Answered step by step

Verified Expert Solution

Question

1 Approved Answer

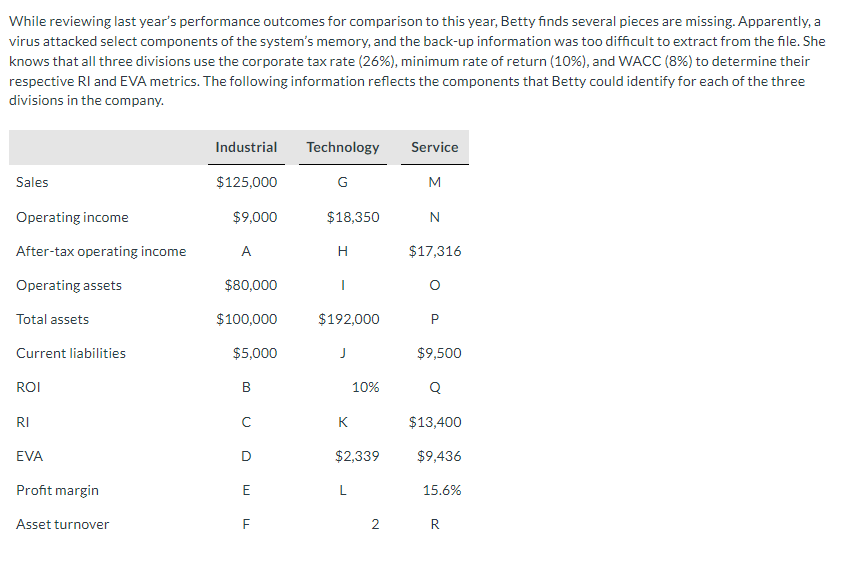

While reviewing last year's performance outcomes for comparison to this year, Betty finds several pieces are missing. Apparently, a virus attacked select components of

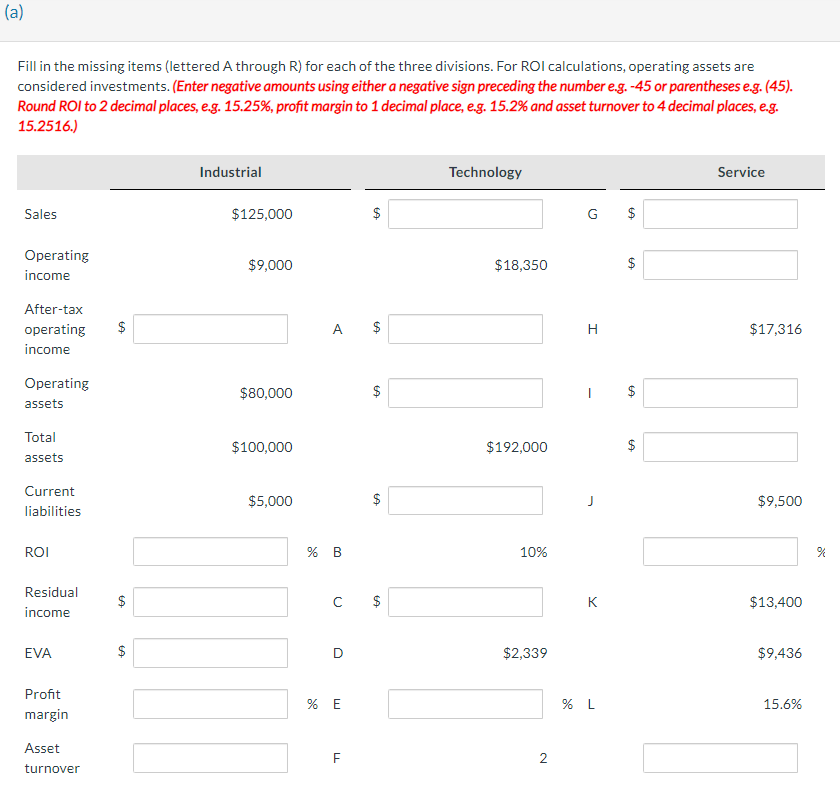

While reviewing last year's performance outcomes for comparison to this year, Betty finds several pieces are missing. Apparently, a virus attacked select components of the system's memory, and the back-up information was too difficult to extract from the file. She knows that all three divisions use the corporate tax rate (26%), minimum rate of return (10%), and WACC (8%) to determine their respective RI and EVA metrics. The following information reflects the components that Betty could identify for each of the three divisions in the company. Industrial Technology Service Sales Operating income $125,000 G M $9,000 $18,350 N After-tax operating income A H $17,316 Operating assets $80,000 Total assets $100,000 $192,000 P Current liabilities $5,000 J $9,500 ROI B 10% RI EVA CD K $13,400 $2,339 $9,436 Profit margin E L 15.6% Asset turnover F 2 R (a) Fill in the missing items (lettered A through R) for each of the three divisions. For ROI calculations, operating assets are considered investments. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45). Round ROI to 2 decimal places, e.g. 15.25%, profit margin to 1 decimal place, e.g. 15.2% and asset turnover to 4 decimal places, e.g. 15.2516.) Sales Operating income After-tax operating $ income Operating Industrial $125,000 $9,000 A $ $80,000 $ assets Total assets Current liabilities ROI $100,000 $5,000 Residual income EVA Profit margin Asset turnover $ LA 1A $ % B $ C $ D % E Technology G $ $18,350 H GA $ $ $192,000 $ 10% $2,339 LL F 2 Service $17,316 $9,500 K $13,400 $9,436 % L 15.6%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started