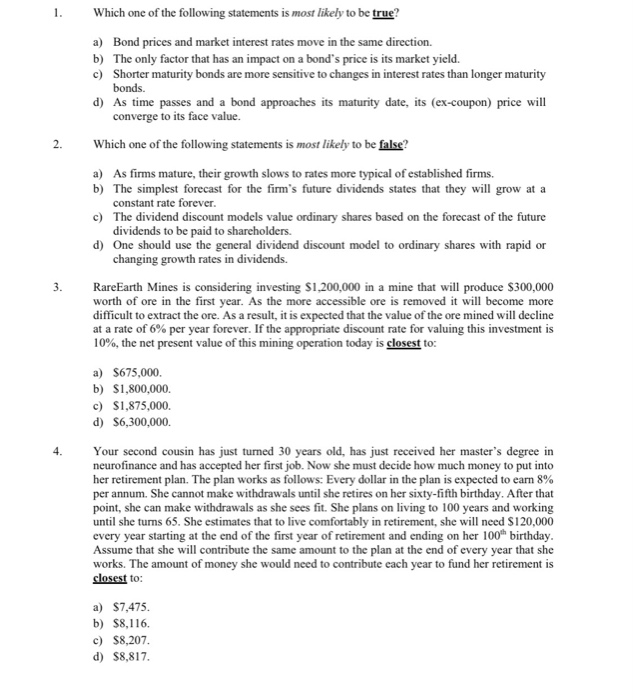

Which one of the following statements is most likely to be true? a) Bond prices and market interest rates move in the same direction. b) The only factor that has an impact on a bond's price is its market yield. c) Shorter maturity bonds are more sensitive to changes in interest rates than longer maturity bonds. d) As time passes and a bond approaches its maturity date, its (ex-coupon) price will converge to its face value. Which one of the following statements is most likely to be false? a) As firms mature, their growth slows to rates more typical of established firms. b) The simplest forecast for the firm's future dividends states that they will grow at a constant rate forever. c) The dividend discount models value ordinary shares based on the forecast of the future dividends to be paid to shareholders. d) One should use the general dividend discount model to ordinary shares with rapid or changing growth rates in dividends. Rare Earth Mines is considering investing $1,200,000 in a mine that will produce $300,000 worth of ore in the first year. As the more accessible ore is removed it will become more difficult to extract the ore. As a result, it is expected that the value of the ore mined will decline at a rate of 6% per year forever. If the appropriate discount rate for valuing this investment is 10%, the net present value of this mining operation today is closest to: a) $675,000 b) $1,800,000. c) $1,875,000. d) $6,300,000. Your second cousin has just turned 30 years old, has just received her master's degree in neurofinance and has accepted her first job. Now she must decide how much money to put into her retirement plan. The plan works as follows: Every dollar in the plan is expected to earn 8% per annum. She cannot make withdrawals until she retires on her sixty-fifth birthday. After that point, she can make withdrawals as she sees fit. She plans on living to 100 years and working until she tums 65. She estimates that to live comfortably in retirement, she will need S120,000 every year starting at the end of the first year of retirement and ending on her 100h birthday. Assume that she will contribute the same amount to the plan at the end of every year that she works. The amount of money she would need to contribute each year to fund her retirement is closest to: a) $7,475. b) $8,116. c) $8,207. d) $8,817