Question: Which statement is NOT correct? According to MM theory Case 1 ( no corporate, no personal taxes, and no bankruptcy costs ) , firm value

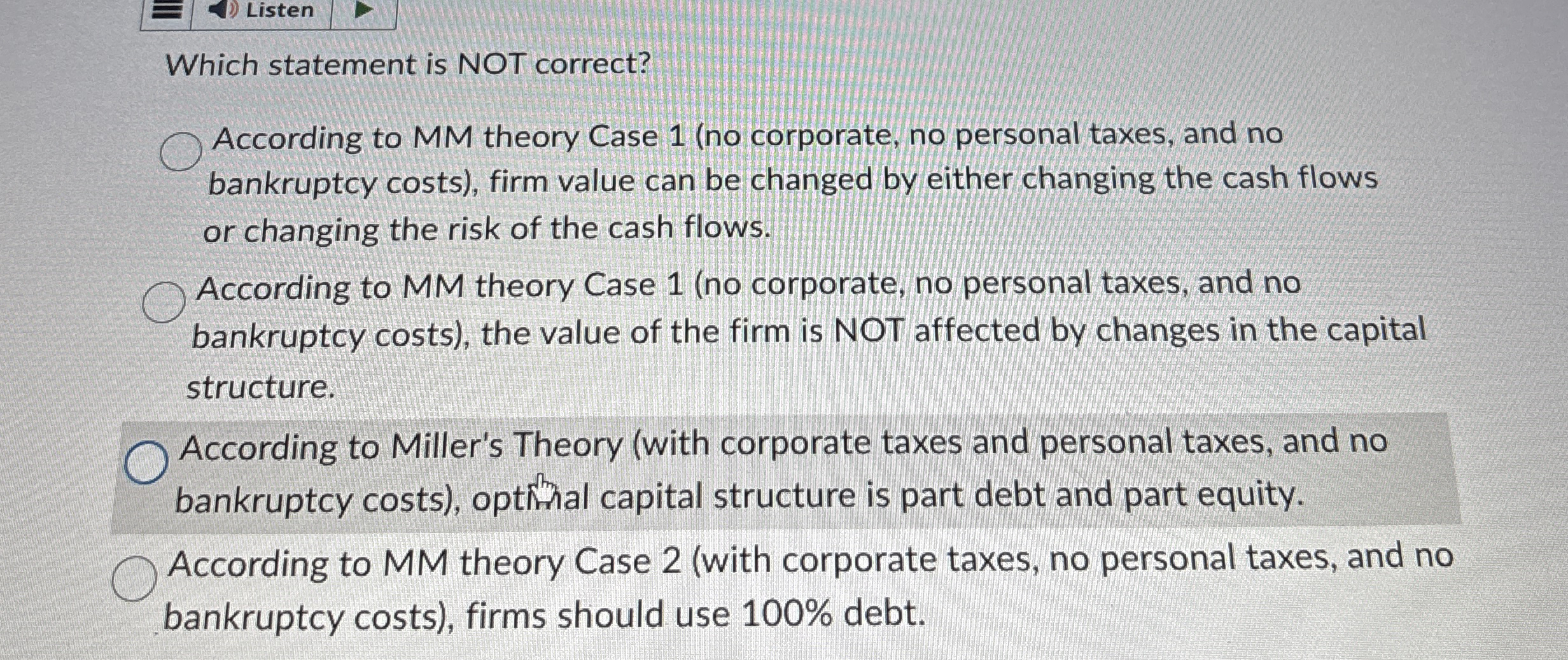

Which statement is NOT correct?

According to MM theory Case no corporate, no personal taxes, and no bankruptcy costs firm value can be changed by either changing the cash flows or changing the risk of the cash flows.

According to MM theory Case no corporate, no personal taxes, and no bankruptcy costs the value of the firm is NOT affected by changes in the capital structure.

According to Miller's Theory with corporate taxes and personal taxes, and no bankruptcy costs optinal capital structure is part debt and part equity.

According to MM theory Case with corporate taxes, no personal taxes, and no bankruptcy costs firms should use debt.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock