Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Whole Foods Market case ? FIN 4893 Summer 2021 Due on July 5th @ 9:15 AM Case 10-Whole Foods Market Valuation a. Using the quiz

Whole Foods Market case

?

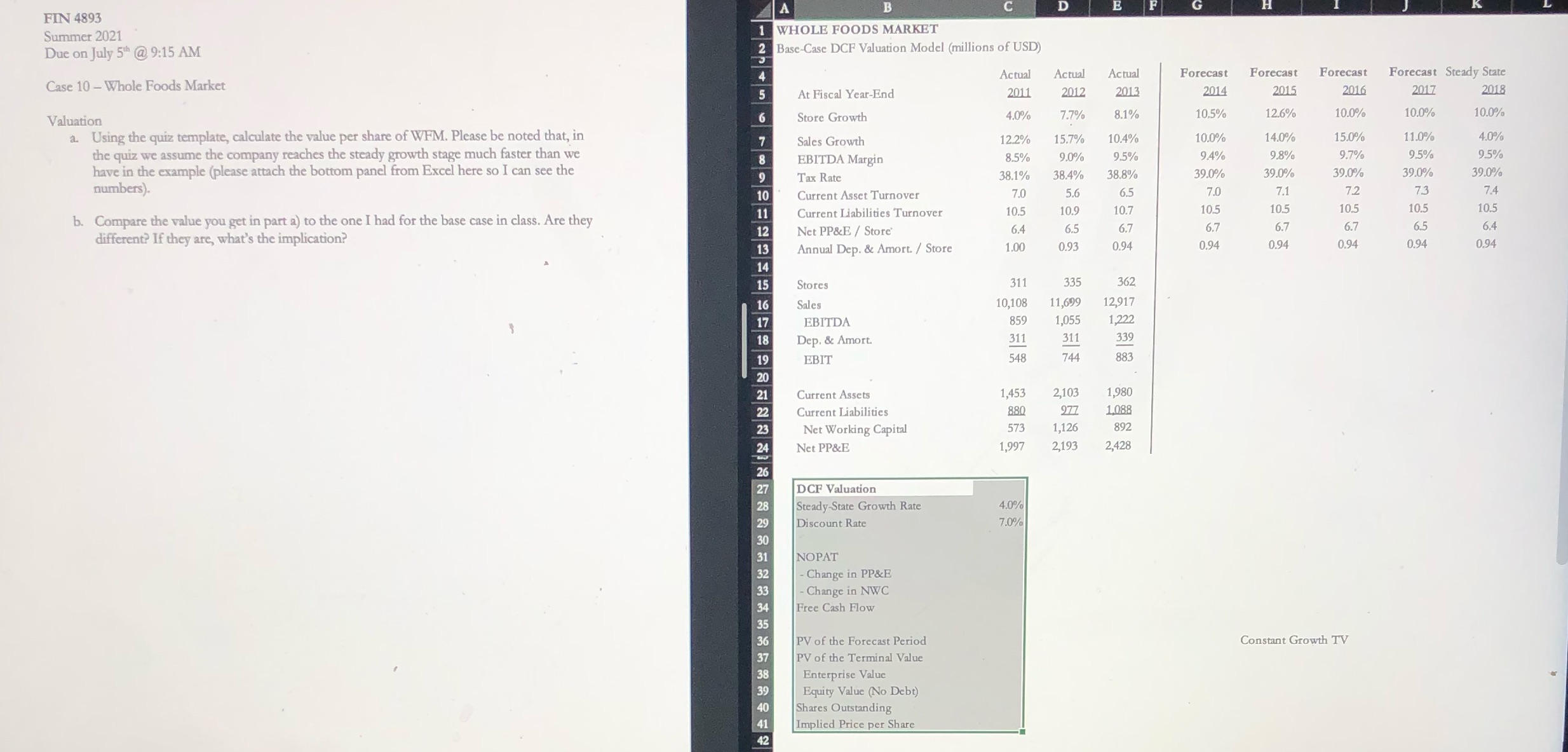

FIN 4893 Summer 2021 Due on July 5th @ 9:15 AM Case 10-Whole Foods Market Valuation a. Using the quiz template, calculate the value per share of WFM. Please be noted that, in the quiz we assume the company reaches the steady growth stage much faster than we have in the example (please attach the bottom panel from Excel here so I can see the numbers). b. Compare the value you get in part a) to the one I had for the base case in class. Are they different? If they are, what's the implication? A B C D E F H 1 WHOLE FOODS MARKET 2 Base-Case DCF Valuation Model (millions of USD) J 4 Actual Actual Actual Forecast Forecast Forecast Forecast Steady State 5 At Fiscal Year-End 2011 2012 2013 2014 2015 2016 2017 2018 6 Store Growth 4.0% 7.7% 8.1% 10.5% 12.6% 10.0% 10.0% 10.0% 7 Sales Growth 12.2% 15.7% 10.4% 10.0% 14.0% 15.0% 11.0% 4.0% 8 EBITDA Margin 8.5% 9.0% 9.5% 9.4% 9.8% 9.7% 9.5% 9.5% 9 Tax Rate 38.1% 38.4% 38.8% 39.0% 39.0% 39.0% 39.0% 39.0% 10 Current Asset Turnover 7.0 5.6 6.5 7.0 7.1 7.2 7.3 7.4 11 Current Liabilities Turnover 10.5 10.9 10.7 10.5 10.5 10.5 10.5 10.5 12 Net PP&E/Store 6.4 6.5 6.7 6.7 6.7 6.7 6.5 6.4 13 Annual Dep. & Amort. / Store 1.00 0.93 0.94 0.94 0.94 0.94 0.94 0.94 14 15 Stores 311 335 362 16 Sales 10,108 11,699 12,917 17 EBITDA 859 1,055 1,222 18 Dep. & Amort. 311 311 339 19 EBIT 548 744 883 20 21 Current Assets 1,453 2,103 1,980 22 Current Liabilities 880 977 1,088 23 Net Working Capital 573 1,126 892 24 Net PP&E 1,997 2,193 2,428 26 27 DCF Valuation 28 Steady-State Growth Rate 4.0% 29 Discount Rate 7.0% 30 31 NOPAT 32 -Change in PP&E 33 -Change in NWC 34 Free Cash Flow 35 36 PV of the Forecast Period Constant Growth TV 37 PV of the Terminal Value 38 Enterprise Value 39 Equity Value (No Debt) 40 Shares Outstanding 41 Implied Price per Share 42

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started