Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Whitney Company purchased equipment on July 12 of Year 1 for $78,200. This equipment has an estimated useful life of five years and an

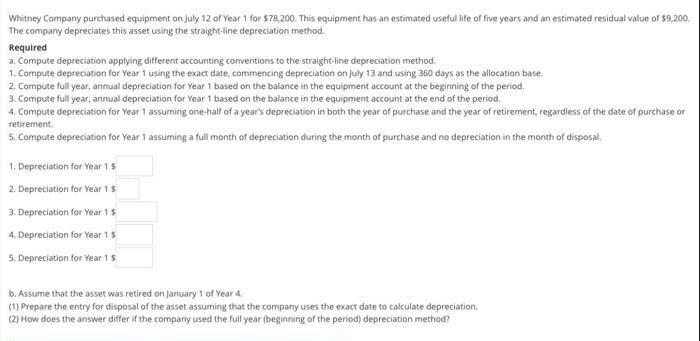

Whitney Company purchased equipment on July 12 of Year 1 for $78,200. This equipment has an estimated useful life of five years and an estimated residual value of $9,200, The company depreciates this asset using the straight-line depreciation method. Required a. Compute depreciation applying different accounting conventions to the straight-line depreciation method. 1. Compute depreciation for Year 1 using the exact date, commencing depreciation on July 13 and using 360 days as the allocation base 2. Compute full year, annual depreciation for Year 1 based on the balance in the equipment account at the beginning of the period. 3. Compute full year, annual depreciation for Year 1 based on the balance in the equipment account at the end of the period. 4. Compute depreciation for Year 1 assuming one-half of a year's depreciation in both the year of purchase and the year of retirement, regardless of the date of purchase or retirement. 5. Compute depreciation for Year 1 assuming a full month of depreciation during the month of purchase and no depreciation in the month of disposal, 1. Depreciation for Year 1 $ 2. Depreciation for Year 1$ 3. Depreciation for Year 1 $ 4. Depreciation for Year 1 5 5. Depreciation for Year 1 $ b. Assume that the asset was retired on January 1 of Year 4. (1) Prepare the entry for disposal of the asset assuming that the company uses the exact date to calculate depreciation. (2) How does the answer differ if the company used the full year (beginning of the period) depreciation method?

Step by Step Solution

★★★★★

3.37 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

a Depreciation for Year 1 78200 9200 x 3601825 14720 Full year annual depreciation for Year 1 78200 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started