Question

Prepare a statement of profit or loss and other comprehensive income, and a statement of changes in equity for Sandham for the year ended 31

- Prepare a statement of profit or loss and other comprehensive income, and a statement of changes in equity for Sandham for the year ended 31 August 2022 and a statement of financial position at 31 August 2022 in a form suitable for publication.

(Notes to the financial statements are not required, expenses should be presented analysed by function and ignore effects on tax of any adjustments.)

Additional information

1. Inventories as at 31 August 2022 had a cost of £43,770. Within this figure there are some defective items currently included at their cost of £14,000 can only be sold for £14,500 after incurring rectification costs of £2,250 and selling costs of £500.

2. On 13 February 2022 Sandham made a 1-for-2 bonus issue, using the share premium account. This has yet to be accounted for.

3. A dividend of 33p per ordinary share was paid on 30 June 2022 on the correct number of shares in issue at that date. This was incorrectly debited to purchases.

4. Sandham Ltd charges depreciation as follows: Buildings – straight line over 50 years charged to administrative expenses Plant and equipment – 20% per annum reducing balance charged to cost of sales

5. Within trade payables there is a balance in US$ of $25,000 relating to a purchase of goods that took place on 1 August 2022. This was correctly translated using a rate of $1.30/£1 on the date of purchase. The exchange rate on 31 August 2022 was $1.40/£1, no entries have been made to reflect this. Exchange differences are treated as admin expenses.

6. The provision relates to litigation from an employee claiming unfair dismissal, latest advice from company solicitors is settlement is expected to be £12,000. Expenses relating to the legal provision is expensed to Administrative expenses.

7. The current year’s interest has not been accrued for the loan note issued on a number of years ago which is repayable on 31 December 2024.

8. The Development asset relates to ongoing research and development into developing a new product. Work on this began 1 November 2021 but it wasn’t until 1 June 2022 that success of testing and intention to bring to market was confirmed. All costs accrued evenly. Any research is to be expensed to cost of sales.

9. The income tax charge for the year has been estimated as £80,450.

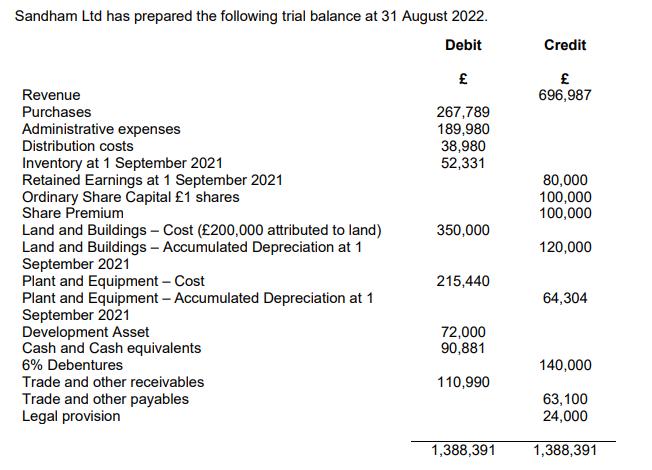

Sandham Ltd has prepared the following trial balance at 31 August 2022. Debit Revenue Purchases Administrative expenses Distribution costs Inventory at 1 September 2021 Retained Earnings at 1 September 2021 Ordinary Share Capital 1 shares Share Premium Land and Buildings - Cost (200,000 attributed to land) Land and Buildings - Accumulated Depreciation at 1 September 2021 Plant and Equipment - Cost Plant and Equipment - Accumulated Depreciation at 1 September 2021 Development Asset Cash and Cash equivalents 6% Debentures Trade and other receivables Trade and other payables Legal provision 267,789 189,980 38,980 52,331 350,000 215,440 72,000 90,881 110,990 1,388,391 Credit 696,987 80,000 100,000 100,000 120,000 64,304 140,000 63,100 24,000 1,388,391

Step by Step Solution

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Total profit after tax is 142850 Statement of Profit f...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started