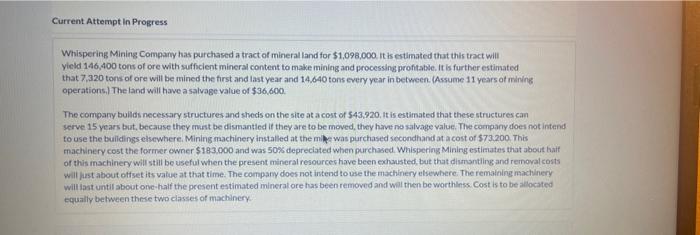

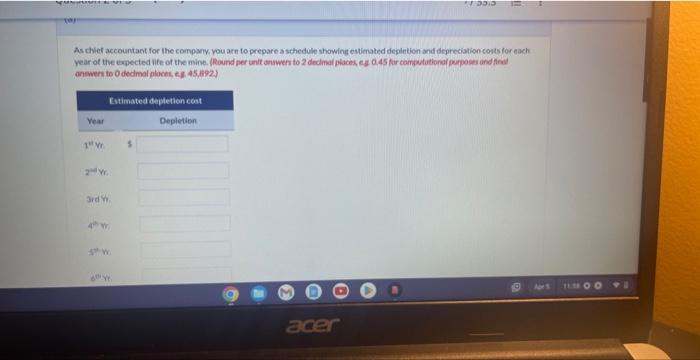

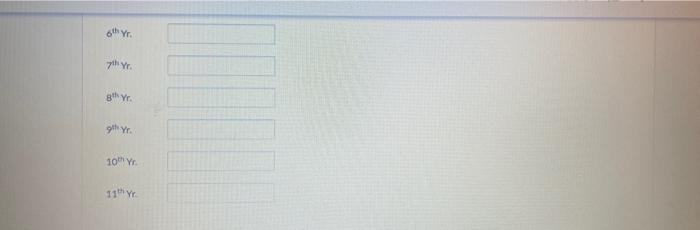

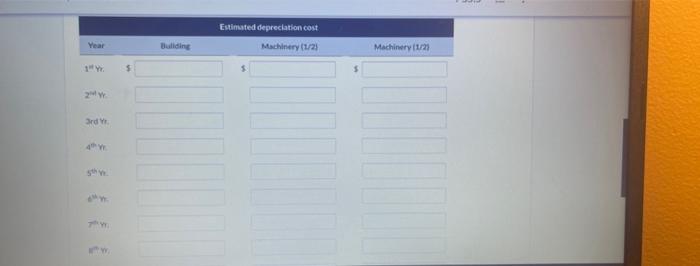

Whispering Mining Compary has purchased a tract of mineral land for $1,098,000 it is eftimated that this tract will yield 146,400 tons of ore with sufficient mineral content to make mining and processing profitable. It is further estimated that 7,320 tons of ore will be mined the first and last year and 14.640 tons every year in between. (Assume 11 years of mining operations,) The land will have a salvage value of $36,600. The company builds necessary structures and sheds on the site at a cost of 543,920 , It is estimated that these structures can serve 15 years but, because they mant be dismantied if they are to be moved, they have no salvage value. The campany does not intend to use the buildings elsewhere. Mining machinery installed at the mile was purchased secondhand at a cost of $73,200. This machinery cost the former owner $183,000 and was 507 depreciated when purchased. Whispering Mining estialates that about haif of this machinery will still be useful when the present mineral resourcec have been exhusted, but that diumantiling and removal costs Will lust about offset its value at that time. The compary does not intend to use the machinery elsewhere. The remaining machinery will iast until about one-half the present estimated minerat ore has been removed and wal then be worthinss. Cost is to be allocated equally between thme two classes of machinery. As chef accountant for the compiny. you arn to prepare a schedule showine estienated depletion and depreciation conts for each year of the eapected nte of the mine. (Round per unit answers to 2 decimal places, eg a.45 for compututional purposes and find aneven to 0 dechmal ploces, eg. 45,tig2. 6thYrr 7thYr. 8thYr. thYr. 10trYrr 11thYrr e Textbeok and Media Attemots. 0 of 5 used Whispering Mining Compary has purchased a tract of mineral land for $1,098,000 it is eftimated that this tract will yield 146,400 tons of ore with sufficient mineral content to make mining and processing profitable. It is further estimated that 7,320 tons of ore will be mined the first and last year and 14.640 tons every year in between. (Assume 11 years of mining operations,) The land will have a salvage value of $36,600. The company builds necessary structures and sheds on the site at a cost of 543,920 , It is estimated that these structures can serve 15 years but, because they mant be dismantied if they are to be moved, they have no salvage value. The campany does not intend to use the buildings elsewhere. Mining machinery installed at the mile was purchased secondhand at a cost of $73,200. This machinery cost the former owner $183,000 and was 507 depreciated when purchased. Whispering Mining estialates that about haif of this machinery will still be useful when the present mineral resourcec have been exhusted, but that diumantiling and removal costs Will lust about offset its value at that time. The compary does not intend to use the machinery elsewhere. The remaining machinery will iast until about one-half the present estimated minerat ore has been removed and wal then be worthinss. Cost is to be allocated equally between thme two classes of machinery. As chef accountant for the compiny. you arn to prepare a schedule showine estienated depletion and depreciation conts for each year of the eapected nte of the mine. (Round per unit answers to 2 decimal places, eg a.45 for compututional purposes and find aneven to 0 dechmal ploces, eg. 45,tig2. 6thYrr 7thYr. 8thYr. thYr. 10trYrr 11thYrr e Textbeok and Media Attemots. 0 of 5 used