Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Why is FV=0 in the solution? How do I find FV? LEARNING BY DOING APPLICATION 6.1 Bidding on a Contract to Rebuild a Bridge Problem

Why is FV=0 in the solution?

How do I find FV?

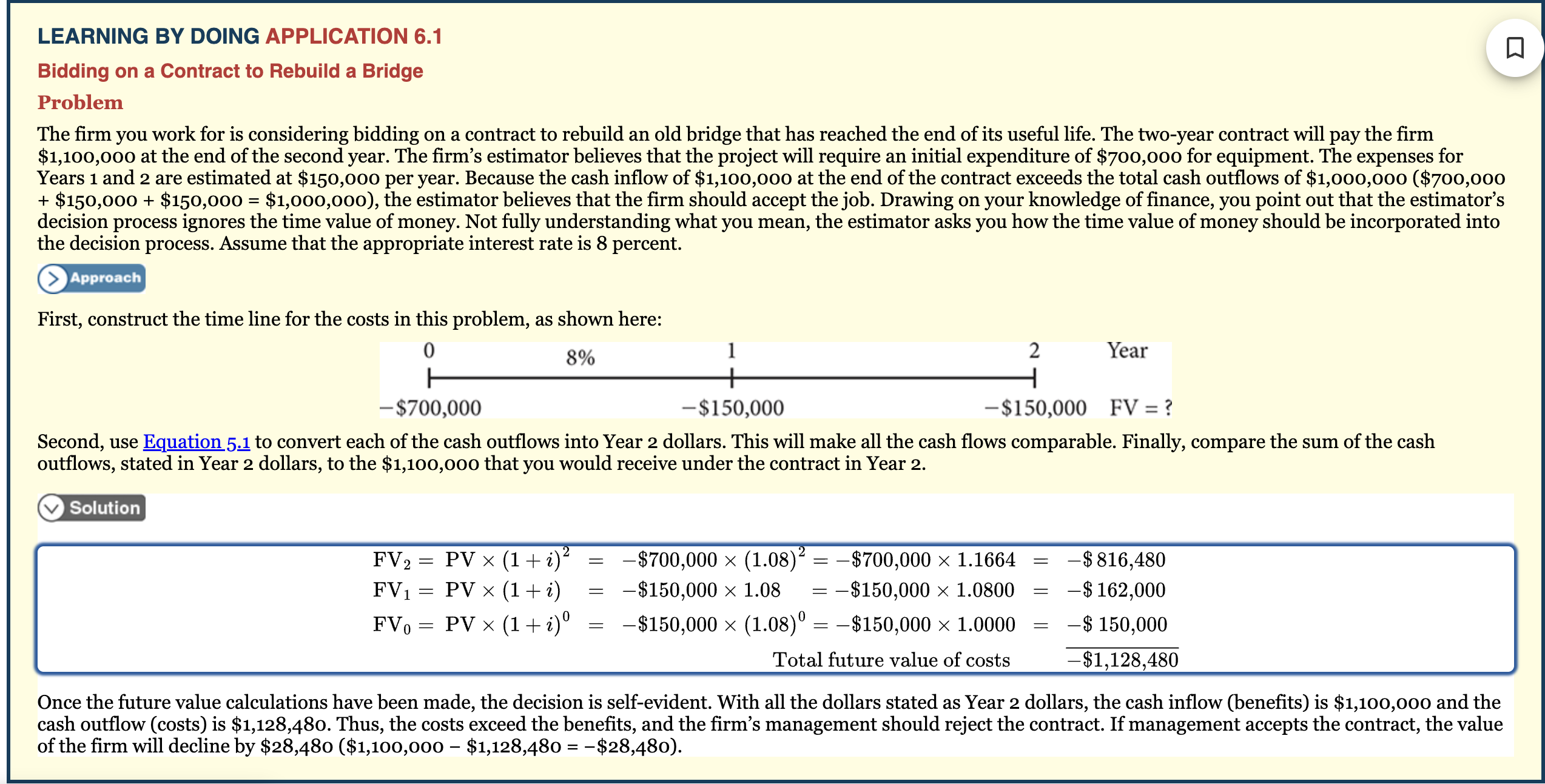

LEARNING BY DOING APPLICATION 6.1 Bidding on a Contract to Rebuild a Bridge Problem The firm you work for is considering bidding on a contract to rebuild an old bridge that has reached the end of its useful life. The two-year contract will pay the firm $1,100,000 at the end of the second year. The firm's estimator believes that the project will require an initial expenditure of $700,000 for equipment. The expenses for Years 1 and 2 are estimated at $150,000 per year. Because the cash inflow of $1,100,000 at the end of the contract exceeds the total cash outflows of $1,000,000 ( $700,000 +$150,000+$150,000=$1,000,000 ), the estimator believes that the firm should accept the job. Drawing on your knowledge of finance, you point out that the estimator's decision process ignores the time value of money. Not fully understanding what you mean, the estimator asks you how the time value of money should be incorporated into the decision process. Assume that the appropriate interest rate is 8 percent. First, construct the time line for the costs in this problem, as shown here: Second, use: to convert each of the cash outflows into Year 2 dollars. This will make all the cash flows comparable. Finally, compare the sum of the cash outflows, stated in Year 2 dollars, to the \$1,100,000 that you would receive under the contract in Year 2. FV2=PV(1+i)2=$700,000(1.08)2=$700,0001.1664=$816,480FV1=PV(1+i)=$150,0001.08=$150,0001.0800=$162,000FV0=PV(1+i)0=$150,000(1.08)0=$150,0001.0000=$150,000Totalfuturevalueofcosts Once the future value calculations have been made, the decision is self-evident. With all the dollars stated as Year 2 dollars, the cash inflow (benefits) is $1,100,000 and the cash outflow (costs) is $1,128,48o. Thus, the costs exceed the benefits, and the firm's management should reject the contract. If management accepts the contract, the value of the firm will decline by $28,480($1,100,000$1,128,480=$28,480)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started