Whirlpool Corporation Global Procurement Case Study

Assignment Questions

1. What are the elements and drivers of Cost?

2. How do the key cost drivers differ across products/regions/suppliers?

3. Do you have any recommendations for whirlpool?

Here's the full case and detailed questions

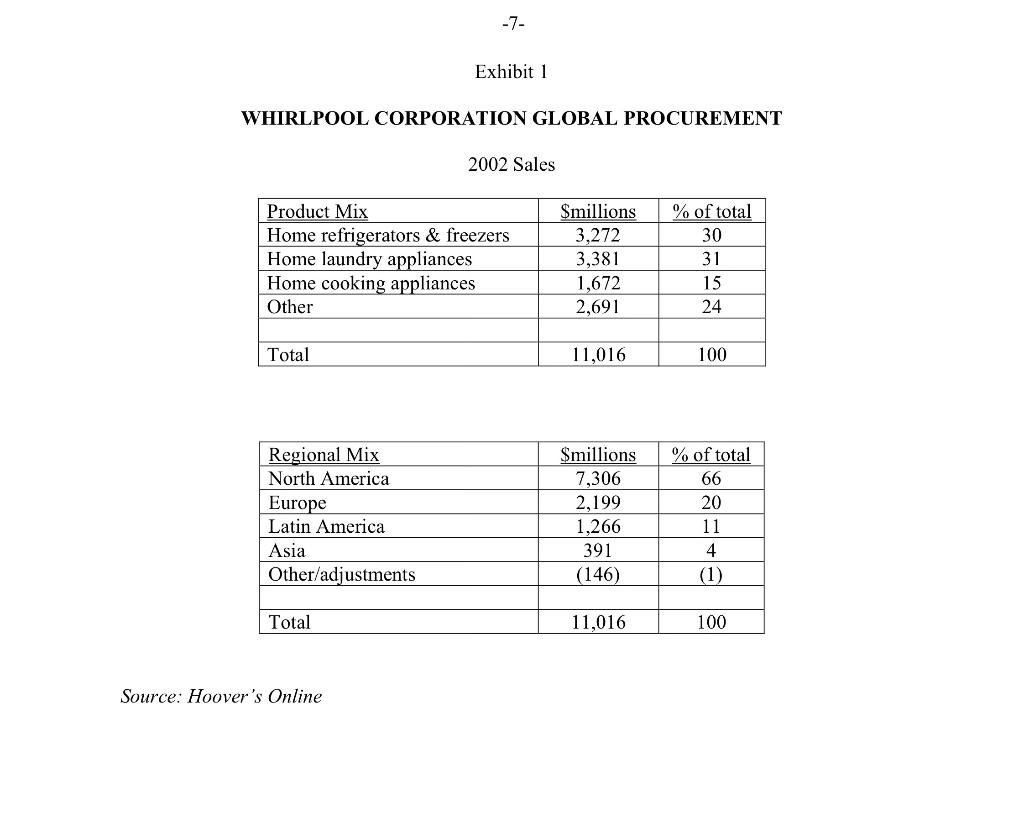

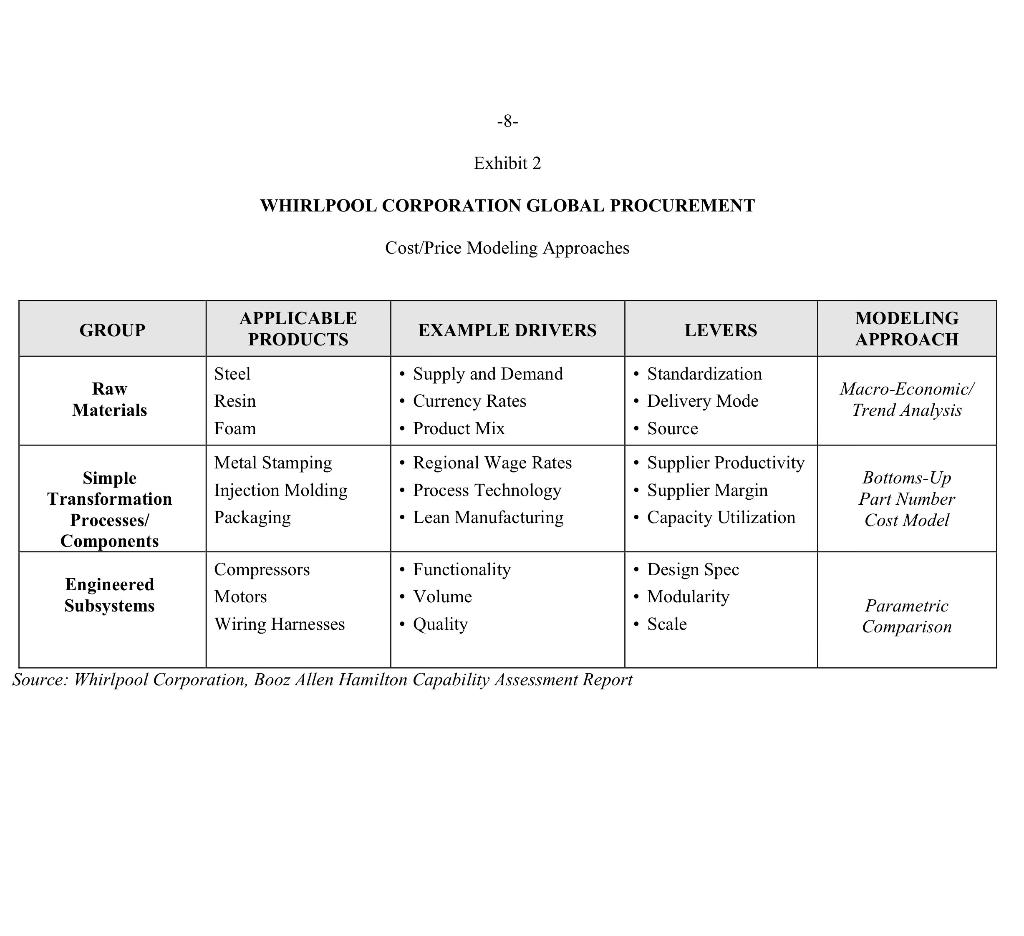

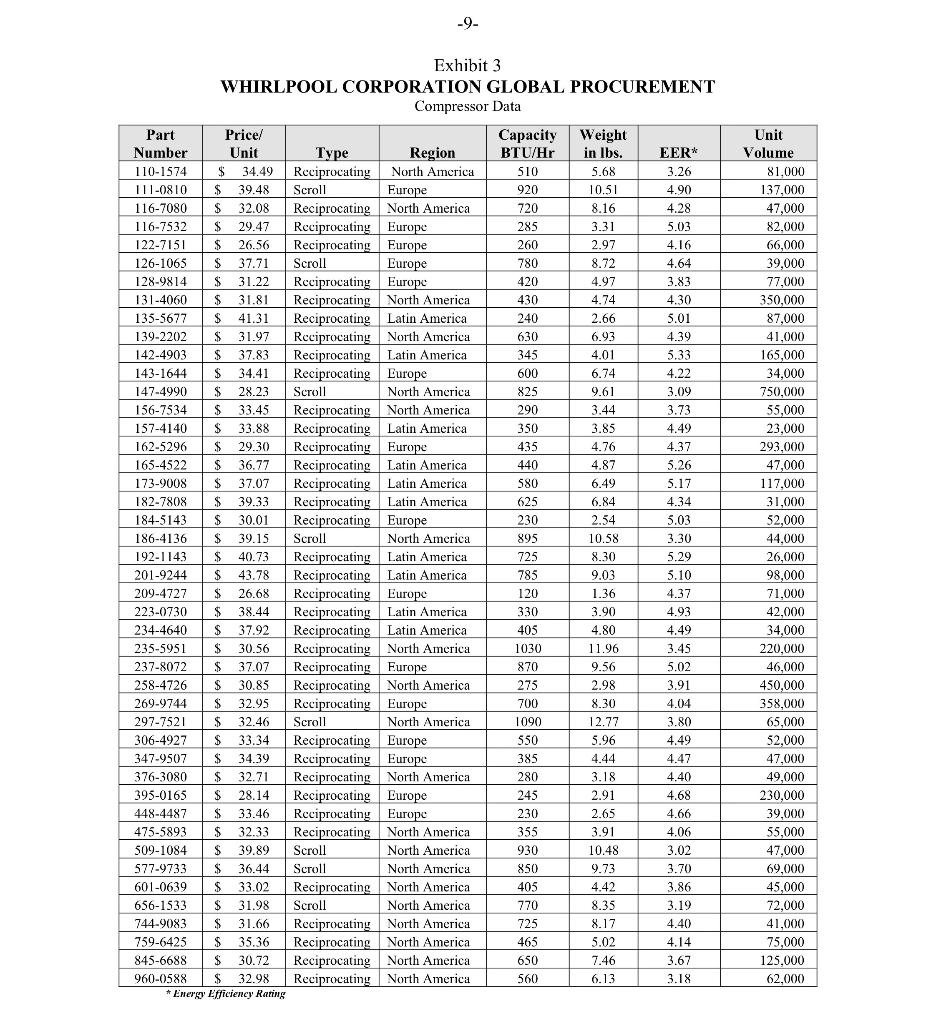

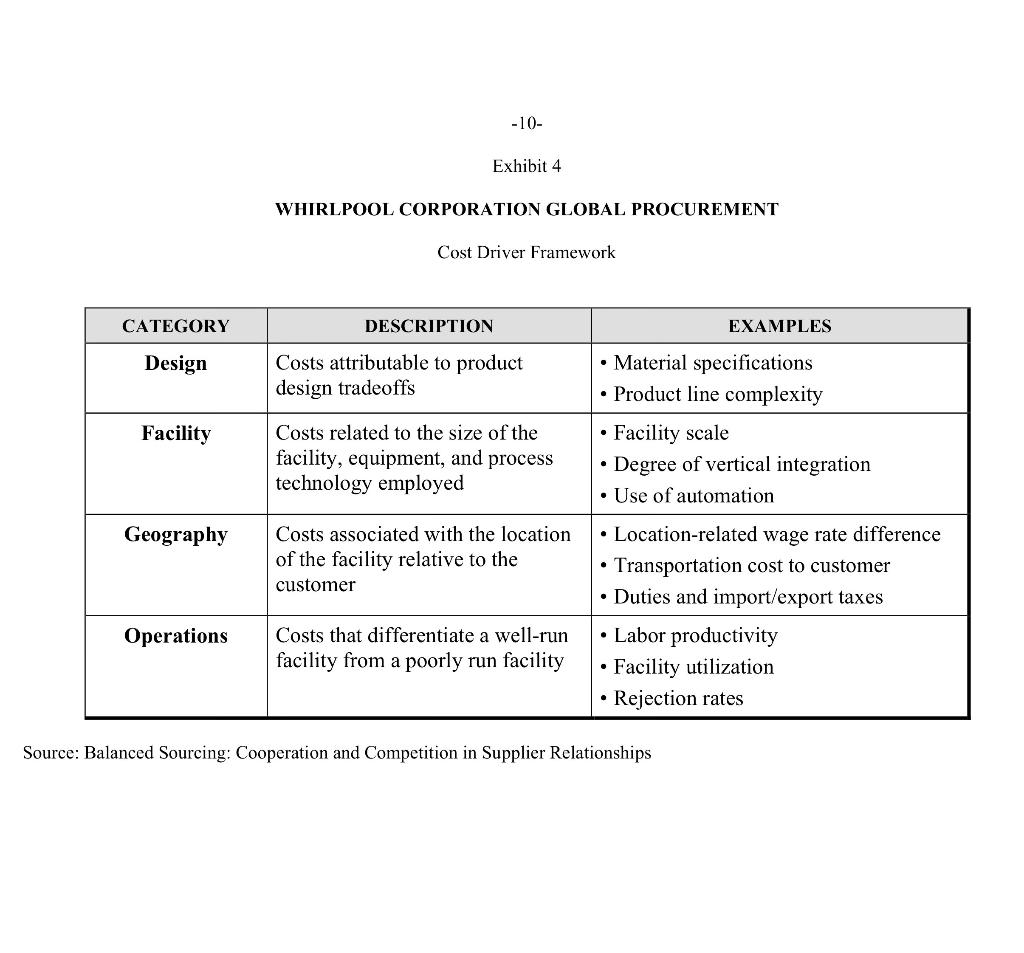

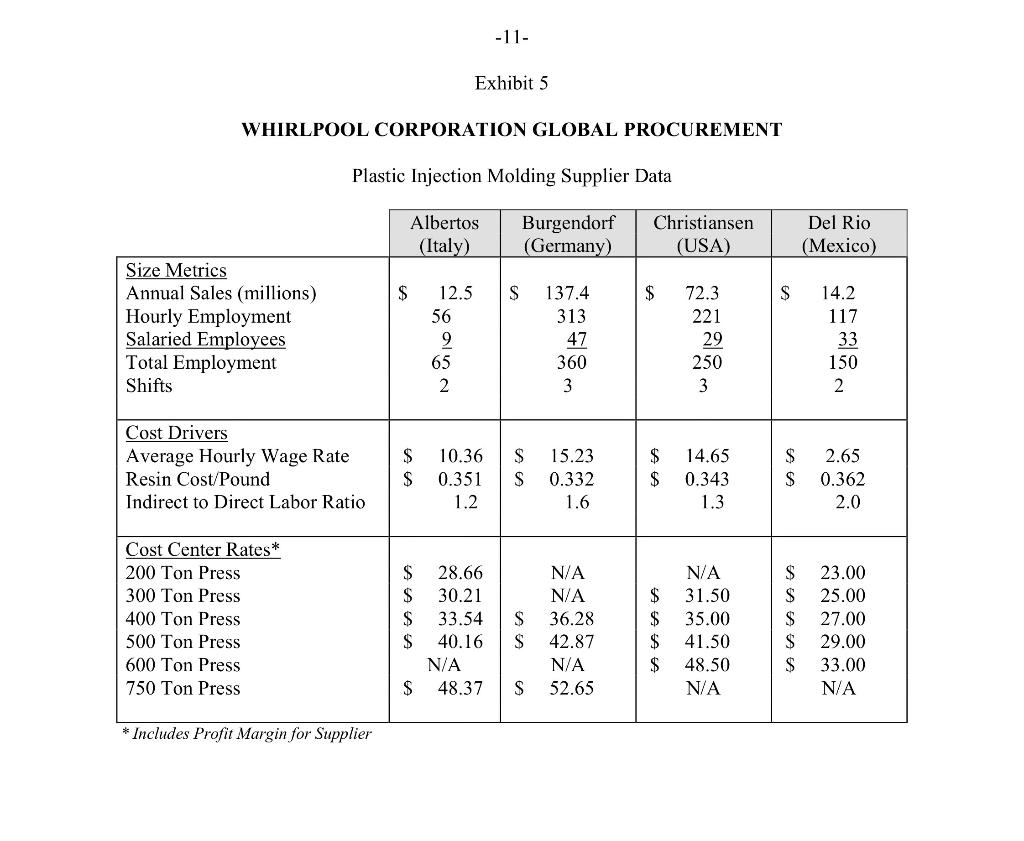

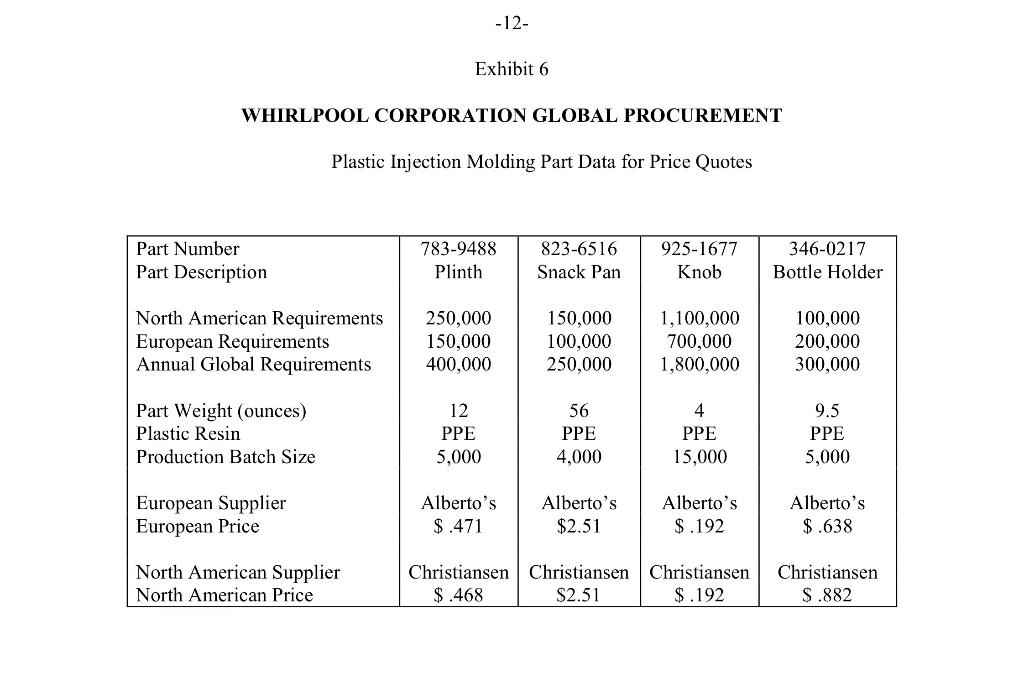

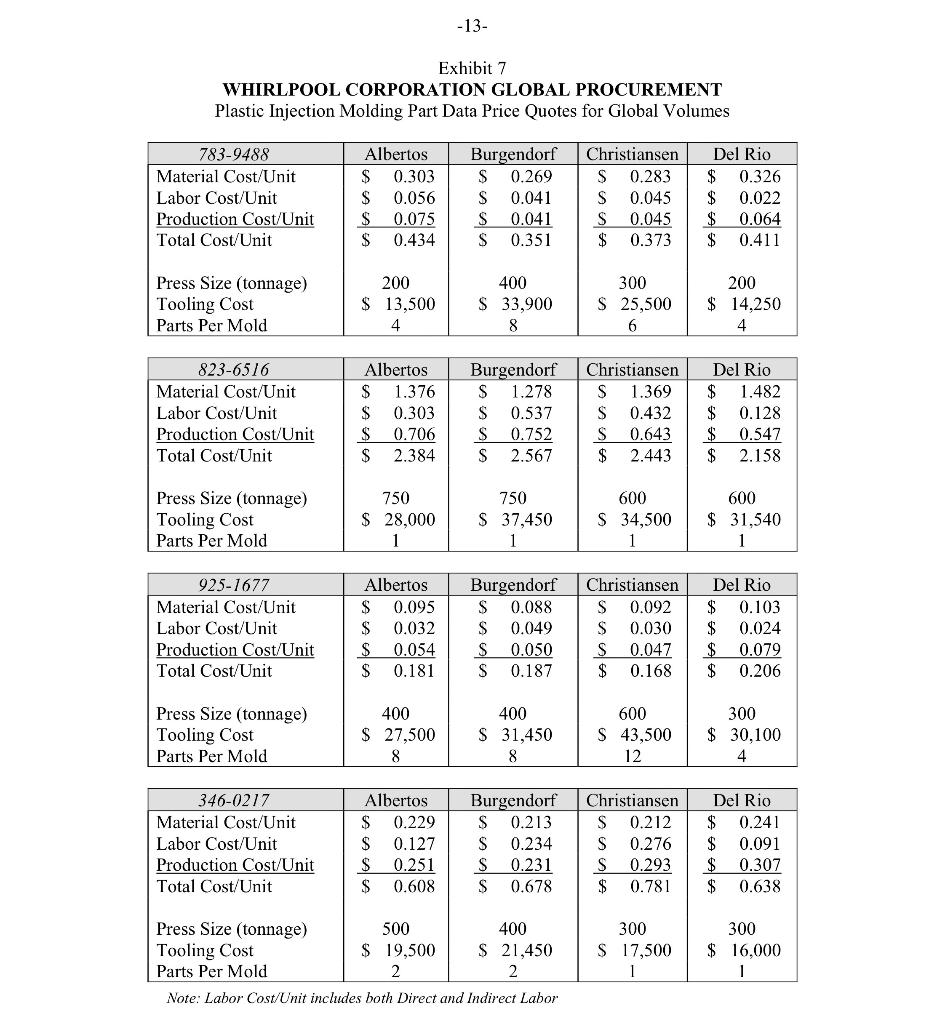

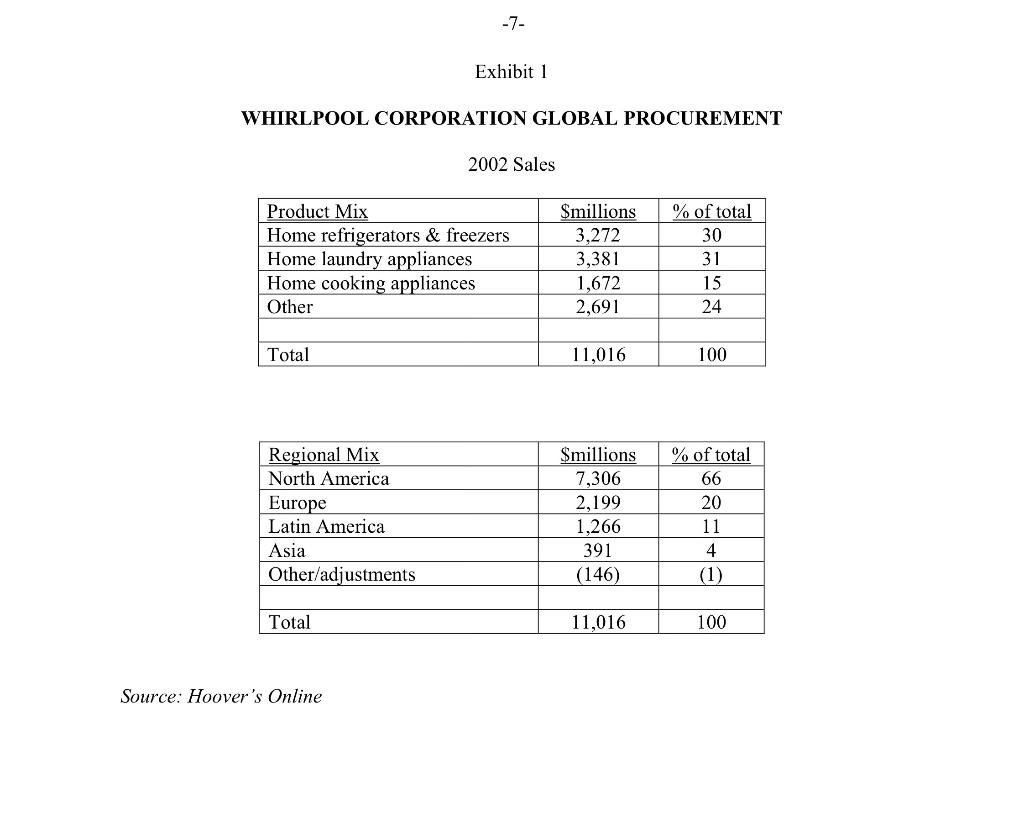

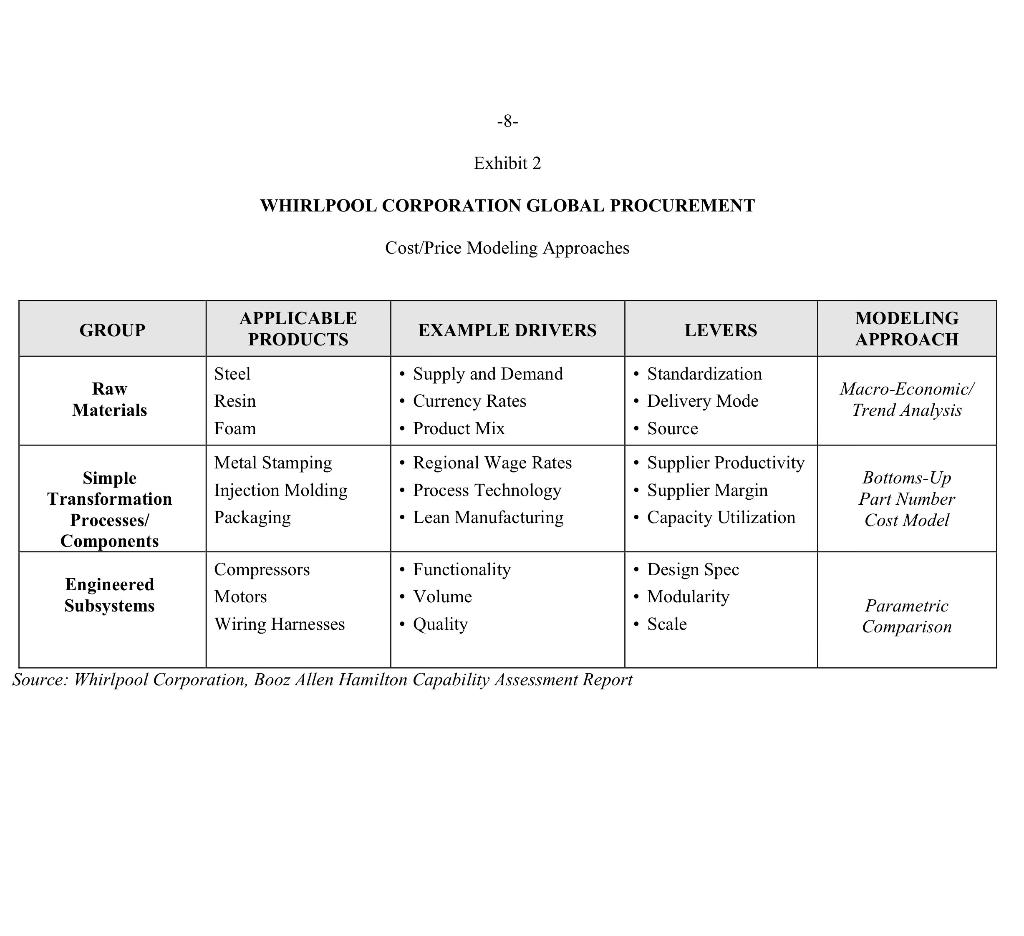

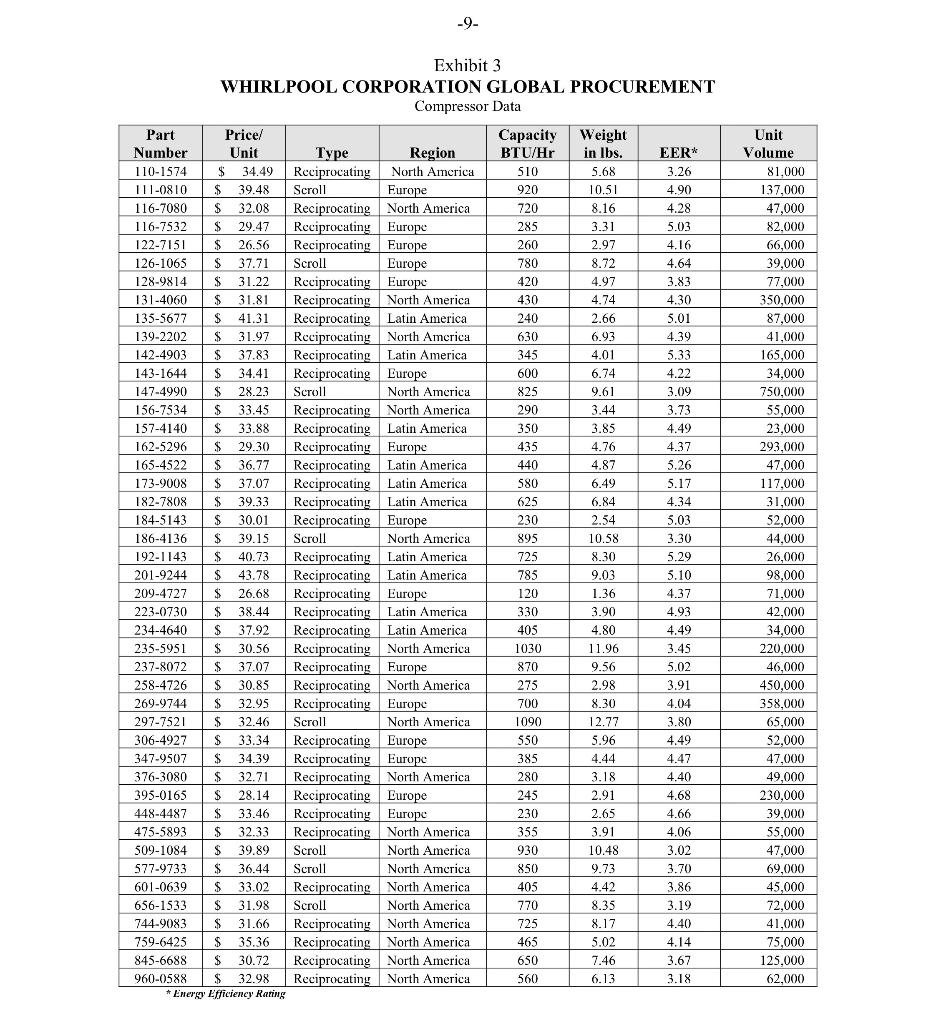

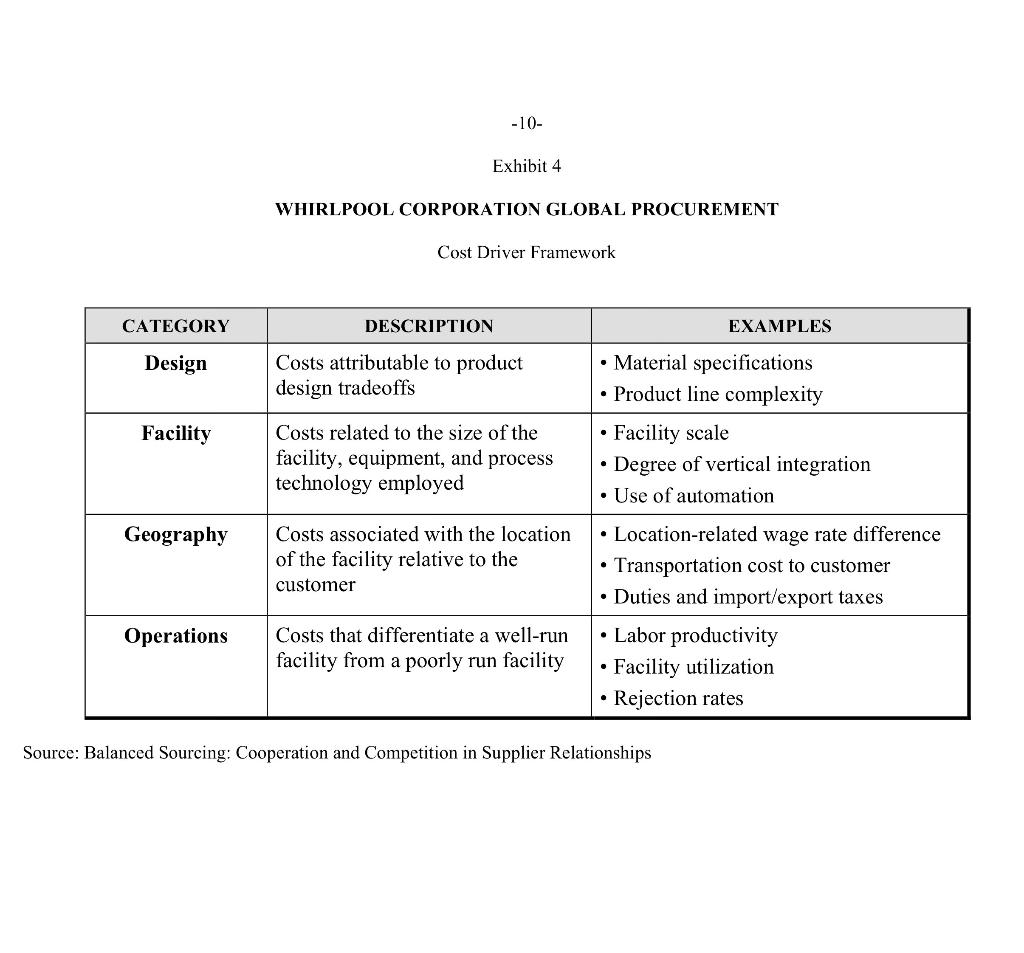

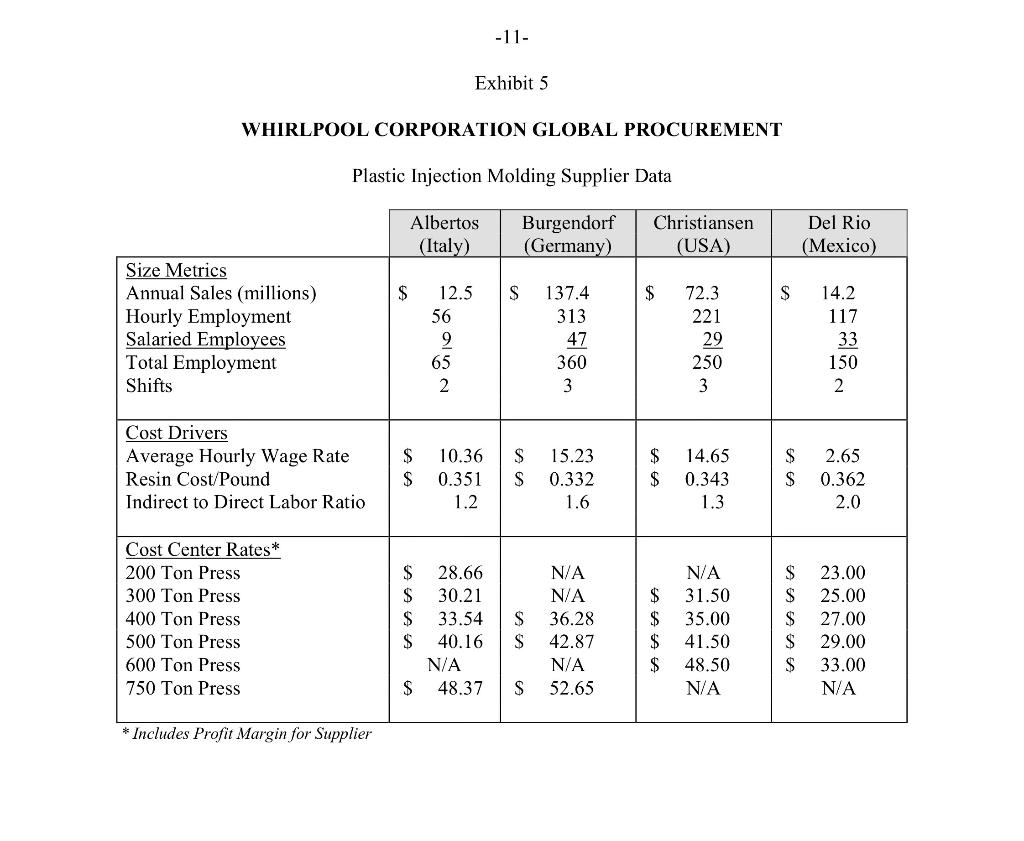

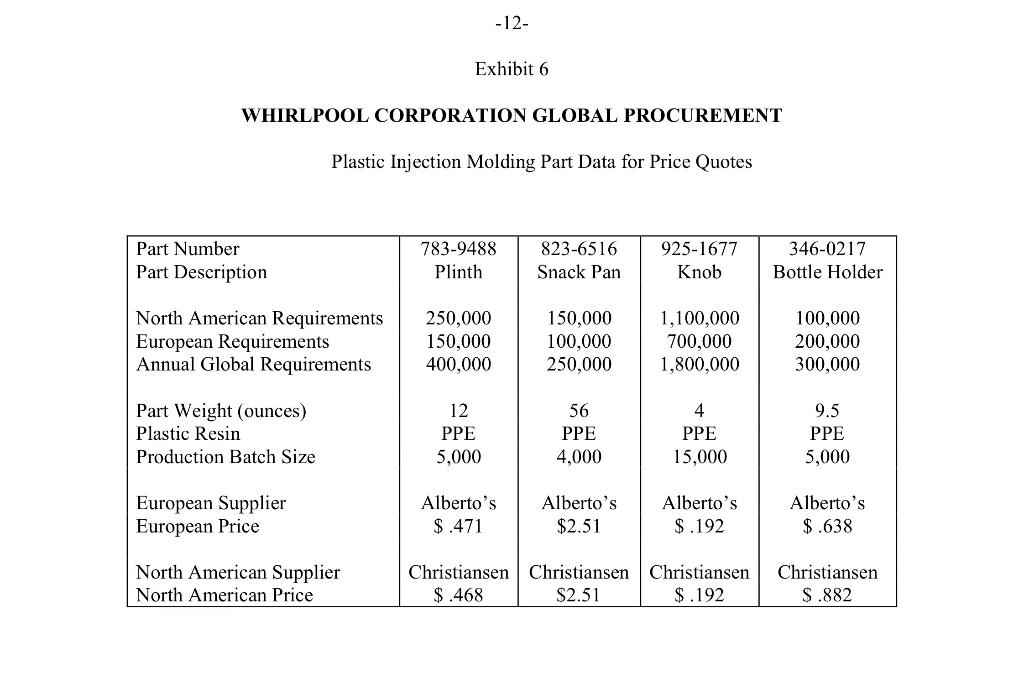

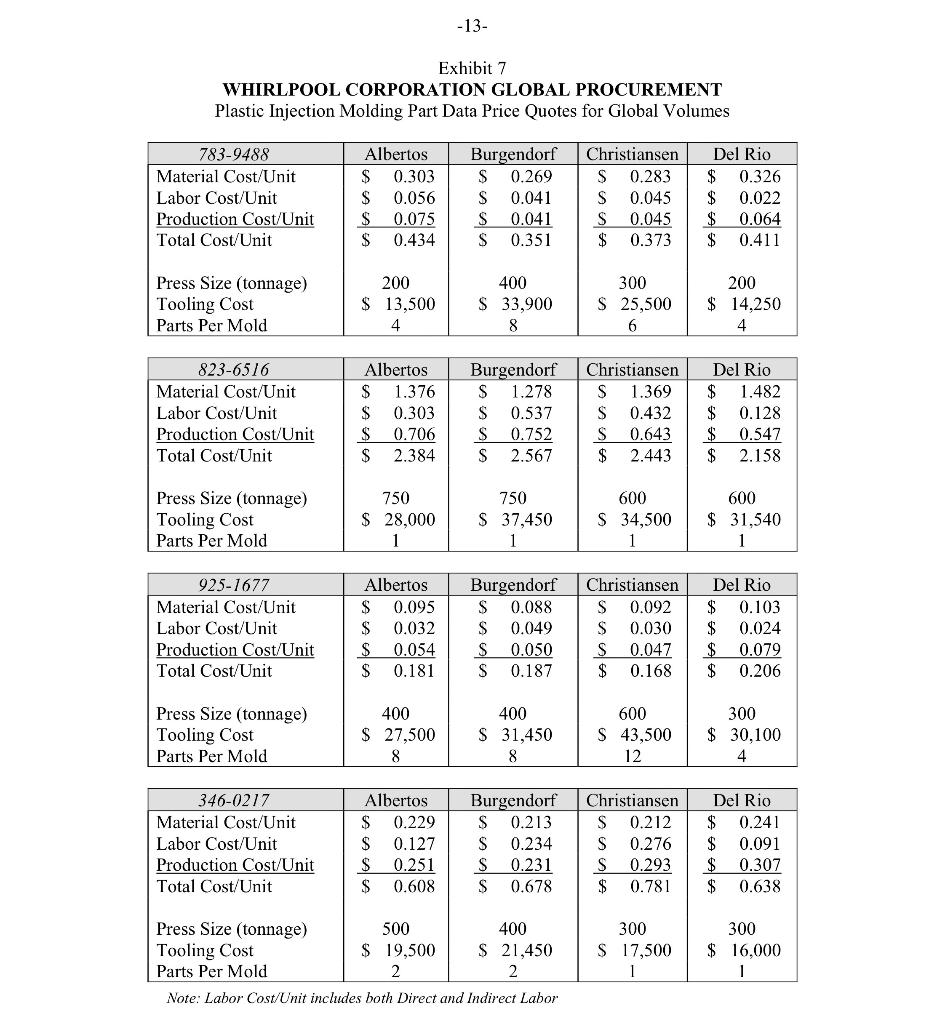

Whirlpool Corporation Global Procurement Case Write-up Assignment Questions Consider compressors and plastic injection molding parts separately, and answer the following questions: 1) What are the elements and drivers of cost? 2) How do the key cost drivers differ across product/region/supplier? 3) Do you have any recommendations for Whirlpool? Guidelines Below I provide some focused questions to assist you in creating a case write-up, and help you navigate your way to answer questions using the data. However, please don't lose sight of the big picture (making meaningful recommendations for Whirlpool based on analyzing this data). The main focus of your analysis should be on understanding the key cost drivers for compressors and plastic parts. There are several suppliers (across the globe) for these parts and many drivers. Understanding which drivers are important is key to understanding why costs vary across suppliers. You may structure your written report as two sections - one for compressors and the other for plastic parts. Write an executive summary at the beginning of your report giving your recommendation(s). Your recommendation(s) should basically be a set of next steps (keep status quo, change something, investigate something, etc.), justified of course by your analyses to the extent possible with the data. Below are some specific guidelines for your analysis of compressors and plastic parts. At the end of this document, I give some clarifications on various exhibits. For Compressors: 1) Identify the elements /drivers of costs and value (price) 2) Use framework in Exhibit 4 to classify the drivers (some drivers can belong to more than one class) 3) Use data in Exhibit 3 to develop an understanding of the key cost or value drivers across product types and geography. What is different across product types/geography? - Tools you can use: simple xy graphs (plot