Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Which one of the following taxpayers is most likely to be treated as a resident of Australia for taxation purposes? O a Singapore national

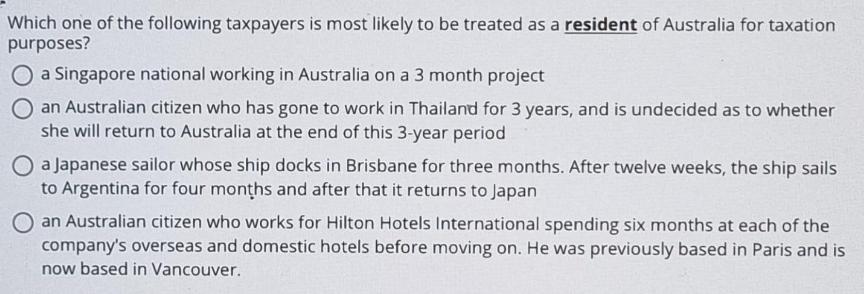

Which one of the following taxpayers is most likely to be treated as a resident of Australia for taxation purposes? O a Singapore national working in Australia on a 3 month project O an Australian citizen who has gone to work in Thailand for 3 years, and is undecided as to whether she will return to Australia at the end of this 3-year period O a Japanese sailor whose ship docks in Brisbane for three months. After twelve weeks, the ship sails to Argentina for four months and after that it returns to Japan O an Australian citizen who works for Hilton Hotels International spending six months at each of the company's overseas and domestic hotels before moving on. He was previously based in Paris and is now based in Vancouver.

Step by Step Solution

★★★★★

3.48 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

A A singapore national working in Australia on a 3 month project Your first Working Holiday visa las...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started