why is the answer 1,820,497 for first sub question and what is the answer for Q 2

why is the answer 1,820,497 for first sub question and what is the answer for Q 2

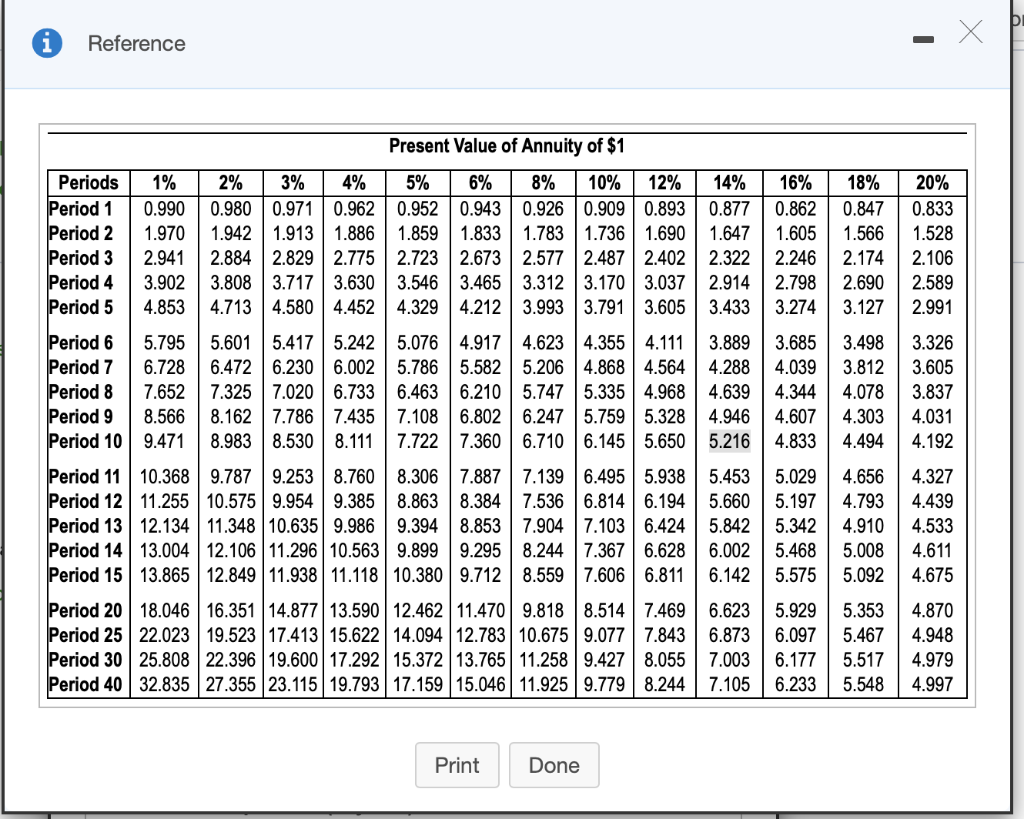

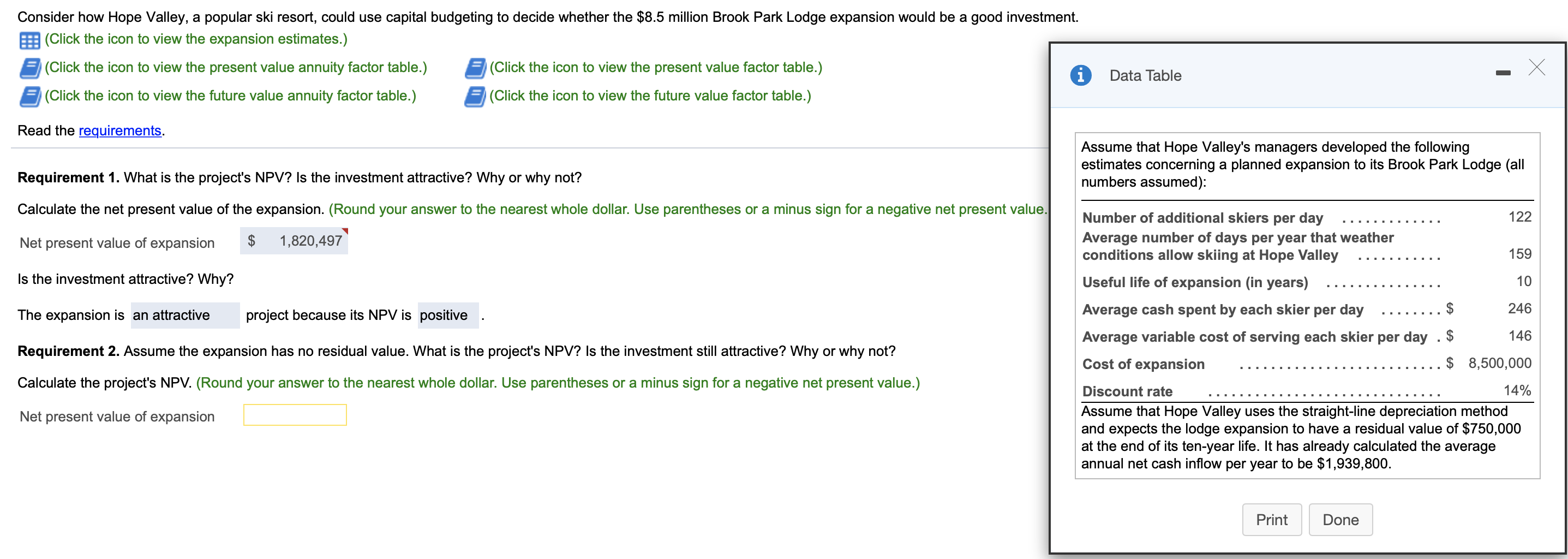

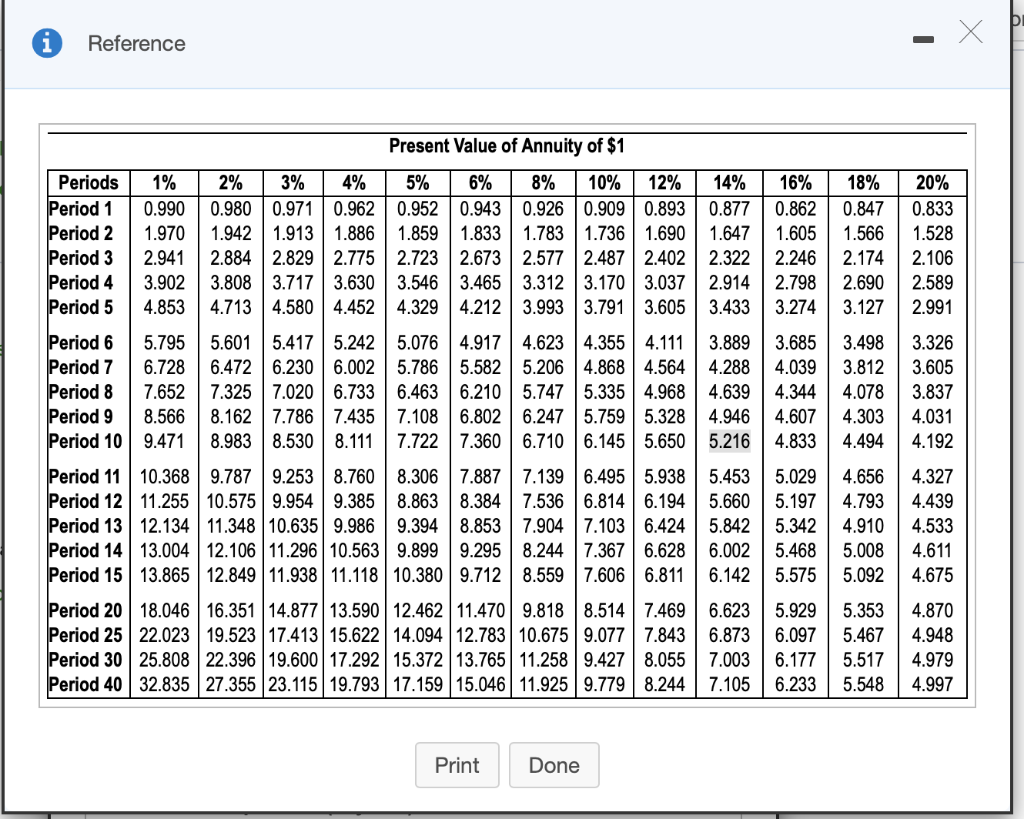

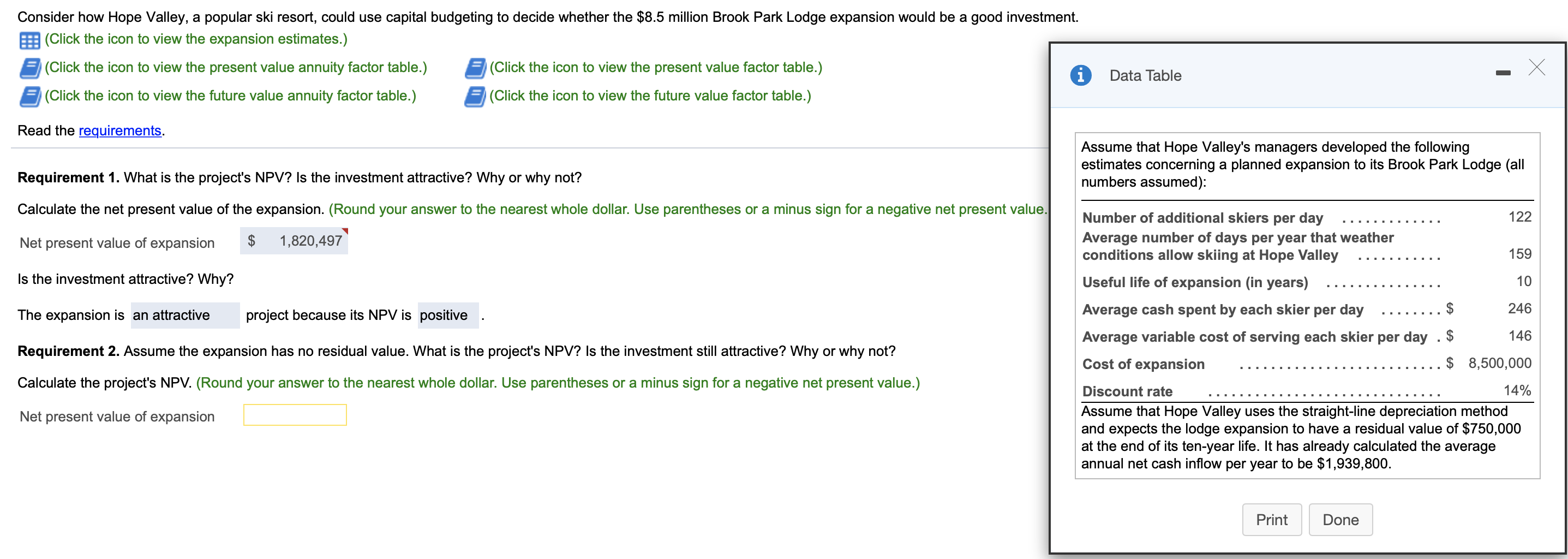

Reference - Present Value of Annuity of $1 Periods 1% 2% 3% 4% 5% 6% 8% 10% 12% 14% Period 1 0.990 0.980 0.971 0.962 0.952 0.943 0.926 0.909 0.893 0.877 Period 2 1.970 1.942 1.9131.886 1.859 1.833 1.783 1.736 1.690 1.647 Period 3 2.941 2.884 2.829 2.775 2.723 2.673 2.577 2.487 2.402 2.322 Period 4 3.902 3.808 3.717 3.630 3.546 3.465 3.312 3.170 3.037 2.914 Period 5 4.853 4.713 4.580 4.452 4.329 4.212 3.993 3.791 3.605 3.433 Period 6 5.795 5.601 5.417 5.2425.076 4.917 4.623 4.355 4.111 3.889 Period 7 6.728 6.472 6.230 6.002 5.786 5.582 5.206 4.868 4.564 4.288 Period 8 7.652 7.325 7.020 6.733 6.463 6.210 5.747 5.335 4.968 4.639 Period 9 8.566 8.1627.786 7.435 7.108 6.8026.247 5.759 5.328 4.946 Period 10 9.471 8.983 8.530 