Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Why are the prices of put options with strike prices between $19 and $20.50 more expensive than the other put options on the list?

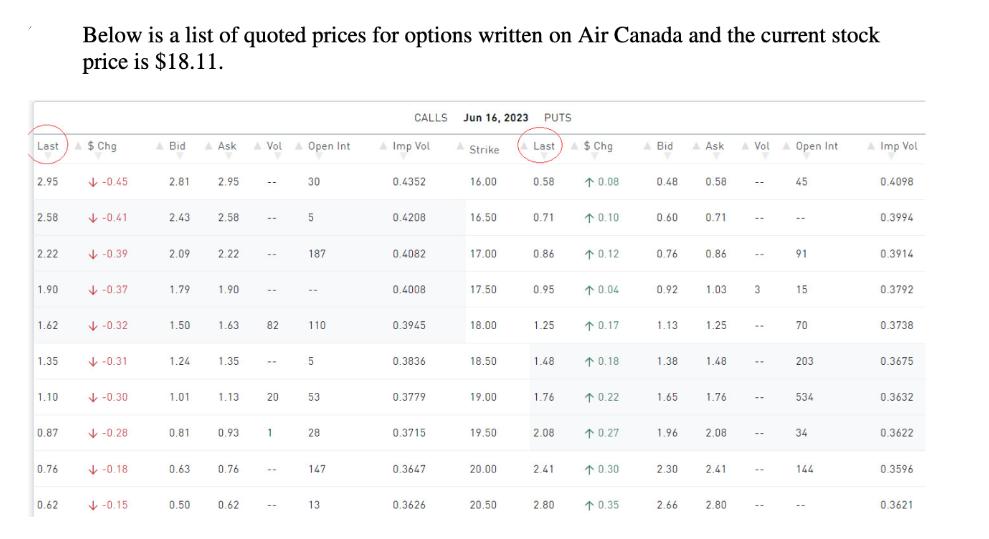

Why are the prices of put options with strike prices between $19 and $20.50 more expensive than the other put options on the list? If the investor sells 10 contracts of $18.50 call options, how much are the total sale proceeds (call premium)? Note that 1 option contract trades 100 shares. If an investor expects the stock price of Air Canada to move up as spring approaches and travel season will start, what trading strategy shall the investor pursue? Call or put? Long or short position? Last A $ Chg 2.95 2.58 2.22 1.90 1.62 1.35 1.10 0.87 0.76 Below is a list of quoted prices for options written on Air Canada and the current stock price is $18.11. 0.62 -0.45 -0.41 -0.39 666 -0.37 -0.32 -0.31 -0.30 -0.28 0.18 -0.15 A Bid A Ask Vol & Open Int 2.81 2.43 2.09 1.79 1.50 1.24 1.01 0.81 0.63 0.50 2.95 2.58 2.22 1.90 1.63 1.35 1.13 0.93 0.76 0.62 82 20 1 30 5 187 110 5 53 28 147 13 CALLS Jun 16, 2023 PUTS Imp Vol 0.4352 0.4208 0.4082 0.4008 0.3945 0.3836 0.3779 0.3715 0.3647 0.3626 A Strike 16.00 16.50 17.00 17.50 18.00 18.50 19.00 19.50 20.00 20.50 Last. A $ Chg 0.58 0.71 0.86 0.95 1.25 1.48 1.76 2.08 2.41 2.80 10.08 10.10 0.12 10.04 0.17 0.18 0.22 0.27 10.30 0.35 A Bid A Ask A Vol A Open Int 0.48 0.60 0.76 0.92 1.13 1.38 1.65 1.96 2.30 2.66 0.58 0.71 0.86 1.03 1.25 1.48 1.76 2,08 2.41 2.80 -- 3 45 91 15 70 203 534 34 144 A Imp Vol 0.4098 0.3994 0.3914 0.3792 0.3738 0.3675 0.3632 0.3622 0.3596 0.3621

Step by Step Solution

★★★★★

3.44 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

The prices of put options with strike prices between 19 and 2050 are more expensive compared to the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started