Question

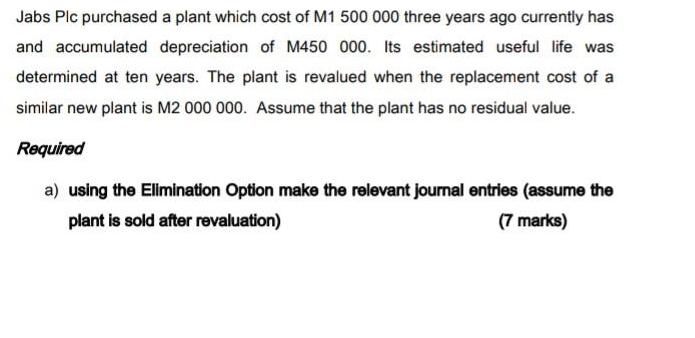

Jabs Plc purchased a plant which cost of M1 500 000 three years ago currently has and accumulated depreciation of M450 000. Its estimated

Jabs Plc purchased a plant which cost of M1 500 000 three years ago currently has and accumulated depreciation of M450 000. Its estimated useful life was determined at ten years. The plant is revalued when the replacement cost of a similar new plant is M2 000 000. Assume that the plant has no residual value. Required a) using the Elimination Option make the relevant journal entries (assume the plant is sold after revaluation) (7 marks)

Step by Step Solution

3.54 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

The answer is below provided step by step manner Cost of asset M 1 500 000 Accumulated Depreciation ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Business Law and the Legal Environment

Authors: Jeffrey F. Beatty, Susan S. Samuelson, Dean A. Bredeson

6th Edition

1285143310, 1111530602, 978-1285143316, 9781111530600, 978-1111530600

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App