8.111 7.722 7.360 6.710 6.145 5.650 5.216 16% 0.862 1.605 2.246 2.798 3.274 18% 0.847 1.566 2.174 2.690 3.127 20% 0.833 1.528 2.106 2.589 2.991 3.685 4.039 4.344 4.607 4.833 3.498 3.812 4.078 4.303 4.494 3.326 3.605 3.837 4.031 4.192 Period 11 | 10.368 9.787 9.253 8.760 8.306 7.887 7.139 6.495 5.938 5.453 Period 12 11.255 10.575 9.954 9.385 8.863 8.384 7.536 6.814 6.194 5.660 Period 13 12.134 11.348 10.635 9.986 9.394 8.853 7.904 7.103 6.424 5.842 Period 1413.004 12.106 11.296 10.563 9.899 9.295 8.244 7.3676.628 6.002 Period 15 13.865 12.849 11.938 11.118 10.380 9.7128.559 7.606 6.811 6.142 Period 2018.046 16.351 14.877 13.590 12.462 11.470 9.818 8.5147.469 6.623 Period 25 22.023 19.523 17.413 15.622 14.094 12.783 10.675 9.077 7.843 6.873 Period 30 25.808 22.396 19.600 17.292 15.372 13.765 11.258 9.427 8.055 7.003 Period 40 32.835 27.355 23.115 19.793 17.159 15.046 11.925 9.779 8.244 7.105 5.029 5.197 5.342 5.468 5.575 4.656 4.793 4.910 5.008 5.092 4.327 4.439 4.533 4.611 4.675 5.929 6.097 6.177 6.233 5.353 5.467 5.517 5.548 4.870 4.948 4.979 