Question

Which statement below does not apply to Equation 1 below? a) Fundamentally, the equation is a division problem to the extent the quotient is equal

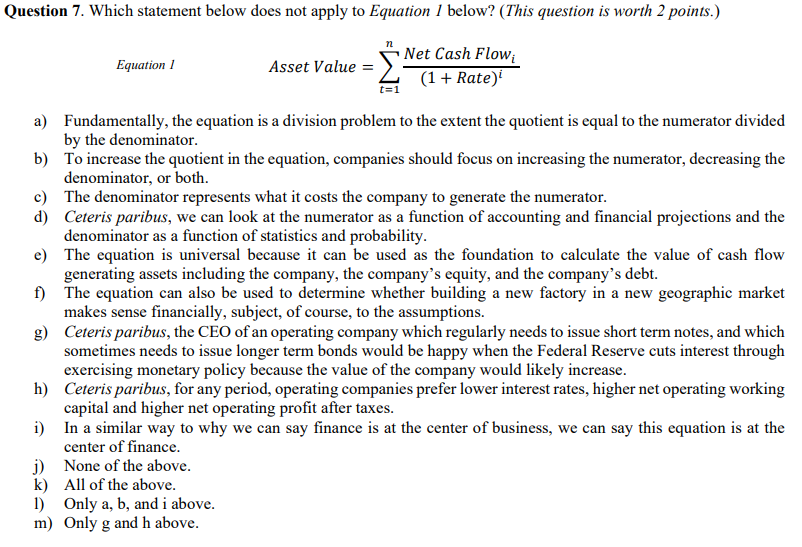

Which statement below does not apply to Equation 1 below?

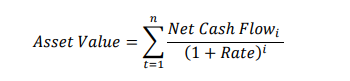

a) Fundamentally, the equation is a division problem to the extent the quotient is equal to the numerator divided by the denominator.

b) To increase the quotient in the equation, companies should focus on increasing the numerator, decreasing the denominator, or both.

c) The denominator represents what it costs the company to generate the numerator.

d) Ceteris paribus, we can look at the numerator as a function of accounting and financial projections and the denominator as a function of statistics and probability.

e) The equation is universal because it can be used as the foundation to calculate the value of cash flow generating assets including the company, the companys equity, and the companys debt.

f) The equation can also be used to determine whether building a new factory in a new geographic market makes sense financially, subject, of course, to the assumptions.

g) Ceteris paribus, the CEO of an operating company which regularly needs to issue short term notes, and which sometimes needs to issue longer term bonds would be happy when the Federal Reserve cuts interest through exercising monetary policy because the value of the company would likely increase.

h) Ceteris paribus, for any period, operating companies prefer lower interest rates, higher net operating working capital and higher net operating profit after taxes.

i) In a similar way to why we can say finance is at the center of business, we can say this equation is at the center of finance.

j) None of the above.

k) All of the above.

l) Only a, b, and i above.

m) Only g and h above.

Equation 1 a) Fundamentally, the equation is a division problem to the extent the quotient is equal to the numerator divided by the denominator. b) To increase the quotient in the equation, companies should focus on increasing the numerator, decreasing the denominator, or both. c) The denominator represents what it costs the company to generate the numerator. d) Ceteris paribus, we can look at the numerator as a function of accounting and financial projections and the denominator as a function of statistics and probability. e) The equation is universal because it can be used as the foundation to calculate the value of cash flow generating assets including the company, the company's equity, and the company's debt. f) The equation can also be used to determine whether building a new factory in a new geographic market makes sense financially, subject, of course, to the assumptions. g) Ceteris paribus, the CEO of an operating company which regularly needs to issue short term notes, and which sometimes needs to issue longer term bonds would be happy when the Federal Reserve cuts interest through exercising monetary policy because the value of the company would likely increase. h) Ceteris paribus, for any period, operating companies prefer lower interest rates, higher net operating working capital and higher net operating profit after taxes. i) In a similar way to why we can say finance is at the center of business, we can say this equation is at the center of finance. j) None of the above. k) All of the above. 1) Only a, b, and i above

Equation 1 a) Fundamentally, the equation is a division problem to the extent the quotient is equal to the numerator divided by the denominator. b) To increase the quotient in the equation, companies should focus on increasing the numerator, decreasing the denominator, or both. c) The denominator represents what it costs the company to generate the numerator. d) Ceteris paribus, we can look at the numerator as a function of accounting and financial projections and the denominator as a function of statistics and probability. e) The equation is universal because it can be used as the foundation to calculate the value of cash flow generating assets including the company, the company's equity, and the company's debt. f) The equation can also be used to determine whether building a new factory in a new geographic market makes sense financially, subject, of course, to the assumptions. g) Ceteris paribus, the CEO of an operating company which regularly needs to issue short term notes, and which sometimes needs to issue longer term bonds would be happy when the Federal Reserve cuts interest through exercising monetary policy because the value of the company would likely increase. h) Ceteris paribus, for any period, operating companies prefer lower interest rates, higher net operating working capital and higher net operating profit after taxes. i) In a similar way to why we can say finance is at the center of business, we can say this equation is at the center of finance. j) None of the above. k) All of the above. 1) Only a, b, and i above Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started