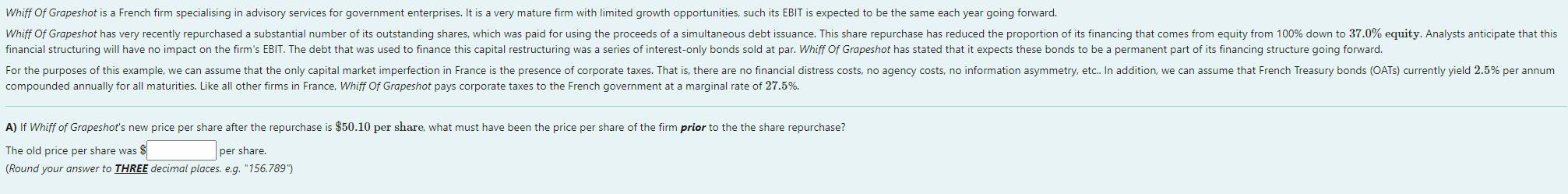

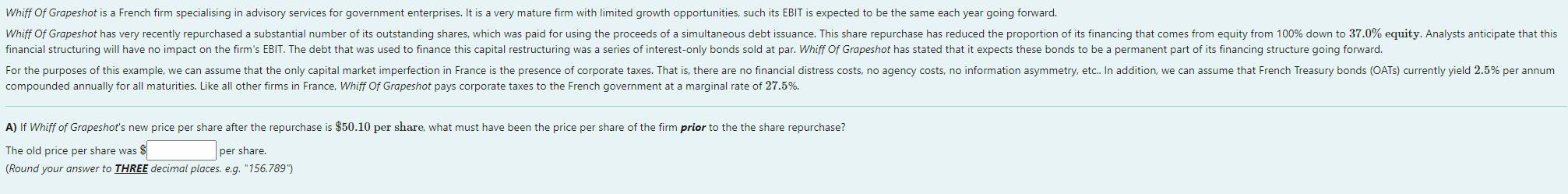

Whiff Of Grapeshot is a French firm specialising in advisory services for government enterprises. It is a very mature firm with limited growth opportunities, such its EBIT is expected to be the same each year going forward. Whiff of Grapeshot has very recently repurchased a substantial number of its outstanding shares, which was paid for using the proceeds of a simultaneous debt issuance. This share repurchase has reduced the proportion of its financing that comes from equity from 100% down to 37.0% equity. Analysts anticipate that this financial structuring will have no impact on the firm's EBIT. The debt that was used to finance this capital restructuring was a series of interest-only bonds sold at par. Whiff Of Grapeshot has stated that it expects these bonds to be a permanent part of its financing structure going forward. For the purposes of this example, we can assume that the only capital market imperfection in France is the presence of corporate taxes. That is, there are no financial distress costs, no agency costs, no information asymmetry, etc. In addition, we can assume that French Treasury bonds (OATS) currently yield 2.5% per annum compounded annually for all maturities. Like all other firms in France, Whiff Of Grapeshot pays corporate taxes to the French government at a marginal rate of 27.5%. A) If Whiff of Grapeshot's new price per share after the repurchase is $50.10 per share, what must have been the price per share of the firm prior to the the share repurchase? The old price per share was $ per share. (Round your answer to THREE decimal places. e.g. "156.789) Whiff Of Grapeshot is a French firm specialising in advisory services for government enterprises. It is a very mature firm with limited growth opportunities, such its EBIT is expected to be the same each year going forward. Whiff of Grapeshot has very recently repurchased a substantial number of its outstanding shares, which was paid for using the proceeds of a simultaneous debt issuance. This share repurchase has reduced the proportion of its financing that comes from equity from 100% down to 37.0% equity. Analysts anticipate that this financial structuring will have no impact on the firm's EBIT. The debt that was used to finance this capital restructuring was a series of interest-only bonds sold at par. Whiff Of Grapeshot has stated that it expects these bonds to be a permanent part of its financing structure going forward. For the purposes of this example, we can assume that the only capital market imperfection in France is the presence of corporate taxes. That is, there are no financial distress costs, no agency costs, no information asymmetry, etc. In addition, we can assume that French Treasury bonds (OATS) currently yield 2.5% per annum compounded annually for all maturities. Like all other firms in France, Whiff Of Grapeshot pays corporate taxes to the French government at a marginal rate of 27.5%. A) If Whiff of Grapeshot's new price per share after the repurchase is $50.10 per share, what must have been the price per share of the firm prior to the the share repurchase? The old price per share was $ per share. (Round your answer to THREE decimal places. e.g. "156.789)