Whites are the question.

Yellows are the answer sheet.

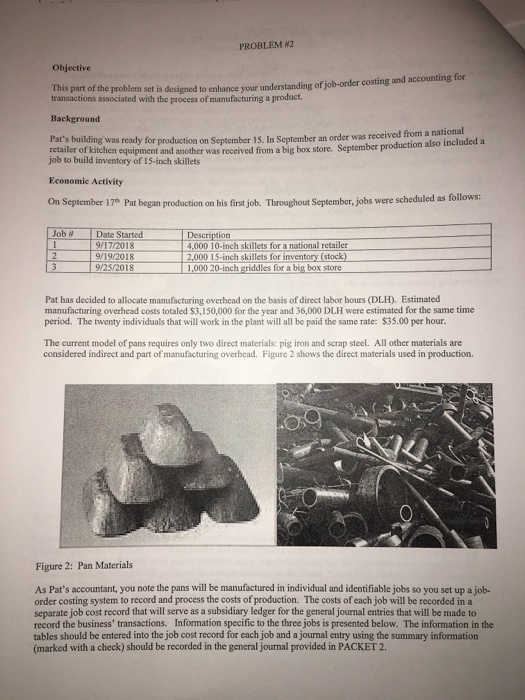

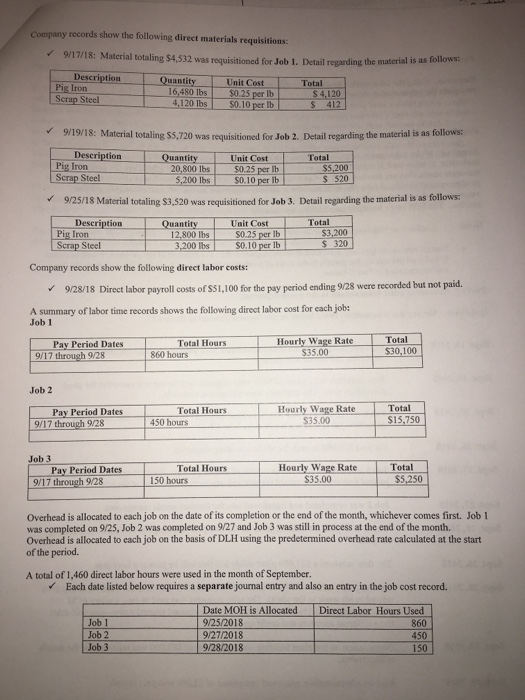

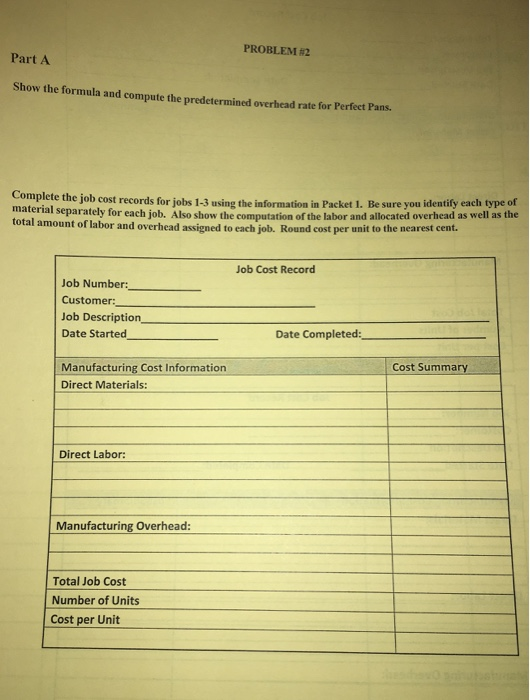

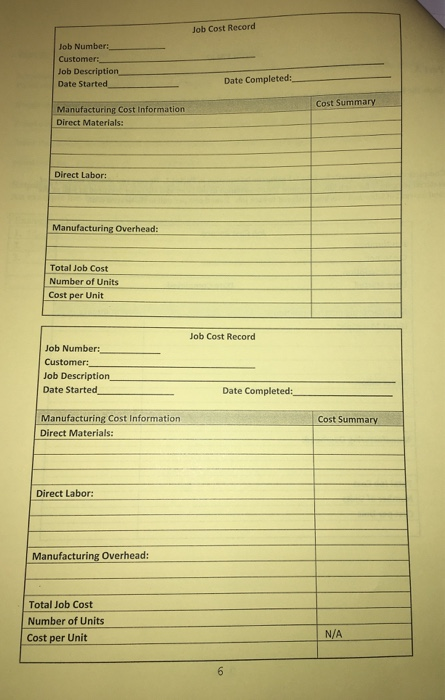

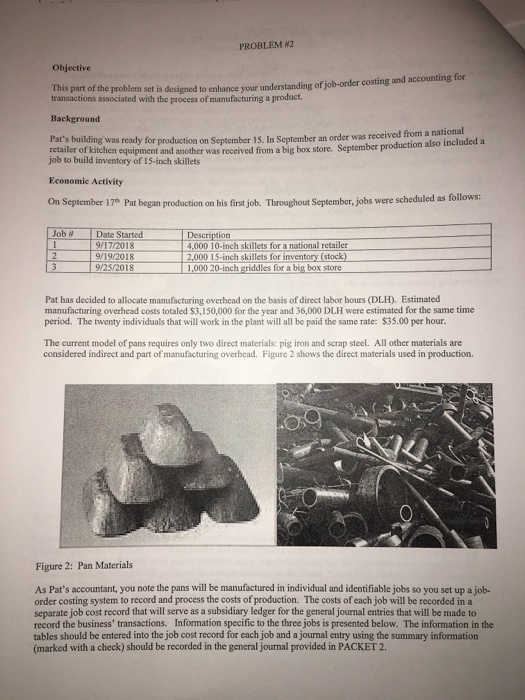

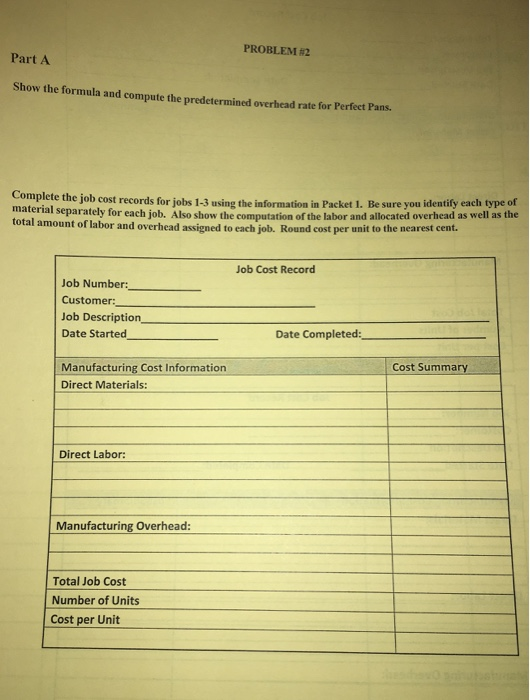

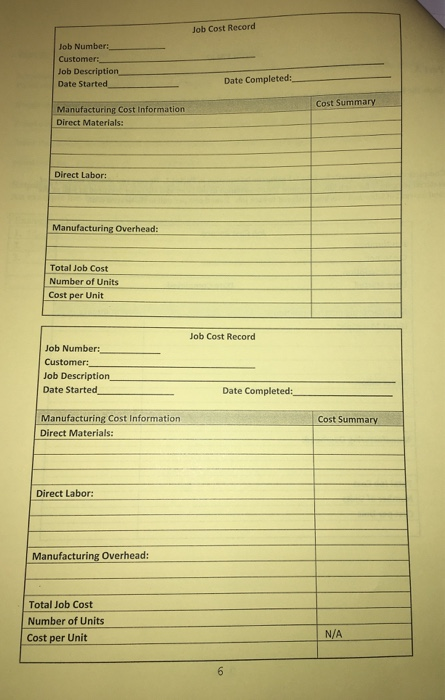

PROBLEM W2 Objective This part of the p problem set is designed to enhance your understanding of job-order costing and accounting for transactions associated with the Background Pat's building was ready for job to build inventory of 15-inch skillets Economic Activity On September 17 Pat began production on his first job. Throughout September, jobs were scheduled as follows the process of manufacturing a product production on September 15. In September an order was received from a national also included a retailer of kitchen equipment and another was received from a big box store. September produn Job # Date Started Description 4,000 10-imch skillets fora national retailer 2,000 1S-inch skillets for inventory (stock) 1,000 20-inch griddles for a big box store /17/2018 9/19/2018 Pat has decided to allocate manufacturing overhead on the basis of direct labor hours (DLH). Estimated manufacturing overhead costs totaled $3,150,000 for the year and 36,000 DLH were estimated for the same time period. The twenty individuals that will work in the plant will all be paid the same rate: $35.00 per hour. The current model of pans requires only two direct materials: pig iron and scrap steel. All other materials are considered indirect and part of manufacturing overbead. Figure 2 shows the direct materials used in production. Figure 2: Pan Materials As Pat's accountant, you note the pans will be manufactured in individual and identifiable jobs so you set up a job- order