y against x ), regression analysis to see which drivers are significant in explaining the price. Can you also predict the price using your regression model? Which supplicrs/products have better/worse pricing compared to predictions by the regression? What insights do you gain from this? 4) Whirlpool is considering if it should consolidate the compressors spend. What would you recommend to Whirlpool? Any other recommendations? For Plastic parts: 1) Identify the elements /drivers of costs 2) Use framework in Exhibit 4 to classify the drivers 3) Use data in Exhibits 5-7 to develop an understanding of how various cost elements impact the total cost across various suppliers, as well as the key factors (size, location, capacity, etc.) that may impact the various drivers. - Remember that sometimes simple graphs can give a lot of insight. What insights do you gain from this? 4) Based on your analysis, what are the advantages and disadvantages of each supplier? What can you recommend to Whirlpool for plastic parts? Should they consolidate? - Exhibit 5 1) The annual sales in Exhibit 5 represent the suppliers' annual sales (to all its customers including Whirlpool) 2) The employment \# represents total hourly employment across all shifts 3) The cost center rates are hourly rates for using a particular machine. Higher tonnage is more expensive to operate per hour, but can produce larger parts (e.g., by weight) or could be faster (producing more per unit of time) than smaller presses. - Exhibit 6 1) On production batch sizes: Whirlpool requested the quotes from suppliers based upon a set batch size. 2) Price data: you should assume that the price shown for Alberto represents its current price for the European volume and the price shown for Christiansen is its current price for the North America volume. Whirpool split the global volume between the two suppliers but is now looking to potentially consolidate to a single global supplier for each of these parts. - Exhibit 7 1) What is the volume basis for the cost numbers in this exhibit? You can assume that the costs quotes are for global annual volumes. Production costs include all costs other than labor and materials. 2) Tooling costs: In injection molding, tooling cost is typically cost of molds. These are fixed though mold have a life span and need to be replaced every so often (recall the Scotts case, where mold had a 5-year life). Parts per mold gives how many parts can be obtained from one mold---depends on how the mold is designed. Press size may not have a direct relationship with parts/mold. In general, one would think that the larger \# of parts/mold will need larger presses. But it will also depend on what the part is; e.g., heavier parts may require larger presses. So it is only