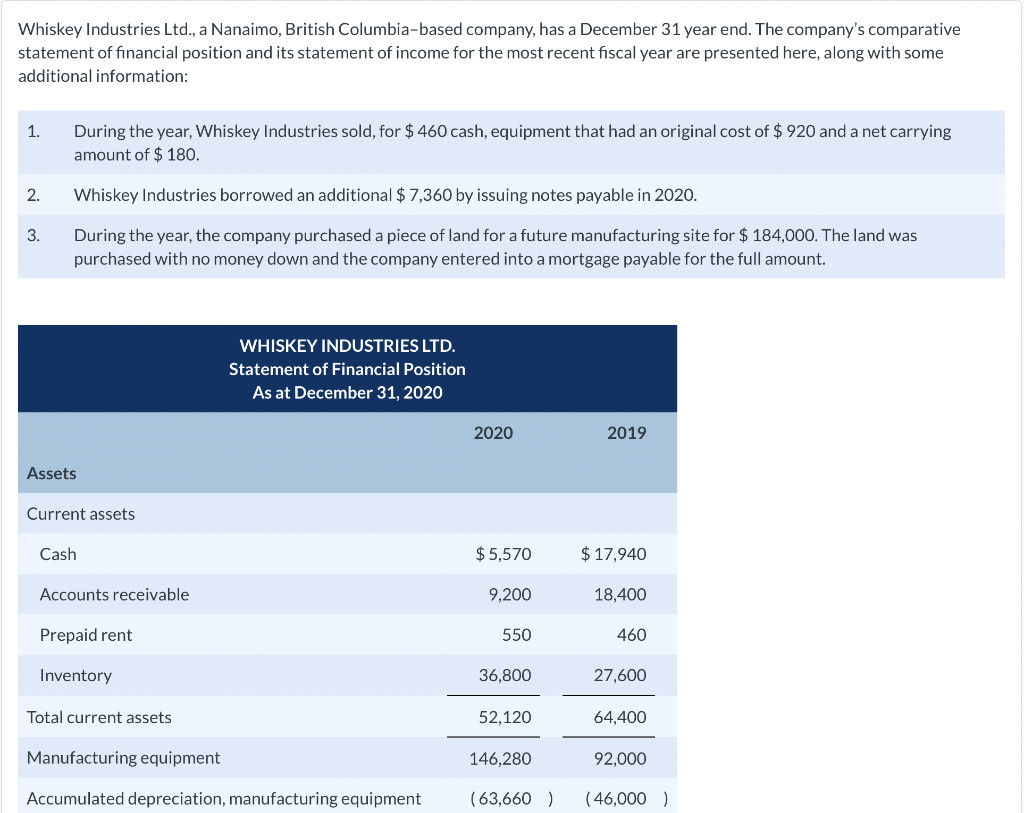

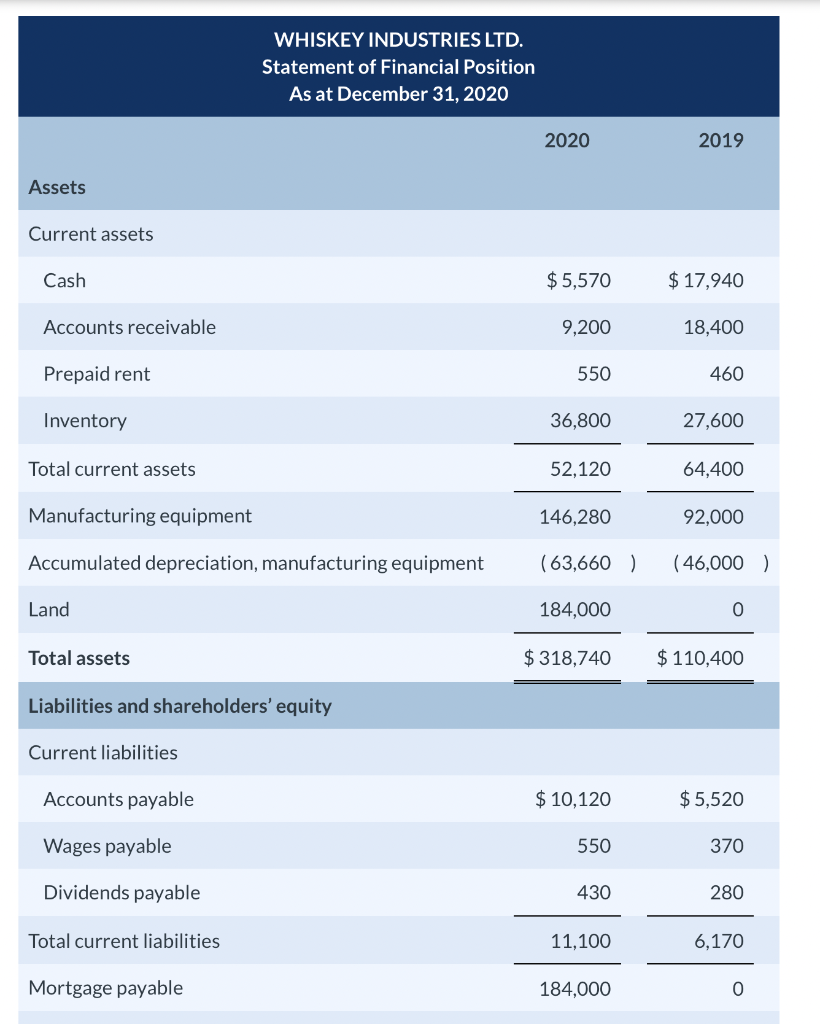

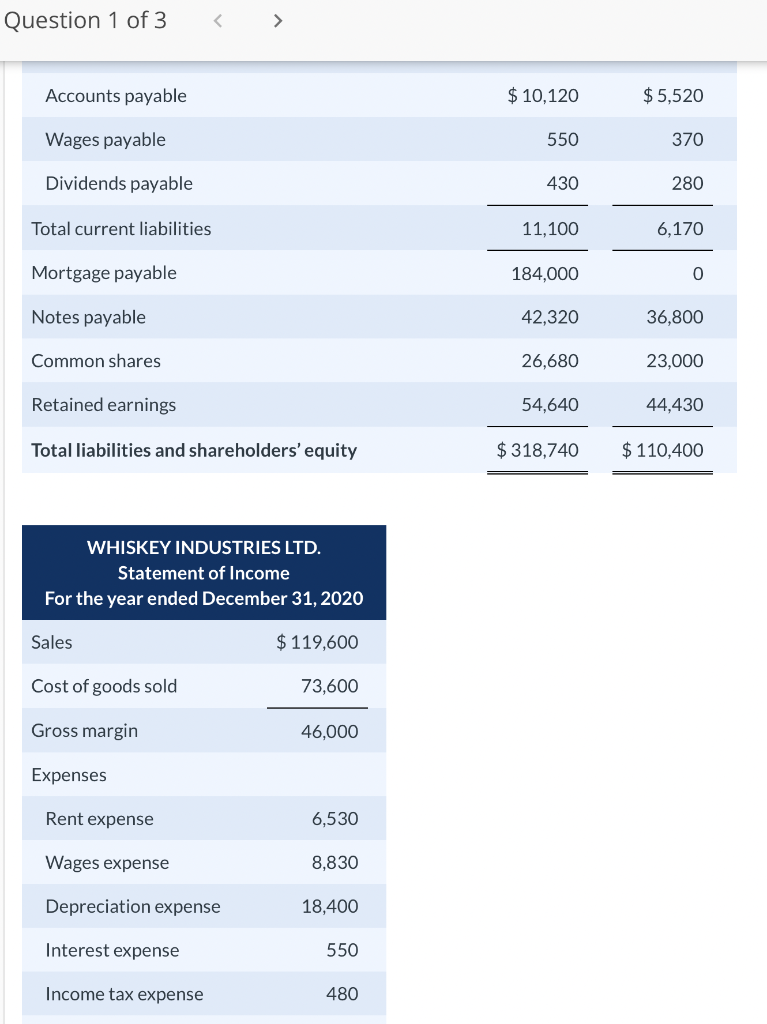

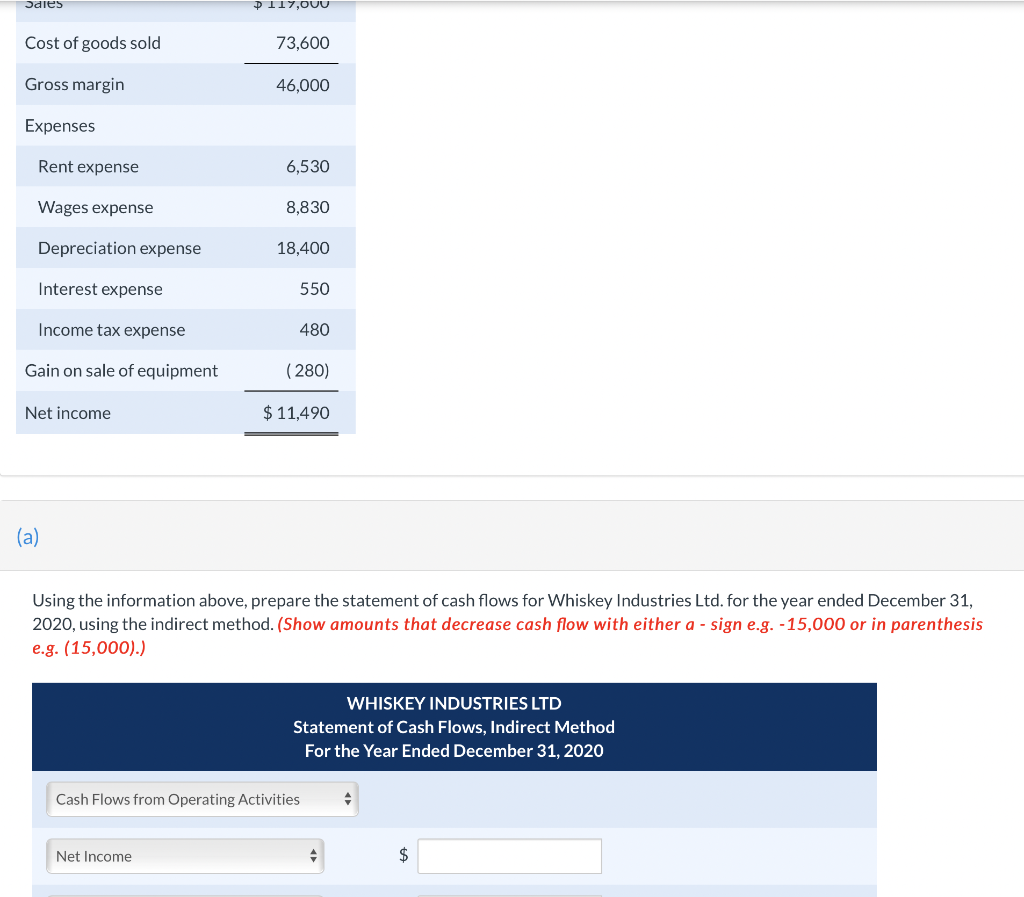

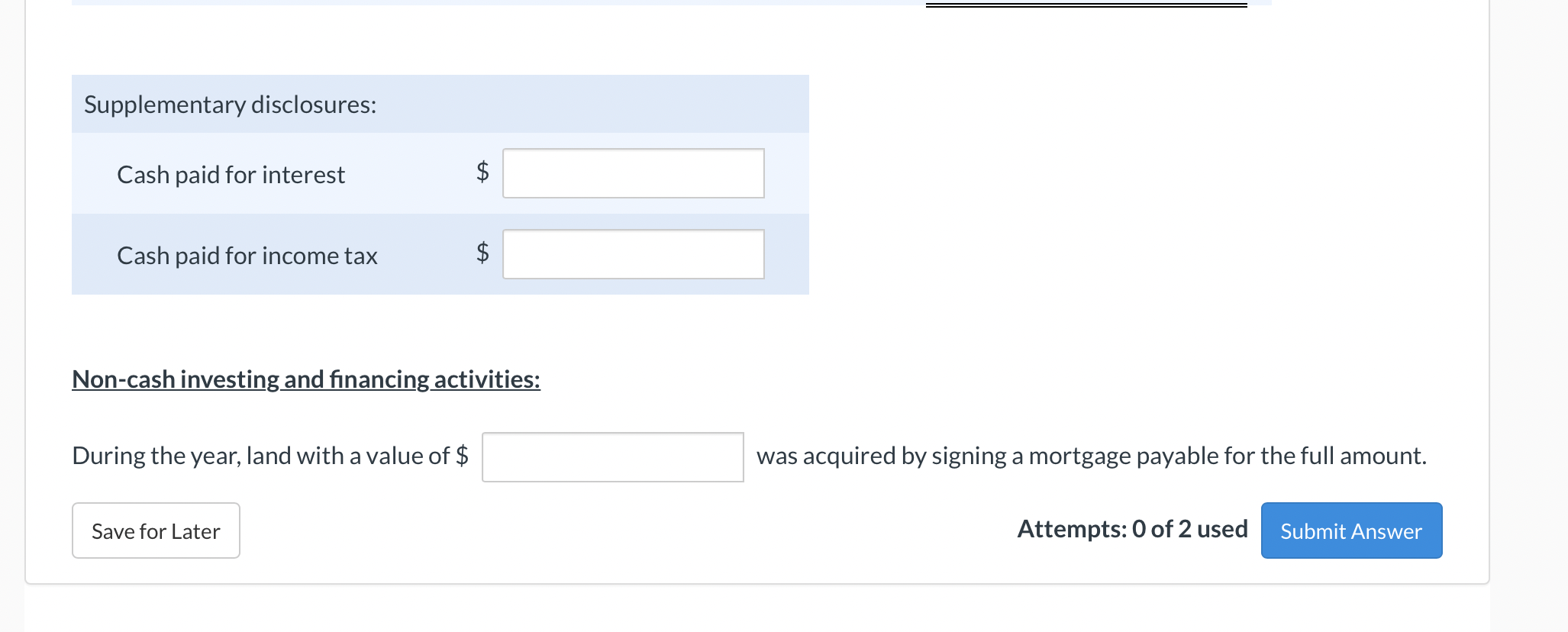

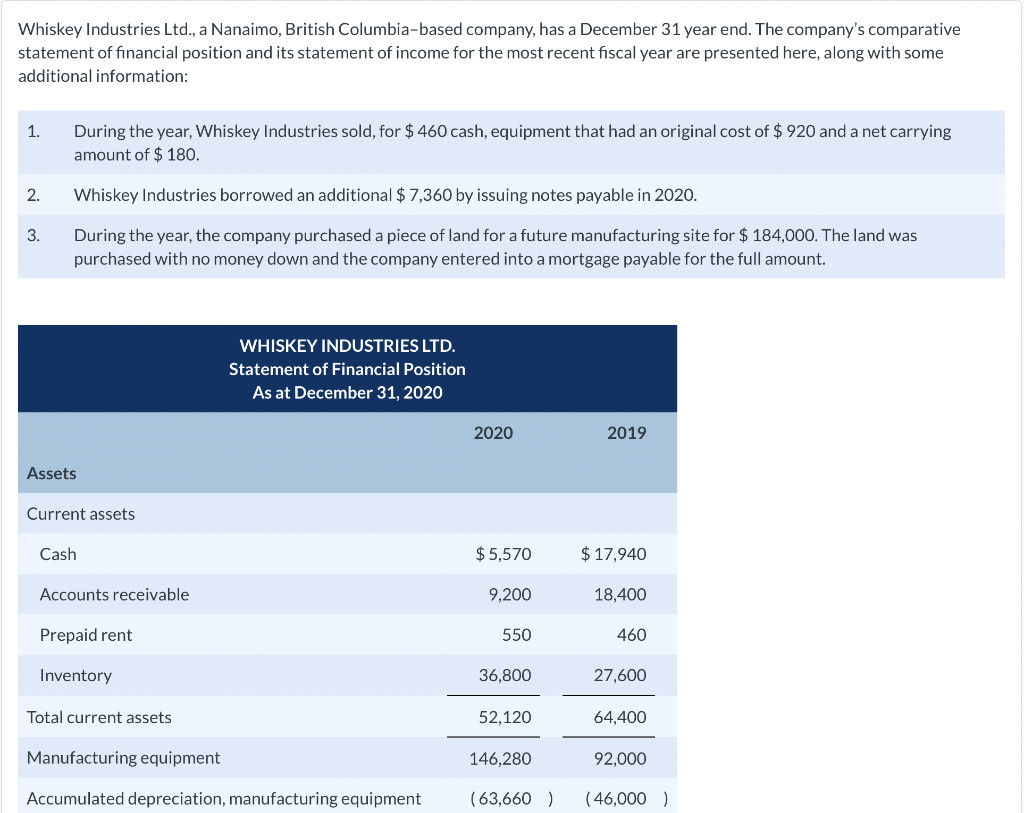

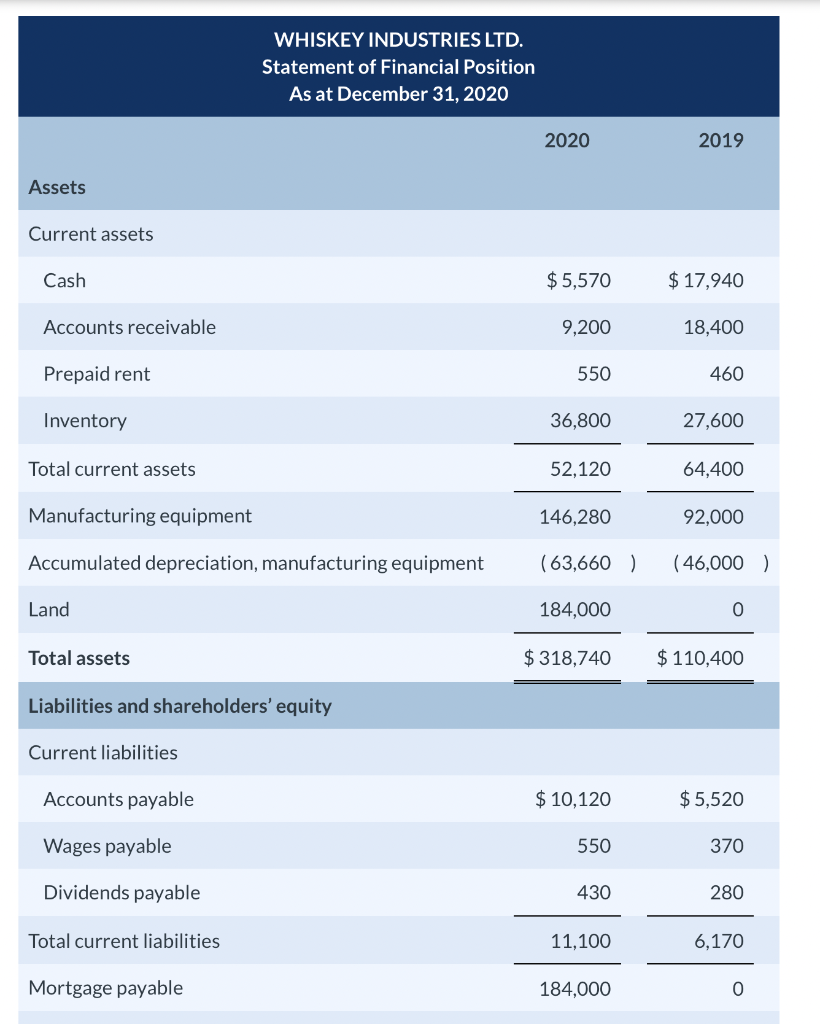

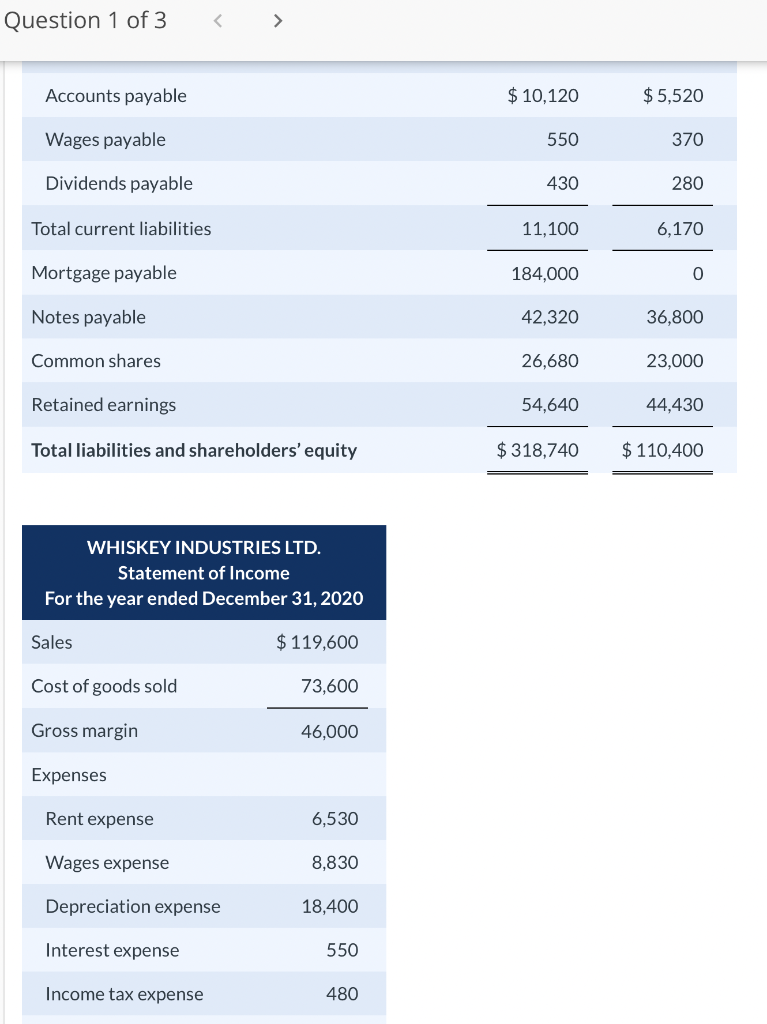

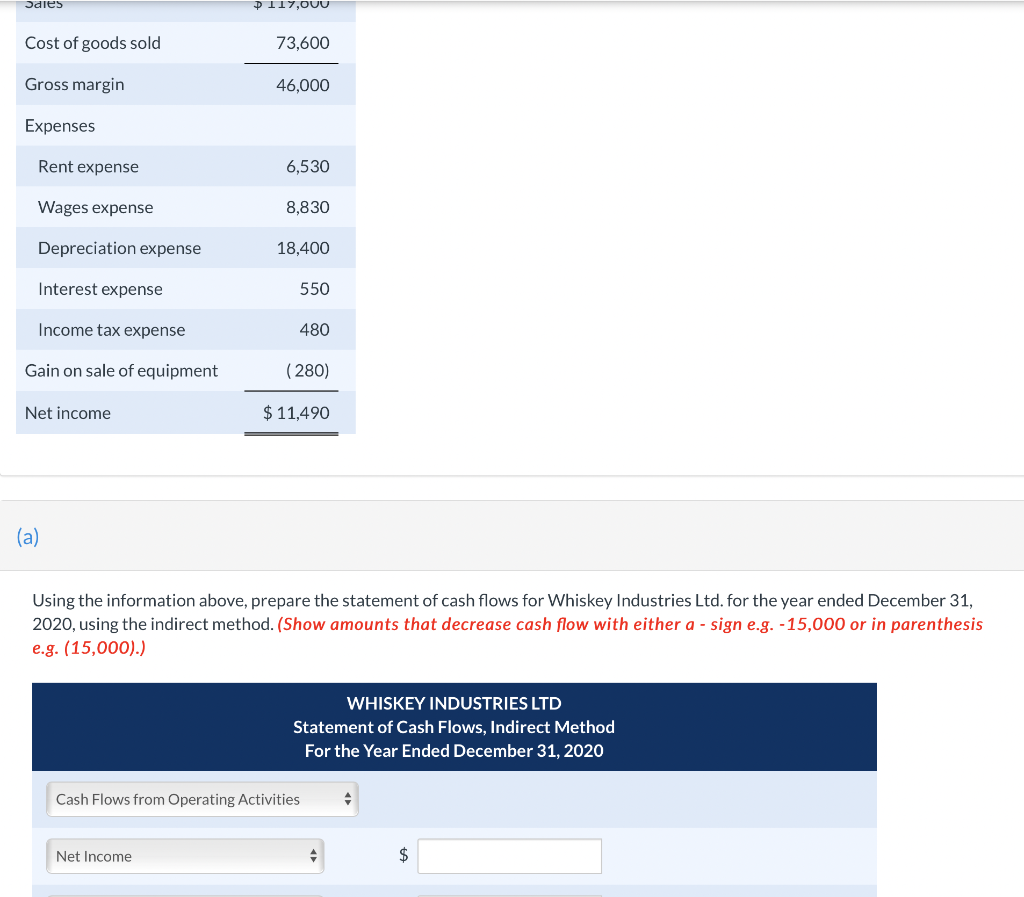

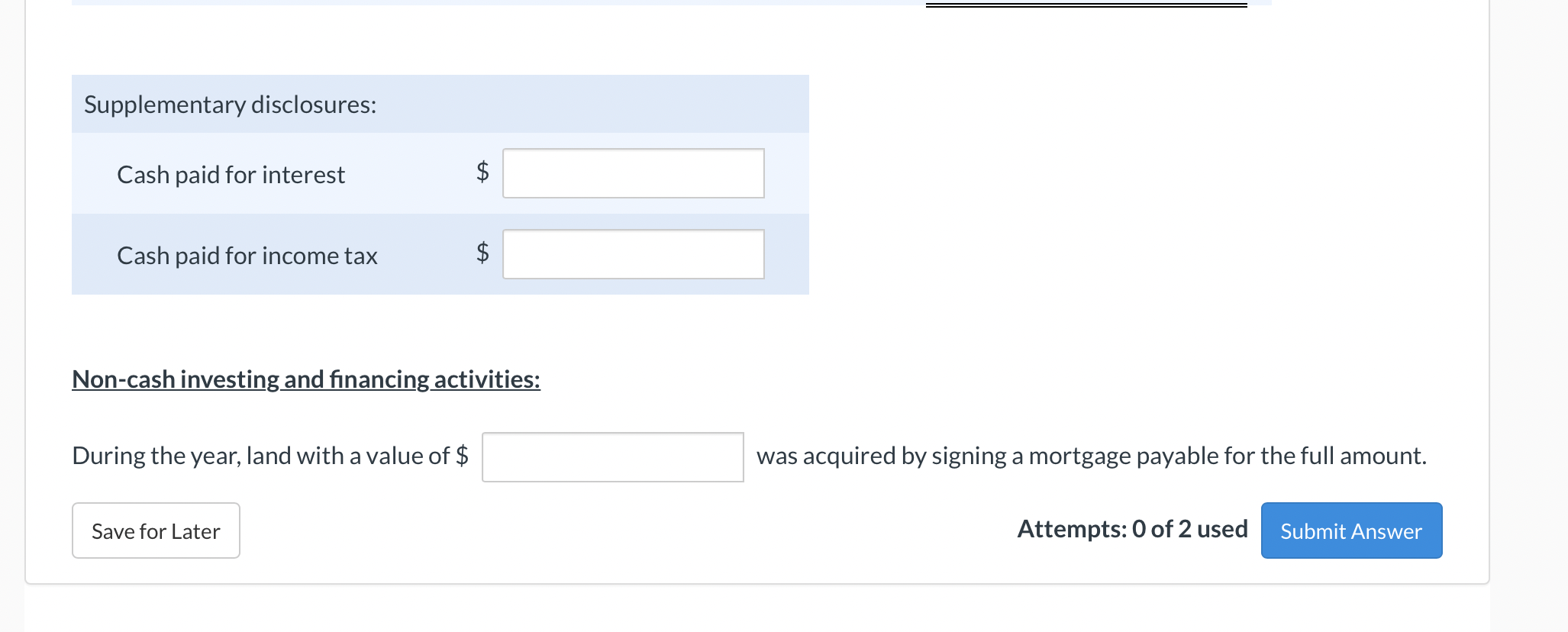

