Answered step by step

Verified Expert Solution

Question

1 Approved Answer

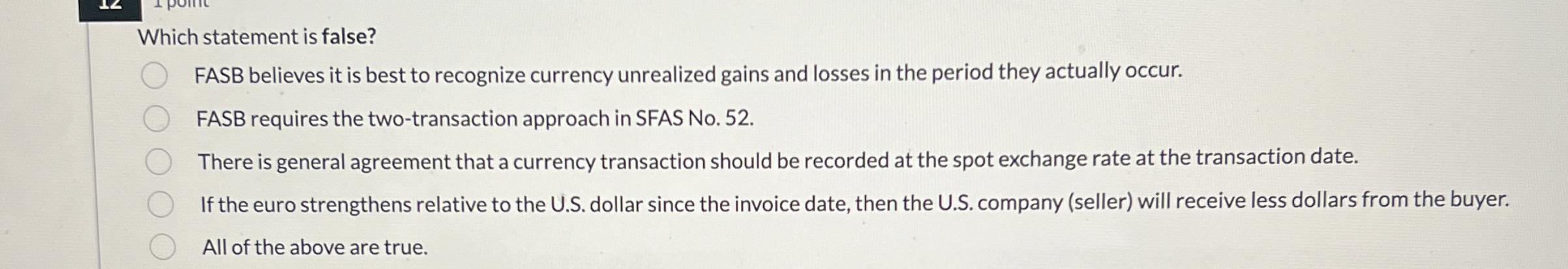

Which statement is false? FASB believes it is best to recognize currency unrealized gains and losses in the period they actually occur. FASB requires the

Which statement is false?

FASB believes it is best to recognize currency unrealized gains and losses in the period they actually occur.

FASB requires the twotransaction approach in SFAS No

There is general agreement that a currency transaction should be recorded at the spot exchange rate at the transaction date.

If the euro strengthens relative to the US dollar since the invoice date, then the US company seller will receive less dollars from the buyer.

All of the above are true.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started