fair to compare this for a given part type. 3) Total cost = material cost + labor cost + production cost + tooling cost Martha Jones and Scott Trebeck, Booz Allen summer interns from the Darden Graduate School, were comparing notes in the conference room of the Whirlpool Corporation's St. Joe Technical Center. As part of a consulting team conducting a six-week capability assessment of Whirlpool Corporation's Global Procurement Organization, they were approaching the crunch time when data needed to be converted to findings that would support actionable recommendations. "Did you get all of the commodity data you needed during your trip to Milan?" Trebeck asked. "I heard that the head of Purchasing for Europe can be rather intimidating." "She's pretty intense and wicked smart," Jones replied, "but, she was a very cordial host. She's quite supportive of the study and provided all the information we requested. How did it go for you in Brazil?" "The South American Procurement group seemed quite laid back and anxious to learn best practices from anyone," Trebeck answered. "I got the sense that the region overall operates more independently from headquarters than the European region. Although their systems are less developed than North America and Europe, I got all the information we requested as well. The issue now is what to do with it all!" "My thoughts exactly," Jones exclaimed. "I've got cost details on four different injection-molded parts produced by four different suppliers in four different countries-but I'm not sure what it tells me." "Only four part numbers?" Trebeck retorted. "I've got data on 45 different compressors from North America, Europe, and Latin America, but everyone tells me that I can't compare them across regions because the designs aren't the same. Hopefully, we can get some guidance from Carlos over dinner tonight now that he's back from India." 2 Whirlpool Corporation: The Global Appliance Leader As the world's leading producer and marketer of major home appliances, Whirlpool Corporation manufactures in 13 countries and markets products in over 170 more. In addition to its own major brands such as Whirlpool, KitchenAid, Roper, Estate, Bauknecht, Ignis, Laden, Inglis, Brastemp, and Consul, the company supplies many of the appliances marketed by Sears, Roebuck and Co. under the Kenmore brand name. Whirlpool Corporation can trace its roots back to the Upton Motor Machine Company, a manufacturer of electric motor-driven washing machines, founded in 1911 in St. Joseph, Michigan. The corporation's relationship with Sears also goes back, to the years 1916, when Upton began producing appliances for Sears, and 1925, when it became the sole supplier of Sears washing machines. After combining with the Nineteen Hundred