4.997 Print Done Consider how Hope Valley, a popular ski resort, could use capital budgeting to decide whether the $8.5 million Brook Park Lodge expansion would be a good investment. |(Click the icon to view the expansion estimates.) (Click the icon to view the present value annuity factor table.) (Click the icon to view the present value factor table.) i (Click the icon to view the future value annuity factor table.) (Click the icon to view the future value factor table.) X Data Table Read the requirements. Assume that Hope Valley's managers developed the following estimates concerning a planned expansion to its Brook Park Lodge (all numbers assumed): Requirement 1. What is the project's NPV? Is the investment attractive? Why or why not? Calculate the net present value of the expansion. (Round your answer to the nearest whole dollar. Use parentheses or a minus sign for a negative net present value. Net present value of expansion $ 1,820,497 Is the investment attractive? Why? The expansion is an attractive project because its NPV is positive. Number of additional skiers per day 122 Average number of days per year that weather conditions allow skiing at Hope Valley 159 Useful life of expansion (in years) 10 Average cash spent by each skier per day 246 Average variable cost of serving each skier per day $ 146 Cost of expansion $ 8,500,000 Discount rate 14% Assume that Hope Valley uses the straight-line depreciation method and expects the lodge expansion to have a residual value of $750,000 at the end of its ten-year life. It has already calculated the average annual net cash inflow per year to be $1,939,800. Requirement 2. Assume the expansion has no residual value. What is the project's NPV? Is the investment still attractive? Why or why not? Calculate the project's NPV. (Round your answer to the nearest whole dollar. Use parentheses or a minus sign for a negative net present value.) Net present value of expansion Print Done

why is the answer 1,820,497 for first sub question and what is the answer for Q 2

why is the answer 1,820,497 for first sub question and what is the answer for Q 2