Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Which one of the following statements is true? On December 3 1 of every year a taxpayer must estimate the increase or decrease in value

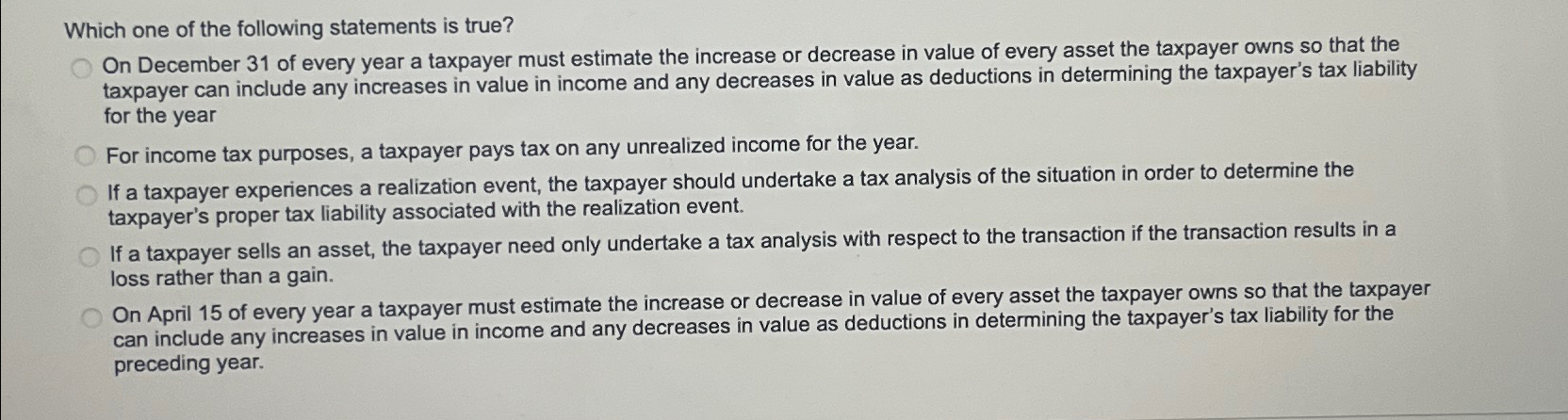

Which one of the following statements is true? On December of every year a taxpayer must estimate the increase or decrease in value of every asset the taxpayer owns so that the taxpayer can include any increases in value in income and any decreases in value as deductions in determining the taxpayer's tax liability for the year For income tax purposes, a taxpayer pays tax on any unrealized income for the year. If a taxpayer experiences a realization event, the taxpayer should undertake a tax analysis of the situation in order to determine the taxpayer's proper tax liability associated with the realization event. If a taxpayer sells an asset, the taxpayer need only undertake a tax analysis with respect to the transaction if the transaction results in a loss rather than a gain. On April of every year a taxpayer must estimate the increase or decrease in value of every asset the taxpayer owns so that the taxpayer can include any increases in value in income and any decreases in value as deductions in determining the taxpayer's tax liability for the preceding year.

Which one of the following statements is true?

On December of every year a taxpayer must estimate the increase or decrease in value of every asset the taxpayer owns so that the taxpayer can include any increases in value in income and any decreases in value as deductions in determining the taxpayer's tax liability for the year

For income tax purposes, a taxpayer pays tax on any unrealized income for the year.

If a taxpayer experiences a realization event, the taxpayer should undertake a tax analysis of the situation in order to determine the taxpayer's proper tax liability associated with the realization event.

If a taxpayer sells an asset, the taxpayer need only undertake a tax analysis with respect to the transaction if the transaction results in a loss rather than a gain.

On April of every year a taxpayer must estimate the increase or decrease in value of every asset the taxpayer owns so that the taxpayer can include any increases in value in income and any decreases in value as deductions in determining the taxpayer's tax liability for the preceding year.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started