Washer Company in 1929 , the predecessor to the Whirlpool Corporation of today became the world's largest washing machine company. After successfully introducing its first automatic washing machine under the Whirlpool brand name, the company changed its name to match the brand in 1950. Whirlpool Corporation expanded to into a full line of major appliances during the 1950s and 1960s-including forays into central heating and even television. Today, the manufacture of its original laundry products continues to be its largest area of production, but this is closely followed by refrigerators and freezers plus a significant level of sales of cooking and other appliances. (See Exhibit 1.) Whirlpool Corporation began its international expansion with an investment in Multibras Eletrodomsticos in 1958 , but most of its international growth came through joint ventures and acquisitions in the 1980s and early 1990s. Today North America-including a major presence in Mexico - accounts for about two-thirds of Whirlpool Corporation's $11 billion in revenues. Although today Whirlpool Corporation operates with an executive team accountable for regional profit and loss, it formed a global Product Development and Procurement Organization in the mid-1990s to drive efficiency in product design and sourcing across the regions. The senior management team includes the chairman, president, and five executive vice presidents. Three of the executive vice presidents cover the three major regions of North America, Europe, and Latin America. The chief financial officer and the chief technology officer-responsible for product development and procurement - complete the set of executive vice presidents. Although the Global Procurement Organization (GPO) reports to the chief technology officer, it must manage a tension between functional and regional priorities. Certain critical commodities are managed across regions on a global basis while simultaneously regional Procurement vice presidents have dotted-line relationships into the management structures supporting the regional executive vice presidents. A global strategy and process group works to ensure collaboration and consistent "best practices" across the globe. The Booz Allen study was commissioned in support of this objective. -3- Dinner Discussion As the team settled around the table on the veranda at Schu's, a restaurant overlooking Lake Michigan, Carlos Martinez didn't bother opening his menu. It was a standing joke among the consulting team that he always ordered a bacon cheeseburger, fries, and a beer if given a chance. After a long week in India, he was in desperate need of his staple. Not wasting any time, as usual, Martinez looked at Scott Trebeck and Martha Jones. "So, how's the cost/price