Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Which statement is TRUE? If next years' tax rate will go down, companies with more existing deferred tax liabilities than deferred tax assets will

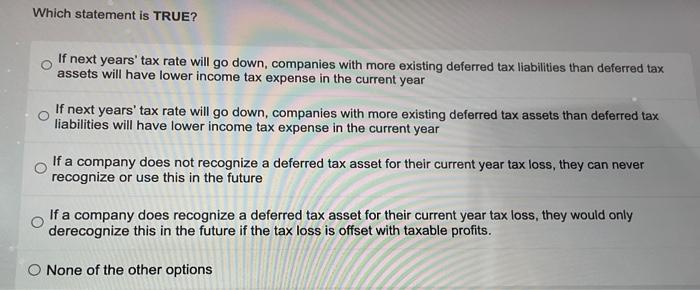

Which statement is TRUE? If next years' tax rate will go down, companies with more existing deferred tax liabilities than deferred tax assets will have lower income tax expense in the current year If next years' tax rate will go down, companies with more existing deferred tax assets than deferred tax liabilities will have lower income tax expense in the current year If a company does not recognize a deferred tax asset for their current year tax loss, they can never recognize or use this in the future If a company does recognize a deferred tax asset for their current year tax loss, they would only derecognize this in the future if the tax loss is offset with taxable profits. None of the other options

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started