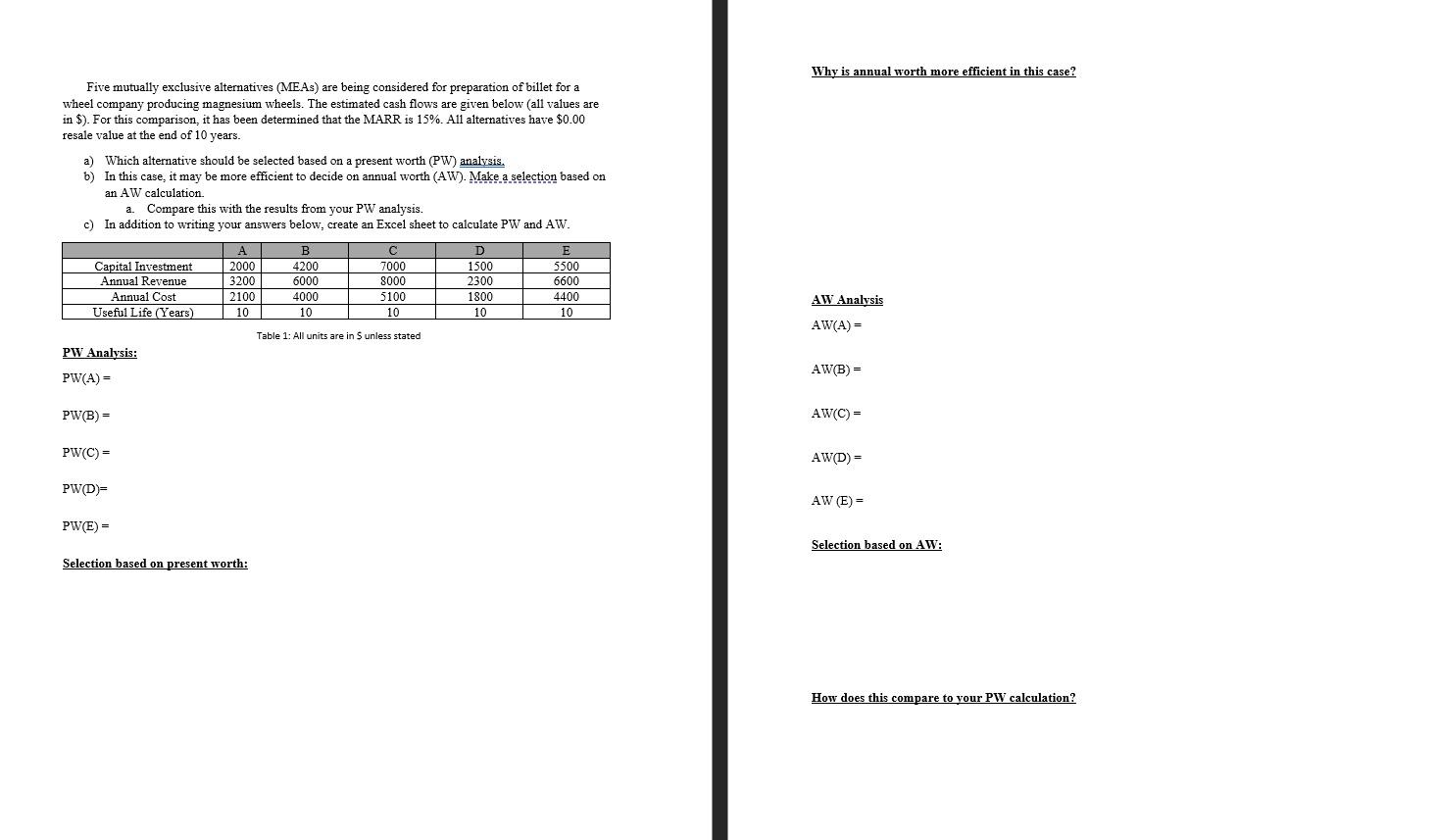

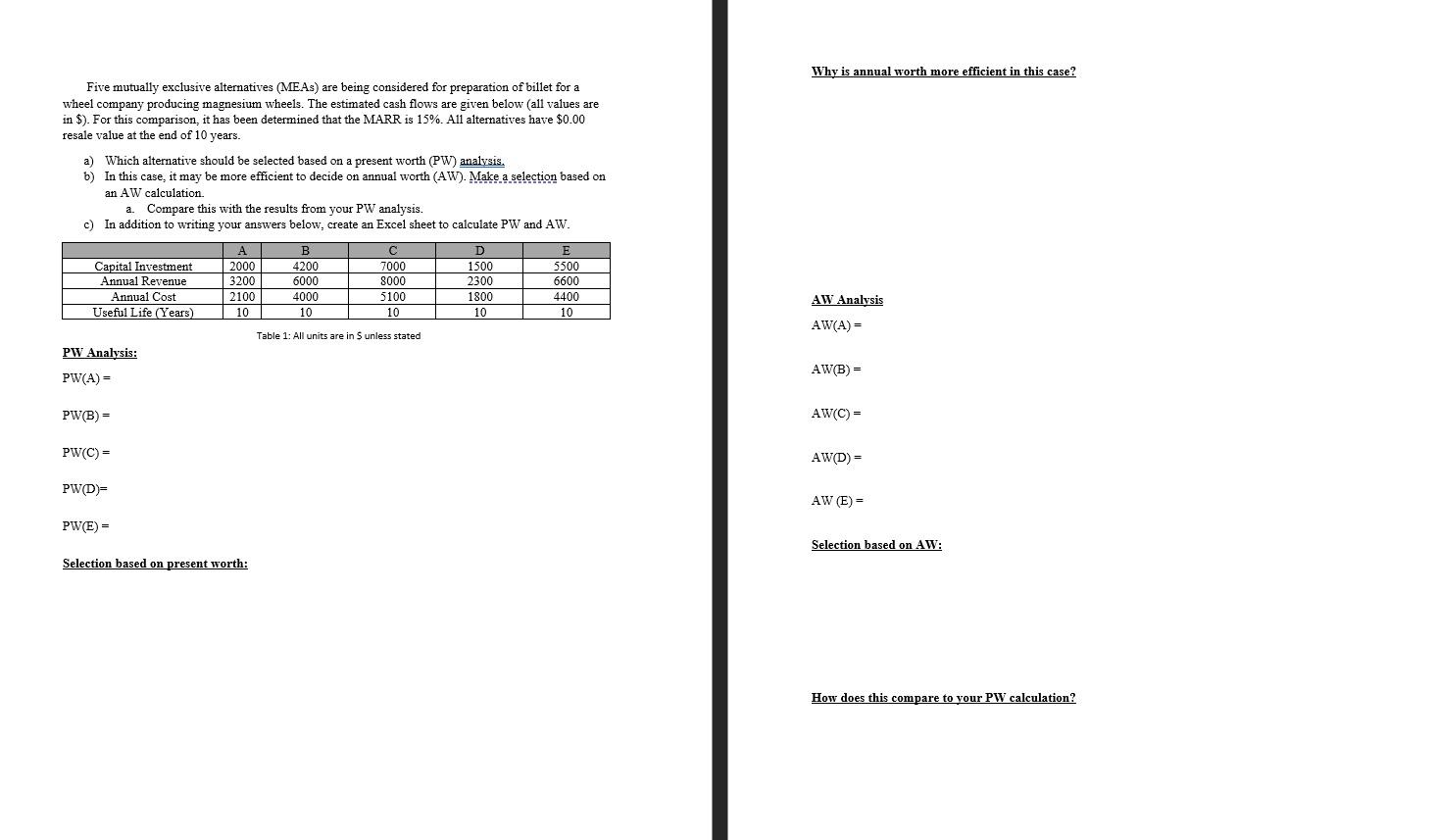

Why is annual worth more efficient in this case? Five mutually exclusive alternatives (MEAs) are being considered for preparation of billet for a wheel company producing magnesium wheels. The estimated cash flows are given below (all values are in $). For this comparison, it has been determined that the MARR is 15%. All alternatives have $0.00 resale value at the end of 10 years. a) Which alternative should be selected based on a present worth (PW) analysis. b) In this case, it may be more efficient to decide on annual worth (AW). Make a selection based on an AW calculation. a. Compare this with the results from your PW analysis. c) In addition to writing your answers below, create an Excel sheet to calculate PW and AW. Capital Investment Annual Revenue Annual Cost Useful Life (Years) A 2000 3200 2100 10 B 4200 6000 4000 10 7000 8000 5100 10 D 1500 2300 1800 10 E 5500 6600 4400 10 AW Analysis AW(A)- Table 1: All units are in Sunless stated PW Analysis: AW(B) = PW(A) = PW(B) = AW(C)= PWC) = AWD)= PWD) AW (E)= PWE)= Selection based on AW: Selection based on present worth: How does this compare to your PW calculation? Why is annual worth more efficient in this case? Five mutually exclusive alternatives (MEAs) are being considered for preparation of billet for a wheel company producing magnesium wheels. The estimated cash flows are given below (all values are in $). For this comparison, it has been determined that the MARR is 15%. All alternatives have $0.00 resale value at the end of 10 years. a) Which alternative should be selected based on a present worth (PW) analysis. b) In this case, it may be more efficient to decide on annual worth (AW). Make a selection based on an AW calculation. a. Compare this with the results from your PW analysis. c) In addition to writing your answers below, create an Excel sheet to calculate PW and AW. Capital Investment Annual Revenue Annual Cost Useful Life (Years) A 2000 3200 2100 10 B 4200 6000 4000 10 7000 8000 5100 10 D 1500 2300 1800 10 E 5500 6600 4400 10 AW Analysis AW(A)- Table 1: All units are in Sunless stated PW Analysis: AW(B) = PW(A) = PW(B) = AW(C)= PWC) = AWD)= PWD) AW (E)= PWE)= Selection based on AW: Selection based on present worth: How does this compare to your PW calculation