analysis going? Got it all figured out?" Trebeck and Jones looked at one another, both hoping the other would take the lead. Trebeck managed to drop his fork on the ground and bent down to pick it up forcing Jones to break the silence. "We've collected all the data you suggested, but we were hoping to get your thoughts on how best to proceed with the analysis," she explained. "No problem," Martinez replied as he reached into his brief case and pulled out a sheet of paper. "Here's the way I've started to think about cost modeling over the past few weeks." Placing a tabular chart (reproduced as Exhibit 2) on the table in front of Jones and Trebeck, he continued, "In the past, when I talked about cost modeling, I thought about bottoms-up models for a supplier facility and/or an individual part number. But, I now realize that those models only work with certain types of products. As you can see from the chart, I refer to Metal Stampings, Injection Molding, and Packaging as 'Simple Transformation Processes' where the bottoms-up approach works well." Martinez pointed to the top row of the chart and continued, "But, for raw materials-true commodities like steel, resin and foam-macro-economic/trend analysis seems more appropriate. For example, consider memory chips - we can build a bottoms-up cost model, but Intel and the other chip makers are going to price according to supply and demand and other industry factors and not simply the current cost." "Engineered subsystems, like compressors, motors, and wiring harnesses also need to be treated differently," explained Martinez. "Usually, it's just not practical to build a detailed cost model for a highly complex product like a motor. But, with an approach like multivariate regression analysis, it's possible to quantify the key drivers of cost. With that knowledge, we can negotiate better prices from suppliers and also convince engineering to specify designs with the best cost/value tradeoff." "That makes sense," responded Trebeck. "I should use regression analysis on the compressors to conduct a 'Parametric Comparison' across the regions. I've got the data," Trebeck continued as he pulled out a spreadsheet (reproduced as Exhibit 3), "but what should I be looking for? My QA professor warned us against simply running the data through the regression tools without any understanding of the relationships between the variables. I'm not sure I know enough about compressors to make a judgment." -4- "I'm not an expert on compressors either, but I think we can hypothesize the key relationships," said Martinez. "What's the main parameter they use to describe a compressor?" "That's easy," Trebeck replied. "They describe the various designs according to the cooling capacity as measured in BTUs per