Answered step by step

Verified Expert Solution

Question

1 Approved Answer

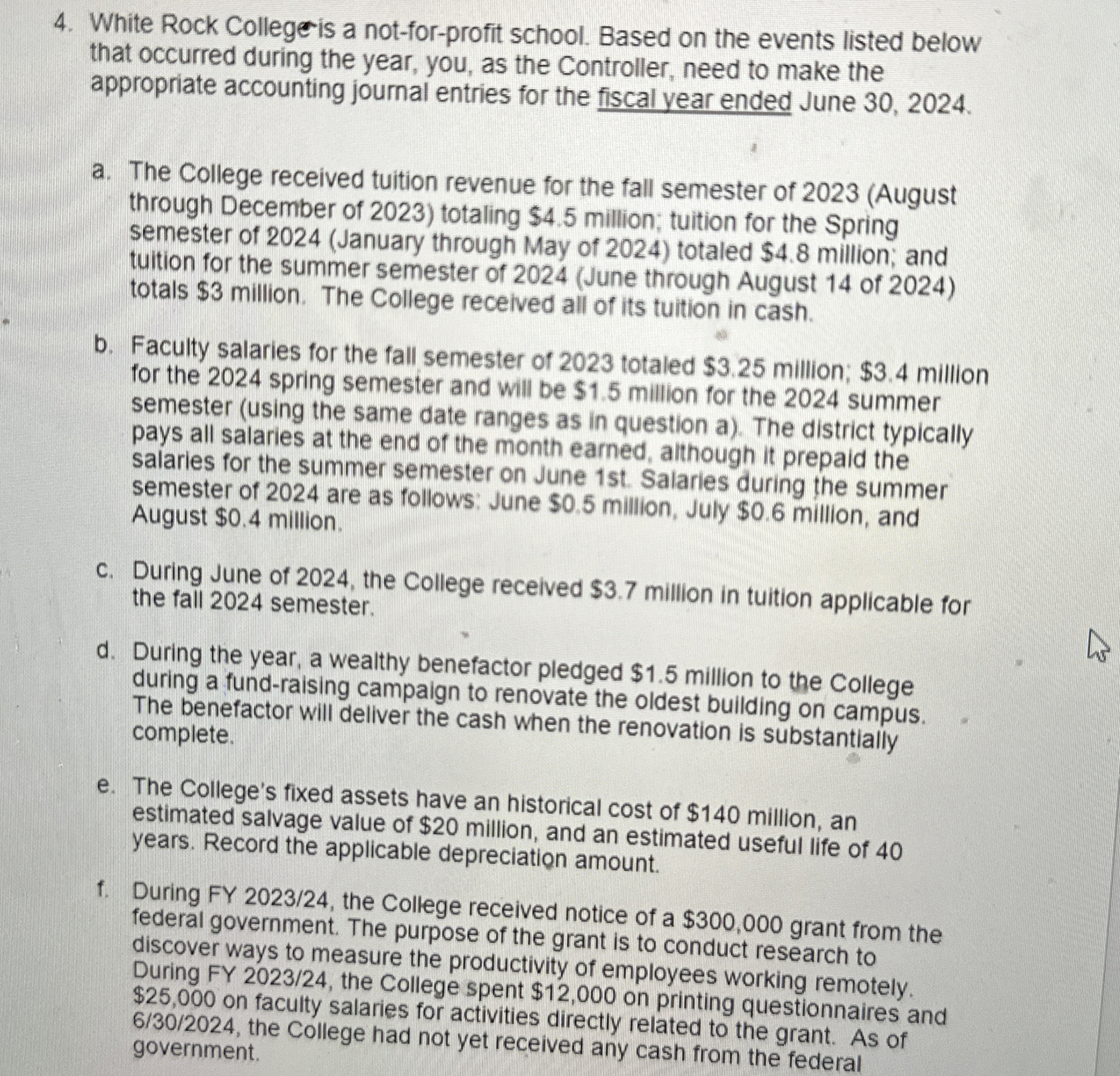

White Rock Collegeris a not - for - profit school. Based on the events listed below that occurred during the year, you, as the Controller,

White Rock Collegeris a notforprofit school. Based on the events listed below

that occurred during the year, you, as the Controller, need to make the

appropriate accounting journal entries for the fiscal year ended June

a The College received tuition revenue for the fall semester of August

through December of totaling $ million; tuition for the Spring

semester of January through May of totaled $ million; and

tuition for the summer semester of June through August of

totals $ million. The college received all of its tuition in cash.

b Faculty salaries for the fall semester of totaled $ million; $ million

for the spring semester and will be $ million for the summer

semester using the same date ranges as in question a The district typically

pays all salaries at the end of the month earned, although it prepaid the

salaries for the summer semester on June st Salaries during the summer

semester of are as follows: June $ million, July $ million, and

August $ million.

c During June of the College recelved $ million in tuition applicable for

the fall semester.

d During the year, a wealthy benefactor pledged $ million to the College

during a fundraising campaign to renovate the oldest building on campus.

The benefactor will deliver the cash when the renovation is substantially

complete.

e The College's fixed assets have an historical cost of $ million, an

estimated salvage value of $ million, and an estimated useful life of

years. Record the applicable depreciation amount.

f During FY the College received notice of a $ grant from the

federal government. The purpose of the grant is to conduct research to

discover ways to measure the productivity of employees working remotely.

During FY the College spent $ on printing questionnaires and

$ on faculty salaries for activities directly related to the grant. As of

the college had not yet received any cash from the federal

government.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started