Whiskey Industries Ltd., a Nanaimo, British Columbia-based company, has a December 31 year end. The company's comparative statement of financial position and its statement of income for the most recent fiscal year are presented here, along with some additional information: 1. During the year, Whiskey Industries sold, for $ 460 cash, equipment that had an original cost of $920 and a net carrying amount of $ 180. 2. Whiskey Industries borrowed an additional $ 7,360 by issuing notes payable in 2020. 3. During the year, the company purchased a piece of land for a future manufacturing site for $ 184,000. The land was purchased with no money down and the company entered into a mortgage payable for the full amount. WHISKEY INDUSTRIES LTD. Statement of Financial Position As at December 31, 2020 2020 2019 Assets Current assets Cash $ 5,570 $ 17,940 Accounts receivable 9,200 18,400 Prepaid rent 550 460 Inventory 36,800 27,600 Total current assets 52,120 64,400 Manufacturing equipment 146,280 92,000 Accumulated depreciation, manufacturing equipment (63,660) (46,000) WHISKEY INDUSTRIES LTD. Statement of Financial Position As at December 31, 2020 2020 2019 Assets Current assets Cash $ 5,570 $ 17,940 Accounts receivable 9,200 18,400 Prepaid rent 550 460 Inventory 36,800 27,600 Total current assets 52,120 64,400 Manufacturing equipment 146,280 92,000 Accumulated