hour." "Can we hypothesize that larger compressors generate more BTUs per hour, and larger ones cost more to make, because they require bigger, heavier parts?" Martinez asked. "And even if they don't require bigger, heavier parts, I would guess they are priced higher because they are worth more to the consumer." "That makes sense to me," Trebeck replied. "And I think I see where you're going. Energy Efficiency should be another important parameter. I'm not sure how it affects cost, but it certainly makes the compressor more valuable because it requires less energy to operate. They also track other parameters like weight and RPM, but those are probably correlated with some of the more important parameters we already discussed." "What about annual purchases?" asked Jones. Trebeck looked perplexed. "What do you mean? I've got that information, but the number of units purchased isn't a product characteristic." "But, higher unit volumes tend to produce lower costs per unit due to economies of scale," explained Jones. "I'm not sure economy of scale is the best way to describe it, but I agree with you that higher volume products should cost less per unit. Generally, that's true because you can amortize one-time costs like product design and batch costs like machine setups over more units," explained Martinez. "Economy of scale is related to facility capacity rather than volume at an individual SKU level." "That's one of the issues I'm struggling with in comparing prices of injection-molded parts between Europe and North America," said Jones. Turning to Trebeck, she quickly added, "Sorry Scott, your turn is over; it's time to talk about my product category, injection-molded parts." "No problem. The appetizers are here now, and I would rather eat than talk!" retorted Trebeck. Turning back to Martinez, Jones discovered him sheepishly cramming a potato skin in his mouth. "Like I was saying," she continued, "I've got lots of detailed supplier data comparing the costs for producing six identical parts in Europe and in North America, but I'm not sure how to analyze it." 5 Martinez quickly swallowed the potato skin and wiped his mouth before answering. "As you know, when building cost models, we're trying to identify and highlight the key drivers of cost. Drawing from the methods employed in competitive cost modeling, I've found it useful to organize the drivers into four categories: Design, Facility, Geography, and Operations. Design recognizes that two products may provide the same functionality but employ different design concepts-for example, reciprocating versus scroll compressors." He turned to Trebeck, who was peering out over the lake. "By the way, Scott, this framework obviously applies to your analysis of compressors as well." "I see