Question

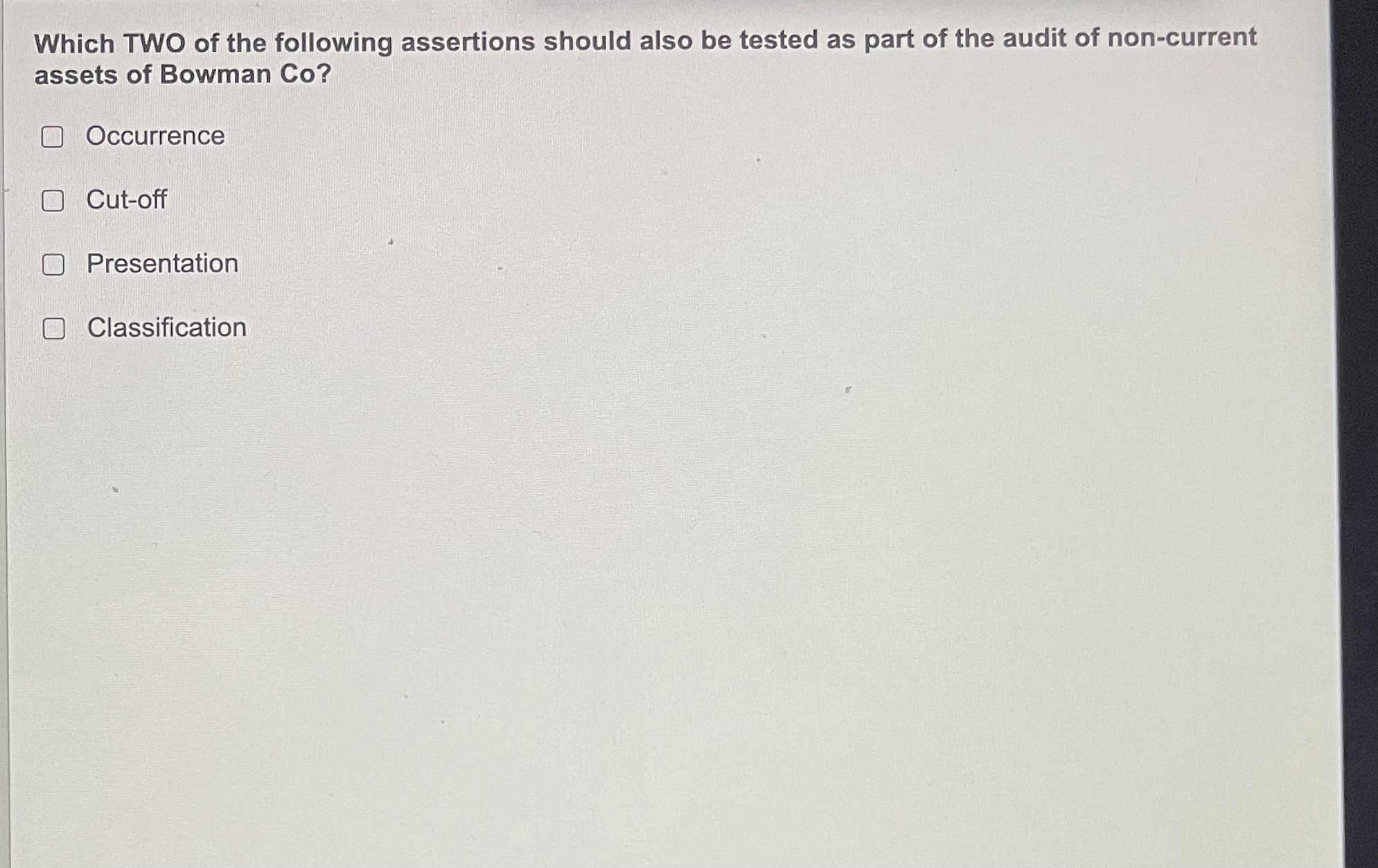

Which TWO of the following assertions should also be tested as part of the audit of non-current assets of Bowman Co? Occurrence Cut-off Presentation

