Question

Why did Snapchat wait two years to issue debt? Why did the company not do so during the time of the IPO? b. What will

Why did Snapchat wait two years to issue debt? Why did the company not do so during the time of the IPO?

Why did Snapchat wait two years to issue debt? Why did the company not do so during the time of the IPO?

b. What will be the balance sheet effect of the sale of the convertible senior notes? How will this affect the companys leverage?

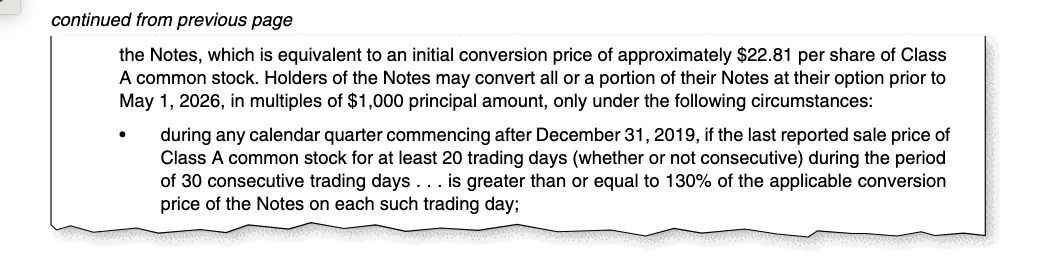

c. Confirm the initial conversion price of $22.81 per share. At what price did SNAP stock close on Au gust 9, 2019 (use an online investment site to determine the closing price that day)? Compare the two prices and explain why the three investment banks might enter into the purchase agreement described above.

d. After December 31, 2019, what minimum stock price is required to permit note holders to convert to Class A common stock?

e. What will Snapchat record as interest expense on the convertible senior notes in fiscal 2019?

f. How will the convertible senior notes impact the computation of basic and diluted earnings per share (EPS)?

g. Assume that on January 2020, SNAP has traded at around $30 for a month and that bondholders convert $400 million notes. Explain how the conversion will affect debt and equity. Which accounts and by how much?

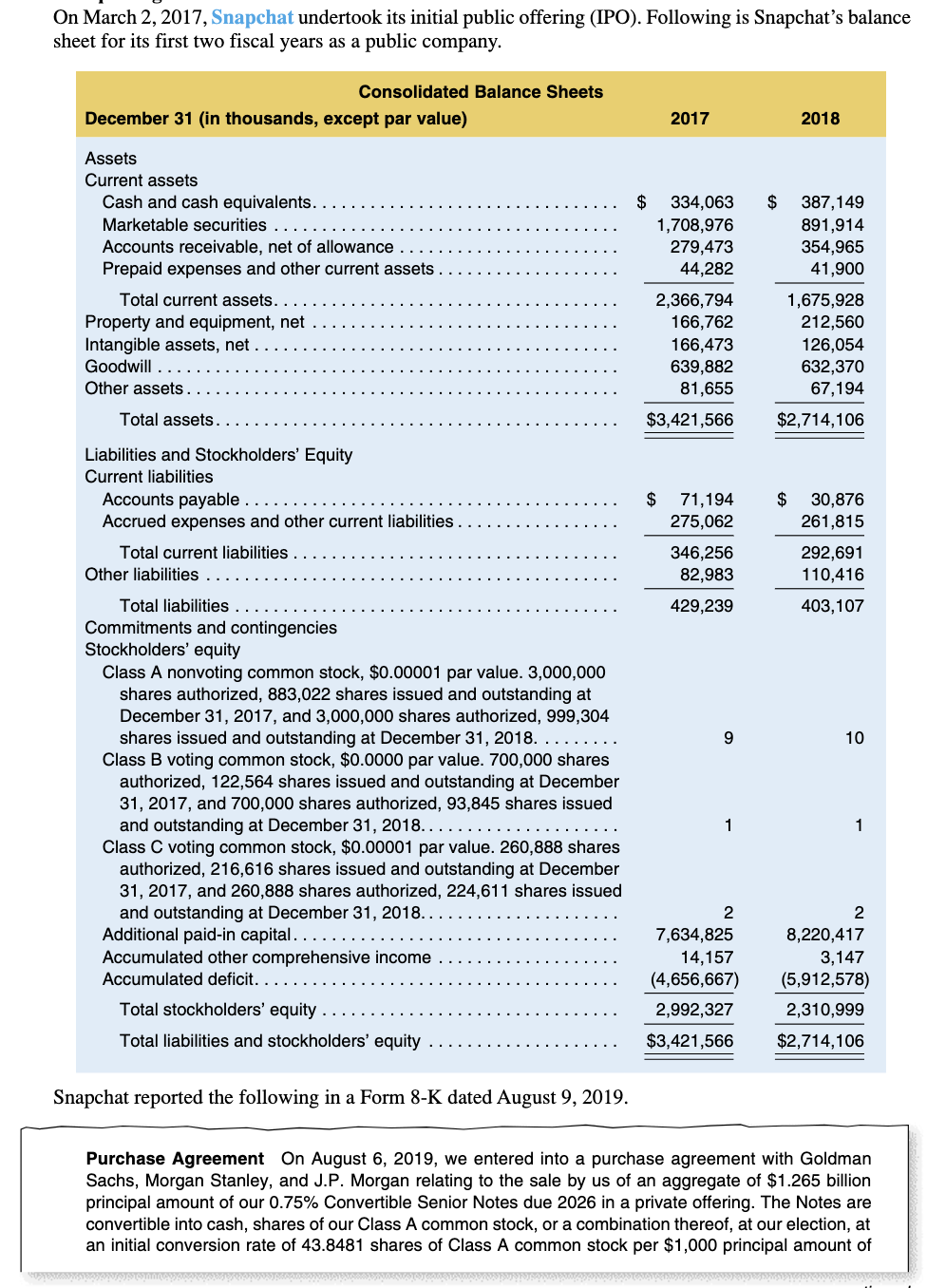

On March 2, 2017, Snapchat undertook its initial public offering (IPO). Following is Snapchat's balance sheet for its first two fiscal years as a public company. Purchase Agreement On August 6, 2019, we entered into a purchase agreement with Goldman Sachs, Morgan Stanley, and J.P. Morgan relating to the sale by us of an aggregate of $1.265 billion principal amount of our 0.75% Convertible Senior Notes due 2026 in a private offering. The Notes are convertible into cash, shares of our Class A common stock, or a combination thereof, at our election, at an initial conversion rate of 43.8481 shares of Class A common stock per $1,000 principal amount of the Notes, which is equivalent to an initial conversion price of approximately $22.81 per share of Class A common stock. Holders of the Notes may convert all or a portion of their Notes at their option prior to May 1, 2026, in multiples of $1,000 principal amount, only under the following circumstances: - during any calendar quarter commencing after December 31, 2019, if the last reported sale price of Class A common stock for at least 20 trading days (whether or not consecutive) during the period of 30 consecutive trading days ... is greater than or equal to 130% of the applicable conversion price of the Notes on each such trading dayStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started