that," said Trebeck "but, it also reminds me of a concern raised during my data gathering efforts. The compressor buyer explained that the regions employed different designs so the products are not really comparable." "That's an important point," replied Martinez. "I'm not sure that I agree that different designs make the task impossible...but his comment reinforces an important principle about regression analysis. The regression approach only shows whether there is a relationship between two things: it does not prove cause and effect. For example, if you find lower pricing in Europe, the cause could be better buying by the European region...but it could also be that the designs are inherently different. We will use the parametric analysis tool to find if a difference exists. We will need to investigate the cause by forming hypotheses and talking to the experts." "Design won't be an issue for plastic parts, because the comparisons are between identical SKUs made to the exact same specifications in both regions," explained Jones. "Interestingly, they have compared prices in the past, but each region has its own supplier for each part." "Even without design differences, you can examine the other three categories," explained Martinez. "You should isolate the cost drivers like wage rates that relate to the regions in the Geography category. If material prices for the raw plastic compound are driven by regional pricing, you would also include them as well. Of course, it might be that material prices are related to purchasing scale because larger companies can buy in greater volume at lower prices. You should also consider differences in molding equipment or tooling in the Facility category. Ultimately, Operations is supposed to capture anything that doesn't fit in the other three." "Since, conceptually at least, the approach adjusts for differences in the design and the plant and the region, what's left?" asked Jones. "The most common issue in the Operations category is a difference in utilization levels, but it might also include some productivity differences. Imagine that two suppliers are making identical parts with identical equipment, but one plant is running only one shift, and the other plant runs two shifts. The costs would be different. And sometimes you simply find that one supplier can run the machine faster or produce less scrap," explained Martinez, as he pulled another bit of paper from his briefcase (reproduced as Exhibit 4). "I think this chart offers a good summary and guide." Jones perused the tabular chart as Martinez grabbed another potato skin. "This helps a lot," she said, barely glancing up and nodding her head at the sheet of paper. "I think I can start making some sense out of the data that I have." (See