costing system to record and process the costs of production. The costs of each job will be recorded in a separate job cost record that will serve as a subsidiary ledger for the general journal entries that will be made to record the business' transactions. Information specific to the three jobs is presented below. The information in the tables should be entered into the job cost record for each job and a journal entry using the summary information (marked with a check) should be recorded in the general journal provided in PACKET 2. Company records show the following direct materials requisitions: 9/17/18: Material totaling $4,532 was requisitioned for Job 1. Detail regarding the material is as followwr: Description QuantityUnit Cost Total Pig Iron 16,480 lbs $0.25 per lb 8,120 l6s$0.10 per lbS 4,120 412 Scrap Steel 9/19/18: Material totaling $$,720 was requisitioned for Job 2. Detail regarding the material is as follows: Pig Iron Deseription Quantity Unit Cost Total 20,800 lbs $0.25 per lb 5,200 lbs $0.10 per lb $5,200 S 520 LScrap Steel 9/25/18 Material totaling $3,520 was requisitioned for Job 3. Detail regarding the material is as follows: Description Quantity! UnitCos-Total 12,800 lbsS0.25 per lb 3,200 lbs S0.10 per Ib 320 Scrap Steel Company records show the following direct labor costs: 9/28/18 Direct labor payroll costs of $$1,100 for the pay period ending 9/28 were recorded but not paid. A summary of labor time records shows the following direct labor cost for each job: Job 1 Hourly Wage Rate Total Total Hours Pay Period Dates 100 $35.00 860 hours 9/17 through 9/28 Job 2 Hourly Wage Rate $35.00 Total Total Hours Pay Period Dates sis,750 450 hours Total Hourly Wage Rate $35.00 Total Hours Pay Period Dates $5,250 150 hours Overhead is allocated to each job on the date of its completion or the