Answered step by step

Verified Expert Solution

Question

1 Approved Answer

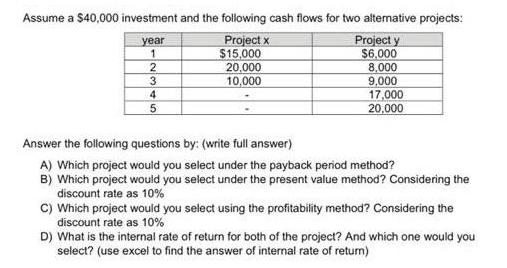

Assume a $40,000 investment and the following cash flows for two alternative projects: Project x Project y $6,000 8,000 9,000 year 1 2 3

Assume a $40,000 investment and the following cash flows for two alternative projects: Project x Project y $6,000 8,000 9,000 year 1 2 3 4 5 $15,000 20,000 10,000 17,000 20,000 Answer the following questions by: (write full answer) A) Which project would you select under the payback period method? B) Which project would you select under the present value method? Considering the discount rate as 10% C) Which project would you select using the profitability method? Considering the discount rate as 10% D) What is the internal rate of return for both of the project? And which one would you select? (use excel to find the answer of internal rate of return)

Step by Step Solution

★★★★★

3.40 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

Cash flows Year Project X Project Y 1 15000 6000 2 20000 8000 3 10000 9000 4 17000 5 20000 A Comparing 2 projects based on payback period Project X Ye...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started