depreciation, manufacturing equipment (63,660) (46,000) Land 184,000 0 Total assets $ 318,740 $ 110,400 Liabilities and shareholders' equity Current liabilities Accounts payable $ 10,120 $ 5,520 Wages payable 550 370 Dividends payable 430 280 Total current liabilities 11,100 6,170 Mortgage payable 184,000 0 o Question 1 of 3 Accounts payable $ 10,120 $ 5,520 Wages payable 550 370 Dividends payable 430 280 Total current liabilities 11,100 6,170 Mortgage payable 184,000 0 Notes payable 42,320 36,800 Common shares 26,680 23,000 Retained earnings 54,640 44,430 Total liabilities and shareholders' equity $ 318,740 $ 110,400 WHISKEY INDUSTRIES LTD. Statement of Income For the year ended December 31, 2020 Sales $ 119,600 Cost of goods sold 73,600 Gross margin 46,000 Expenses Rent expense 6,530 Wages expense 8,830 Depreciation expense 18,400 Interest expense 550 Income tax expense 480 Sales P117,0UU Cost of goods sold 73,600 Gross margin 46,000 Expenses Rent expense 6,530 Wages expense 8,830 Depreciation expense 18,400 Interest expense 550 Income tax expense 480 Gain on sale of equipment (280) Net income $ 11,490 (a) Using the information above, prepare the statement of cash flows for Whiskey Industries Ltd. for the year ended December 31, 2020, using the indirect method. (Show amounts that decrease cash flow with either a - sign e.g. - 15,000 or in parenthesis e.g. (15,000).) WHISKEY INDUSTRIES LTD Statement of Cash Flows, Indirect Method For the Year Ended December 31, 2020 Cash Flows from Operating Activities Net Income $ Supplementary disclosures: Cash paid for interest $ Cash paid for income tax TA $ Non-cash investing and financing activities: During the year, land with a value of $ was acquired by signing a mortgage payable for the full amount. Save for Later Attempts: 0 of 2 used Submit