Which would you pick as a benchmark, and why? What is the benchmark amount? a. Identify and select the most appropriate financial statement benchmark for

Which would you pick as a benchmark, and why? What is the benchmark amount?

a. Identify and select the most appropriate financial statement benchmark for establishing overall planning materiality. Briefly justify your selection in the text box provided.

b. Select and document an appropriate materiality factor (percentage) for determining overall planning materiality. Briefly justify your selection in the text box provided in the working paper.

| Account | 12/31/2014 Balance (projected) | 12/31/2013 Balance (audited) | 12/31/2012 Balance (audited) |

| Sales | $ 25,354,128 | $ 22,122,039 | $ 23,346,943 |

| Total Assets | $ 19,885,320 | $ 17,336,809 | $ 18,204,143 |

| Gross Profit | $ 12,409,357 | $ 10,819,457 | $ 11,236,851 |

| Pre-Tax Income | $ 6,423,040 | $ 5,615,674 | $ 5,881,853 |

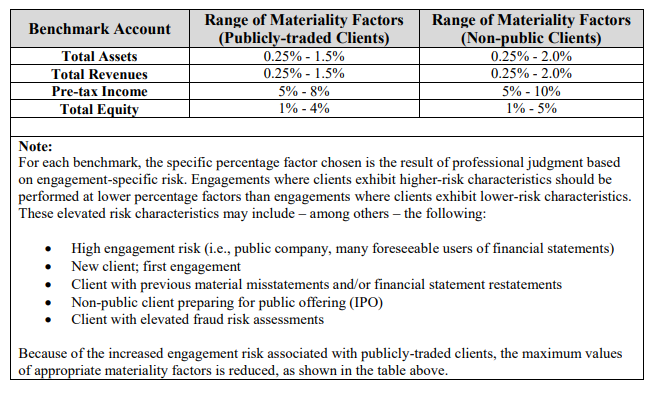

Range of Materiality Factors (Publicly-traded Clients) Range of Materiality Factors (Non-public Clients) 0.25% - 2.0% 0.25% - 2.0% Benchmark Account Total Assets Total Revenues Pre-tax Income Total Equity 0.25% - 1.5% 0.25% - 1.5% 5% - 8% 5% - 10% 1% - 4% 1% - 5% Note: For each benchmark, the specific percentage factor chosen is the result of professional judgment based on engagement-specific risk. Engagements where clients exhibit higher-risk characteristics should be performed at lower percentage factors than engagements where clients exhibit lower-risk characteristics. These elevated risk characteristics may include among others the following: High engagement risk (i.e., public company, many foreseeable users of financial statements) New client; first engagement Client with previous material misstatements and/or financial statement restatements Non-public client preparing for public offering (IPO) Client with elevated fraud risk assessments Because of the increased engagement risk associated with publicly-traded clients, the maximum values of appropriate materiality factors is reduced, as shown in the table above.

Step by Step Solution

3.45 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

Benchmark value or amount identification and its analysis are very important to c...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started