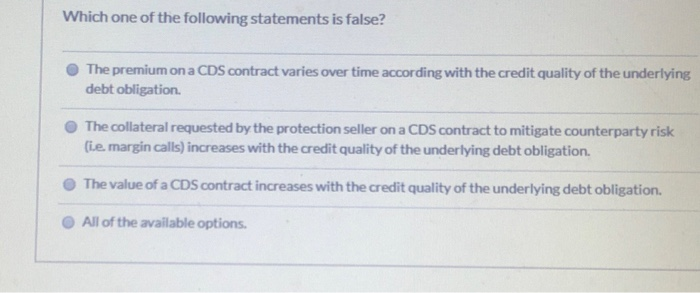

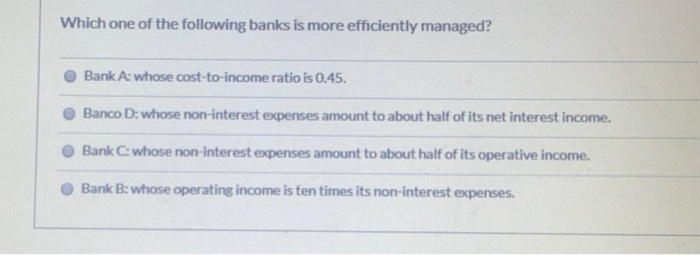

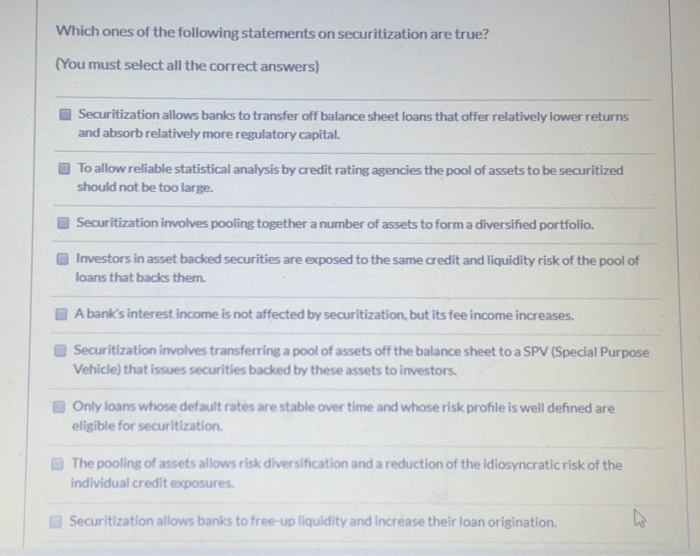

Which one of the following statements is false? The premium on a CDS contract varies over time according with the credit quality of the underlying debt obligation The collateral requested by the protection seller on a CDS contract to mitigate counterparty risk lie margin calls) increases with the credit quality of the underlying debt obligation The value of a CDS contract increases with the credit quality of the underlying debt obligation. All of the available options Which one of the following banks is more efficiently managed? Bank A: whose cost-to-income ratio is 0.45. Banco D:whose non-interest expenses amount to about half of its net interest income. Bank Cs whose non-interest expenses amount to about half of its operative income. Bank B: whose operating income is ten times its non-interest expenses. Which ones of the following statements on securitization are true? (You must select all the correct answers) Securitization allows banks to transfer off balance sheet loans that offer relatively lower returns and absorb relatively more regulatory capital. To allow reliable statistical analysis by credit rating agencies the pool of assets to be securitized should not be too large. Securitization involves pooling together a number of assets to form a diversified portfolio Investors in asset backed securities are exposed to the same credit and liquidity risk of the pool of loans that backs them A bank's interest income is not affected by securitization, but its fee income increases. Securitization involves transferring a pool of assets off the balance sheet to a SPV (Special Purpose Vehicle) that issues securities backed by these assets to investors. Only loans whose default rates are stable over time and whose risk profile is well defined are eligible for securitization The pooling of assets allows risk diversification and a reduction of the idiosyncratic risk of the individual credit exposures. Securitization allows banks to free-up liquidity and increase their loan origination. h