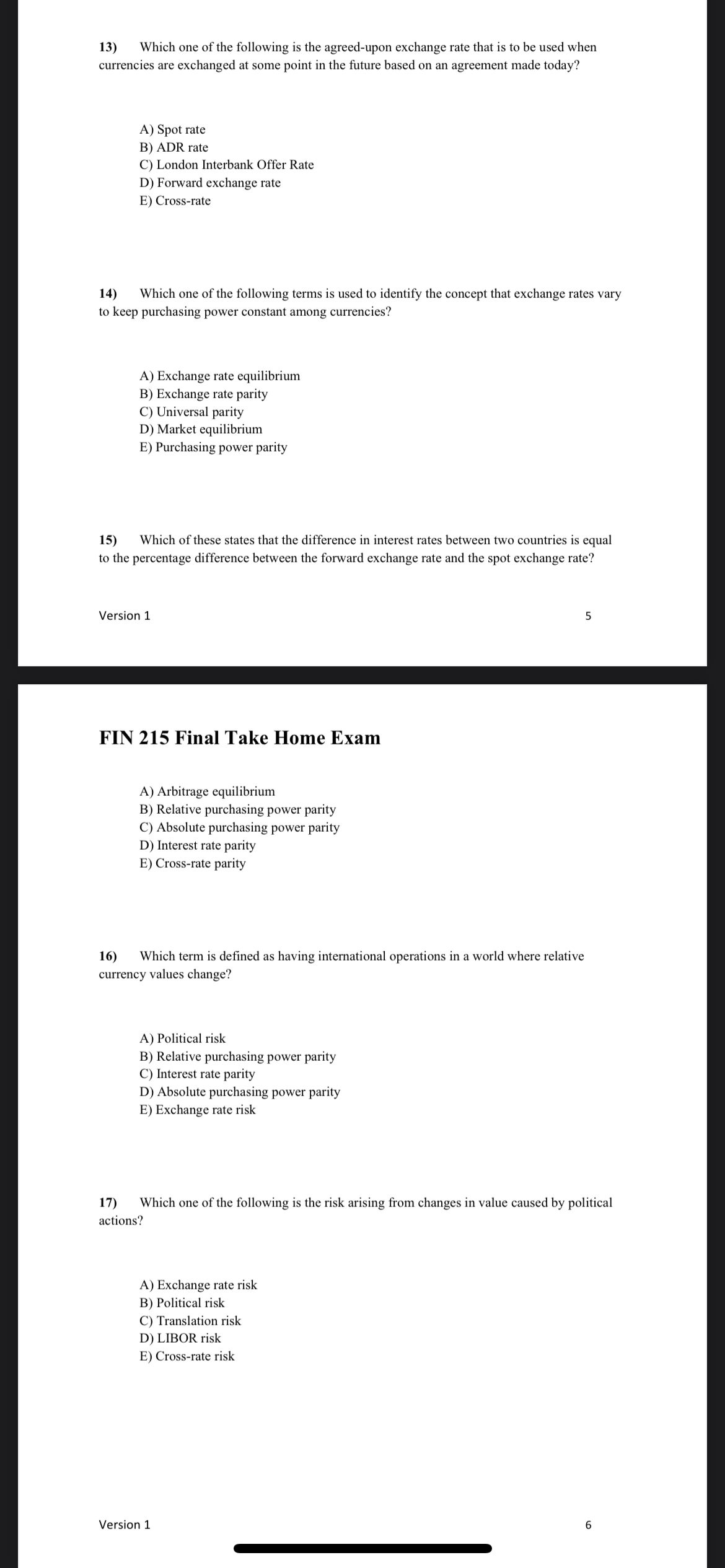

Which one of the following is the agreedupon exchange rate that is to be used when currencies are exchanged at some point in the future based on an agreement made today?

A Spot rate

B ADR rate

C London Interbank Offer Rate

D Forward exchange rate

E Crossrate

Which one of the following terms is used to identify the concept that exchange rates vary to keep purchasing power constant among currencies?

A Exchange rate equilibrium

B Exchange rate parity

C Universal parity

D Market equilibrium

E Purchasing power parity

Which of these states that the difference in interest rates between two countries is equal to the percentage difference between the forward exchange rate and the spot exchange rate?

Version

FIN Final Take Home Exam

A Arbitrage equilibrium

B Relative purchasing power parity

C Absolute purchasing power parity

D Interest rate parity

E Crossrate parity

Which term is defined as having international operations in a world where relative currency values change?

A Political risk

B Relative purchasing power parity

C Interest rate parity

D Absolute purchasing power parity

E Exchange rate risk

Which one of the following is the risk arising from changes in value caused by political actions?

A Exchange rate risk

B Political risk

C Translation risk

D LIBOR risk

E Crossrate risk

Version

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started