end of the month, whichever comes first. Job 1 was completed on 9/25, Job 2 was completed on 9/27 and Job 3 was still in process at the end of the month. Overhead is allocated to each job on the basis of DLH using the predetermined overhead rate calculated at the start of the period A total of 1,460 direct labor hours were used in the month of September. Each date listed below requires a separate journal entry and also an entry in the job cost record. Date MOH is Allocated Direct Labor Hours Used Job 1 Job 2 Job 3 860 450 150 9/27/2018 9/28/2018 Part A: Preparing job cost records Required: Using the information presented above, compute the predetermined overhead rate for 2018 and complete the job cost records in Packet 2. PROBLEM #2 Part A Show the formula and compute the predetermined overhead rate for Perfect Pans Complete the job cost records for jobs 1-3 using the information in Packet 1. Be sure you identify each type of erial separately for each job. Also show the computation of the labor and allocated overhead as well as the total amount of labor and overhead assigned to each job. Round cost per unit to the nearest cent. Job Cost Record Job Number:_ Customer: Job Description Date Started Date Completed: Cost Summary Manufacturing Cost Information Direct Materials: Direct Labor: Manufacturing Overhead Total Job Cost Number of Units Cost per Unit Job Cost Record Job Number Customer:_ Job Description Date Started Date Completed: Cost Summary Manufacturing Cost Information Direct Materlals: Direct Labor: Manufacturing Overhead: Total Job Cost Number of Units Cost per Unit Job Cost Record Job Number: Customer: Job Description Date Started Date Completed Manufacturing Cost Information Direct Materials: Cost Summary Direct Labor: Manufacturing Overhead: Total Job Cost Number of Units Cost per Unit N/A