Answered step by step

Verified Expert Solution

Question

1 Approved Answer

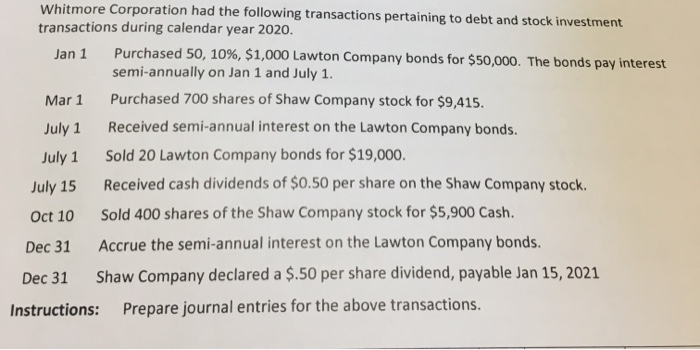

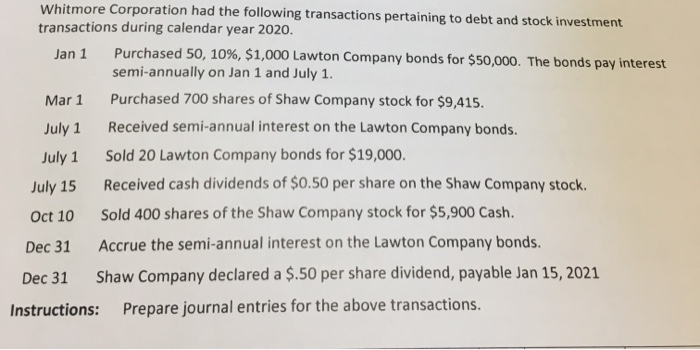

Whitmore Corporation had the following transactions pertaining to debt and stock investment transactions during calendar year 2020. Purchased 50, 10%, $1,000 Lawton Company bonds for

Whitmore Corporation had the following transactions pertaining to debt and stock investment transactions during calendar year 2020. Purchased 50, 10%, $1,000 Lawton Company bonds for $50,000. The bonds pay interest semi-annually on Jan 1 and July 1. Jan 1 Purchased 700 shares of Shaw Company stock for $9,415. Mar 1 Received semi-annual interest on the Lawton Company bonds. July 1 Sold 20 Lawton Company bonds for $19,000. July 1 Received cash dividends of $0.50 per share on the Shaw Company stock. July 15 Sold 400 shares of the Shaw Company stock for $5,900 Cash. Oct 10 Accrue the semi-annual interest on the Lawton Company bonds Dec 31 Shaw Company declared a $.50 per share dividend, payable Jan 15, 2021 Dec 31 Prepare journal entries for the above transactions Instructions

Whitmore Corporation had the following transactions pertaining to debt and stock investment transactions during calendar year 2020. Purchased 50, 10%, $1,000 Lawton Company bonds for $50,000. The bonds pay interest semi-annually on Jan 1 and July 1. Jan 1 Purchased 700 shares of Shaw Company stock for $9,415. Mar 1 Received semi-annual interest on the Lawton Company bonds. July 1 Sold 20 Lawton Company bonds for $19,000. July 1 Received cash dividends of $0.50 per share on the Shaw Company stock. July 15 Sold 400 shares of the Shaw Company stock for $5,900 Cash. Oct 10 Accrue the semi-annual interest on the Lawton Company bonds Dec 31 Shaw Company declared a $.50 per share dividend, payable Jan 15, 2021 Dec 31 Prepare journal entries for the above transactions Instructions

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started