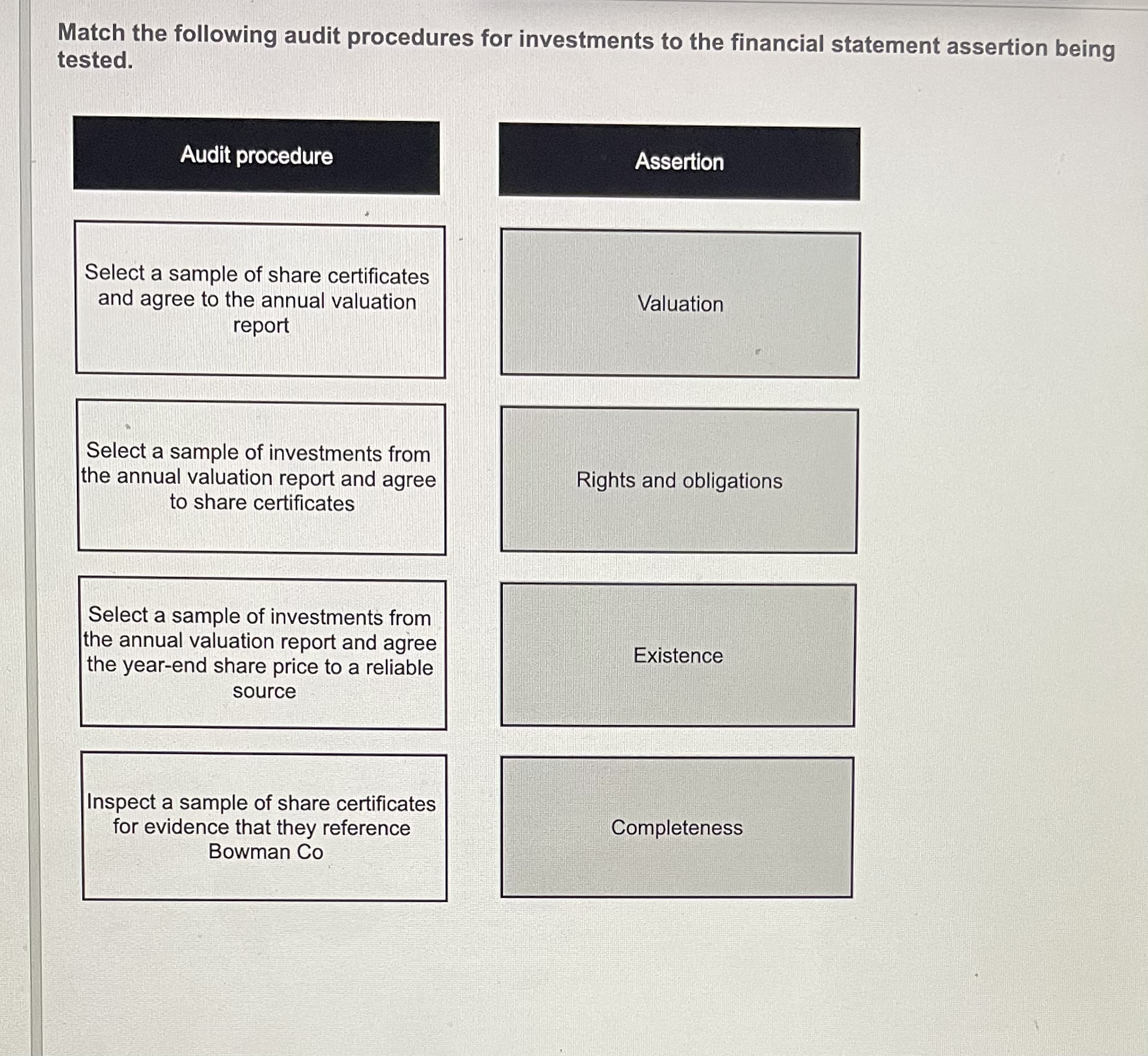

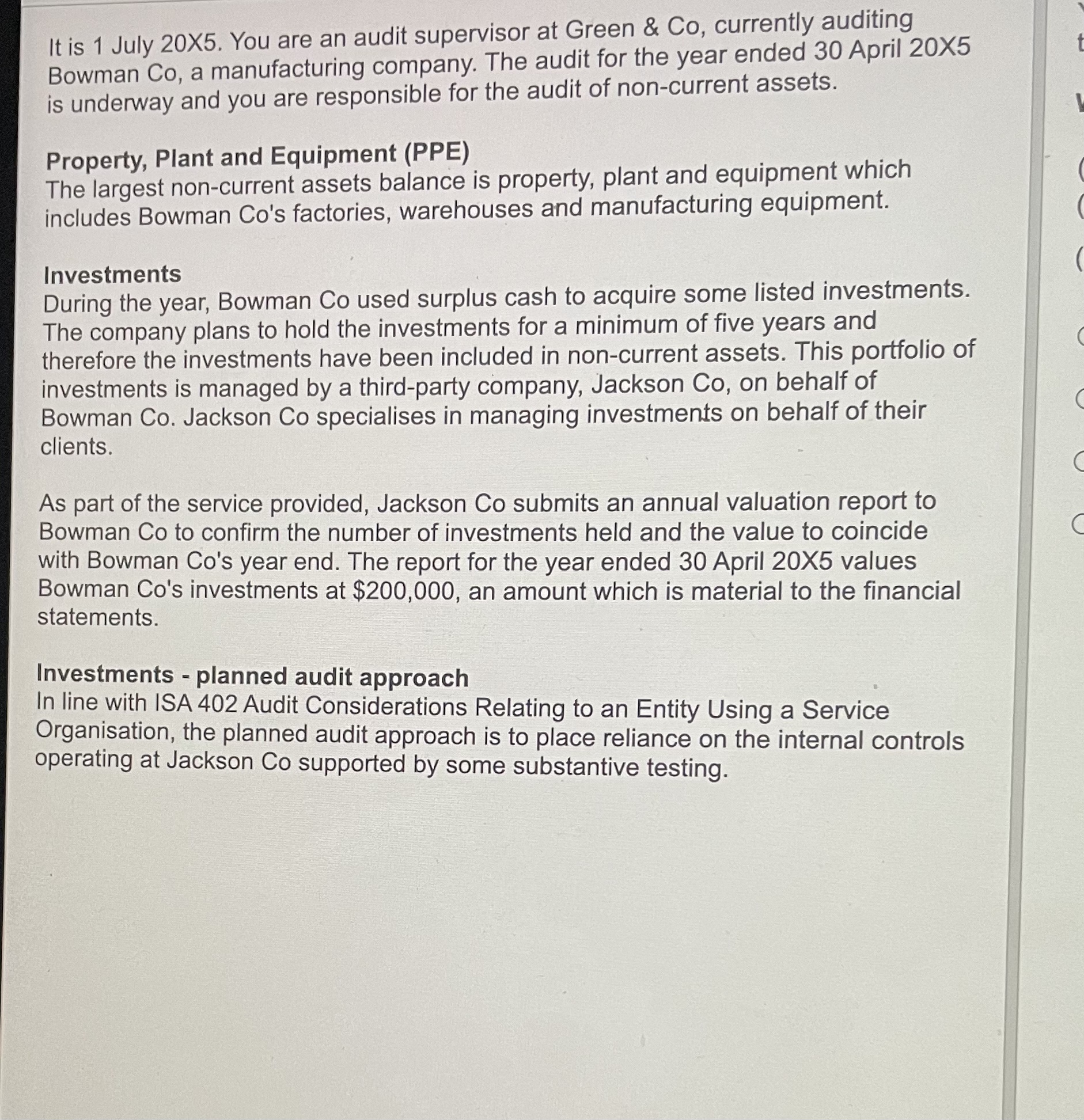

Which TWO of the following assertions should also be tested as part of the audit of non-current assets of Bowman Co? Occurrence Cut-off Presentation Classification Match the following audit procedures for investments to the financial statement assertion being tested. Audit procedure Select a sample of share certificates and agree to the annual valuation report Select a sample of investments from the annual valuation report and agree to share certificates Select a sample of investments from the annual valuation report and agree the year-end share price to a reliable source Inspect a sample of share certificates for evidence that they reference Bowman Co Assertion Valuation Rights and obligations Existence Completeness It is 1 July 20X5. You are an audit supervisor at Green & Co, currently auditing Bowman Co, a manufacturing company. The audit for the year ended 30 April 20X5 is underway and you are responsible for the audit of non-current assets. Property, Plant and Equipment (PPE) The largest non-current assets balance is property, plant and equipment which includes Bowman Co's factories, warehouses and manufacturing equipment. Investments During the year, Bowman Co used surplus cash to acquire some listed investments. The company plans to hold the investments for a minimum of five years and therefore the investments have been included in non-current assets. This portfolio of investments is managed by a third-party company, Jackson Co, on behalf of Bowman Co. Jackson Co specialises in managing investments on behalf of their clients. As part of the service provided, Jackson Co submits an annual valuation report to Bowman Co to confirm the number of investments held and the value to coincide with Bowman Co's year end. The report for the year ended 30 April 20X5 values Bowman Co's investments at $200,000, an amount which is material to the financial statements. Investments - planned audit approach In line with ISA 402 Audit Considerations Relating to an Entity Using a Service Organisation, the planned audit approach is to place reliance on the internal controls operating at Jackson Co supported by some substantive testing.

Step by Step Solution

3.45 Rating (139 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below Occurrence Explanation The assertion of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started