Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Whitman Company has just completed its first year of operations. The company's traditional format income statement for the year follows: Whitman Company Income Statement

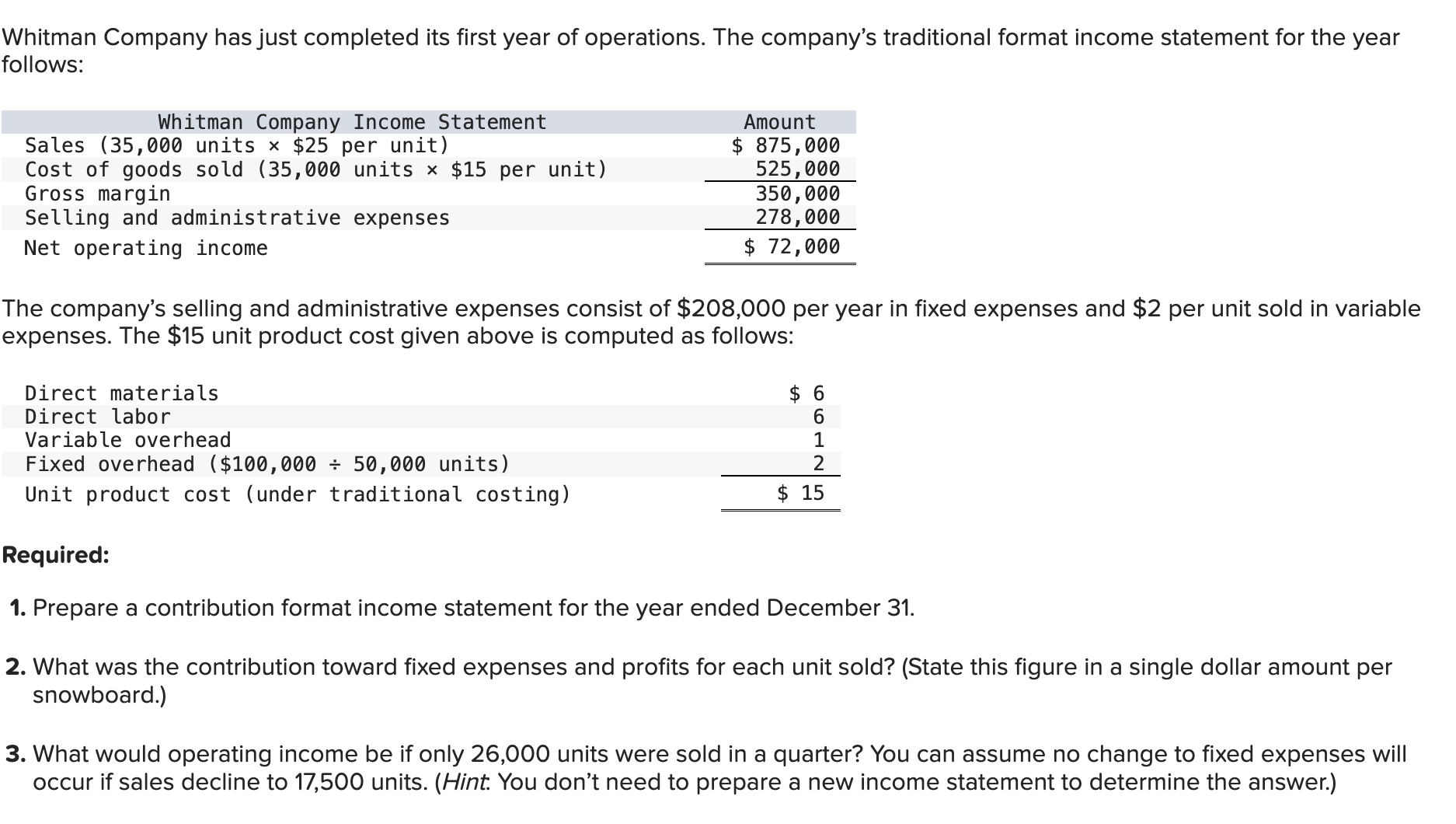

Whitman Company has just completed its first year of operations. The company's traditional format income statement for the year follows: Whitman Company Income Statement Sales (35,000 units $25 per unit) Cost of goods sold (35,000 units $15 per unit) Gross margin Selling and administrative expenses Net operating income Amount $ 875,000 525,000 350,000 278,000 $ 72,000 The company's selling and administrative expenses consist of $208,000 per year in fixed expenses and $2 per unit sold in variable expenses. The $15 unit product cost given above is computed as follows: Direct materials Direct labor Variable overhead Fixed overhead ($100,000 50,000 units) Unit product cost (under traditional costing) Required: $ 6 6 1 2 $ 15 1. Prepare a contribution format income statement for the year ended December 31. 2. What was the contribution toward fixed expenses and profits for each unit sold? (State this figure in a single dollar amount per snowboard.) 3. What would operating income be if only 26,000 units were sold in a quarter? You can assume no change to fixed expenses will occur if sales decline to 17,500 units. (Hint. You don't need to prepare a new income statement to determine the answer.)

Step by Step Solution

★★★★★

3.46 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Whitman Company Analysing Performance with Contribution Margin 1 Contribution Format Income St...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started