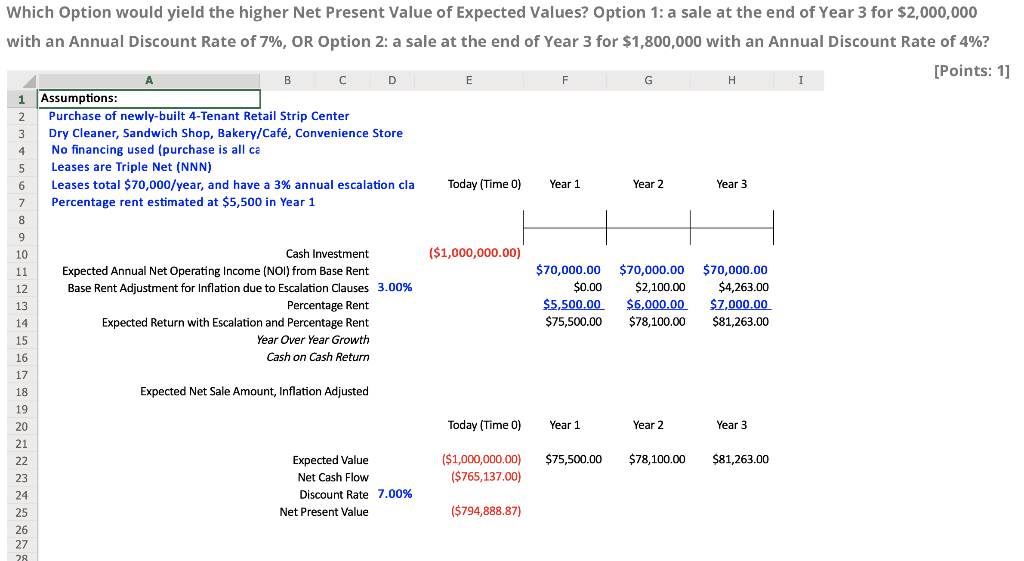

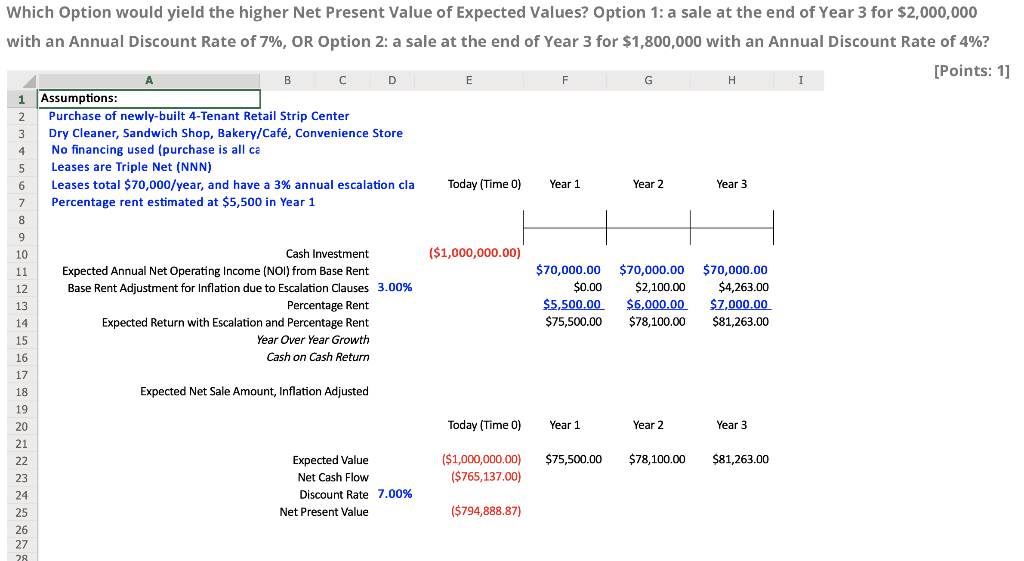

Which Option would yield the higher Net Present Value of Expected Values? Option 1: a sale at the end of Year 3 for $2,000,000 with an Annual Discount Rate of 7%, OR Option 2: a sale at the end of Year 3 for $1,800,000 with an Annual Discount Rate of 4%? Points: 1] 1 Assumptions: 2 Purchase of newly-built 4-Tenant Retail Strip Center 3 Dry Cleaner, Sandwich Shop, Bakery/Caf, Convenience Store 4 No financing used (purchase is all ca 5 Leases are Triple Net (NNN) Leases total $70,000/year, and have a 3% annual escalation cla Percentage rent estimated at $5,500 in Year 1 Today me0) Year 2 Year 3 Year! 7 ($1,000,000.00) Cash Investment 10 $70,000.00 $70,000.00 $70,000.00 $0.00 $2,100.00$4,263.00 $5,500.00 $6,000.00 $7,000.00 $75,500.00 $78,100.00 $81,263.00 Expected Annual Net Operating Income (NOI) from Base Rent Base Rent Adjustment for Inflation due to Escalation Clauses 3.00% 12 Percentage Rent 13 Expected Return with Escalation and Percentage Rent 14 Year Over Year Growth 15 Cash on Cash Return 16 17 Expected Net Sale Amount, Inflation Adjusted 19 Today (Time 0) Year 1 Year 2 Year 3 20 21 ($1,000,000.00 $75,500.00 $78,100.00 $81,263.00 ($765,137.00) Expected Value Net Cash Flow 23 Discount Rate 7.00% 24 ($794,888.87) 25 Net Present Value 26 27 Which Option would yield the higher Net Present Value of Expected Values? Option 1: a sale at the end of Year 3 for $2,000,000 with an Annual Discount Rate of 7%, OR Option 2: a sale at the end of Year 3 for $1,800,000 with an Annual Discount Rate of 4%? Points: 1] 1 Assumptions: 2 Purchase of newly-built 4-Tenant Retail Strip Center 3 Dry Cleaner, Sandwich Shop, Bakery/Caf, Convenience Store 4 No financing used (purchase is all ca 5 Leases are Triple Net (NNN) Leases total $70,000/year, and have a 3% annual escalation cla Percentage rent estimated at $5,500 in Year 1 Today me0) Year 2 Year 3 Year! 7 ($1,000,000.00) Cash Investment 10 $70,000.00 $70,000.00 $70,000.00 $0.00 $2,100.00$4,263.00 $5,500.00 $6,000.00 $7,000.00 $75,500.00 $78,100.00 $81,263.00 Expected Annual Net Operating Income (NOI) from Base Rent Base Rent Adjustment for Inflation due to Escalation Clauses 3.00% 12 Percentage Rent 13 Expected Return with Escalation and Percentage Rent 14 Year Over Year Growth 15 Cash on Cash Return 16 17 Expected Net Sale Amount, Inflation Adjusted 19 Today (Time 0) Year 1 Year 2 Year 3 20 21 ($1,000,000.00 $75,500.00 $78,100.00 $81,263.00 ($765,137.00) Expected Value Net Cash Flow 23 Discount Rate 7.00% 24 ($794,888.87) 25 Net Present Value 26 27