Exhibits 5, 6 and 7.) "Great," replied Martinez. "Remember, we have several objectives in conducting the analysis. First, we want to demonstrate the power of cost modeling as a tool. We also want to show that different techniques can apply depending on the product category. Finally, we're looking for any evidence that one region does a better job than another, or at least some evidence that they should be sharing insights and learning from one another." "Wait a minute," implored Trebeck. "I've been focused on simply doing the analysis and trying to compare across regions. I haven't really stepped back to think how Whirlpool Corporation can apply the cost models going forward." "First, remember that a cost model is simply a tool...but it can be a powerful one," explained Martinez. "A cost model can drive a sourcing strategy. For example, the geographic cost drivers may demonstrate that cost savings of sourcing from a low-factor cost country are more than offset by the high transportation cost." "Can you also use them in negotiations?" asked Jones. "It's a good place to start," answered Martinez. "But, simply knowing the cost doesn't guarantee results. Issues like industry structure and competitive tension will also influence the negotiation. Tomorrow we can all meet after lunch, and you can each show me your progress in analyzing the compressor data and the injection-molded parts data. At that time we can also talk further about how to apply the model results." Trebeck looked at his watch and replied, "No problem. Lunch tomorrow is nearly 16 hours from now. We've got plenty of time." "Speak for yourself," Jones countered as she glared at him. "We'll let Scott meet with me first to give you more time. Besides, Martha's analysis of the injected molded parts will probably take more creativity and time than the regression of the compressor data," added Martinez to break the tension. "But for now, let's enjoy our meal and the sunset over Lake Michigan because here comes my bacon cheeseburger!" Exhibit 1 WHIRLPOOL CORPORATION GLOBAL PROCUREMENT 2002Sales Source: Hoover's Online WHIRLPOOL CORPORATION GLOBAL PROCUREMENT Cost/Price Modeling Approaches Source: Whirlpool Corporation, Booz Allen Hamilton Capability Assessment Report Exhibit 3 WHIRLPOOL CORPORATION GLOBAL PROCUREMENT Cost Driver Framework Source: Balanced Sourcing: Cooperation and Competition in Supplier Relationships Exhibit 5 WHIRLPOOL CORPORATION GLOBAL PROCUREMENT Plastic Injection Molding Supplier Data NHIRLPOOL CORPORATION GLOBAL PROCUREMENT Plastic Injection Molding Part Data for Price Quotes Exhibit 7 WHIRLPOOL CORPORATION GLOBAL PROCUREMENT Plastic Injection Molding Part Data Price Quotes for Global Volumes Note: Labor Cost/Unit includes both Direct and Indirect Labor