Why is the answer's for A and B the correct answer?

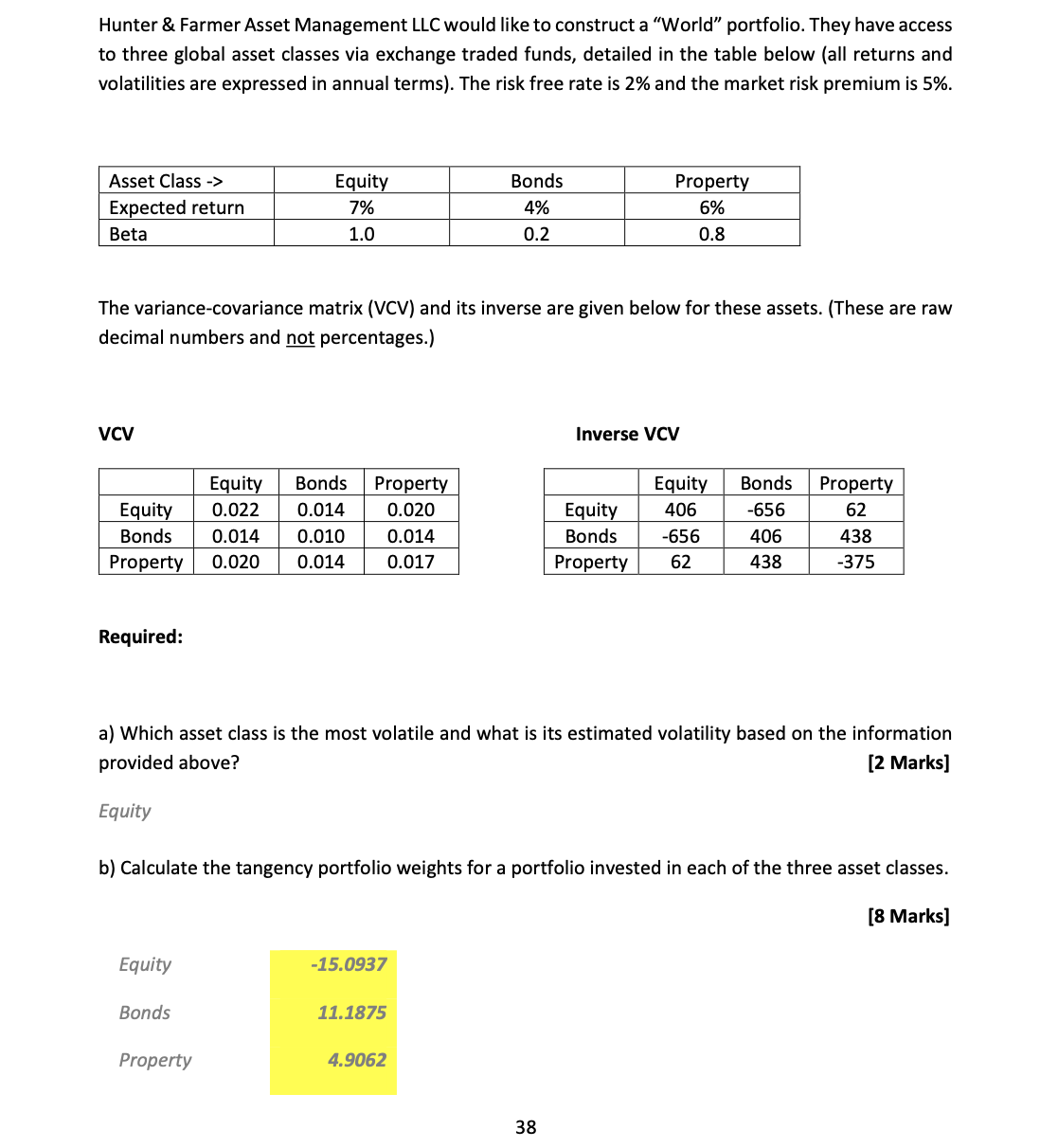

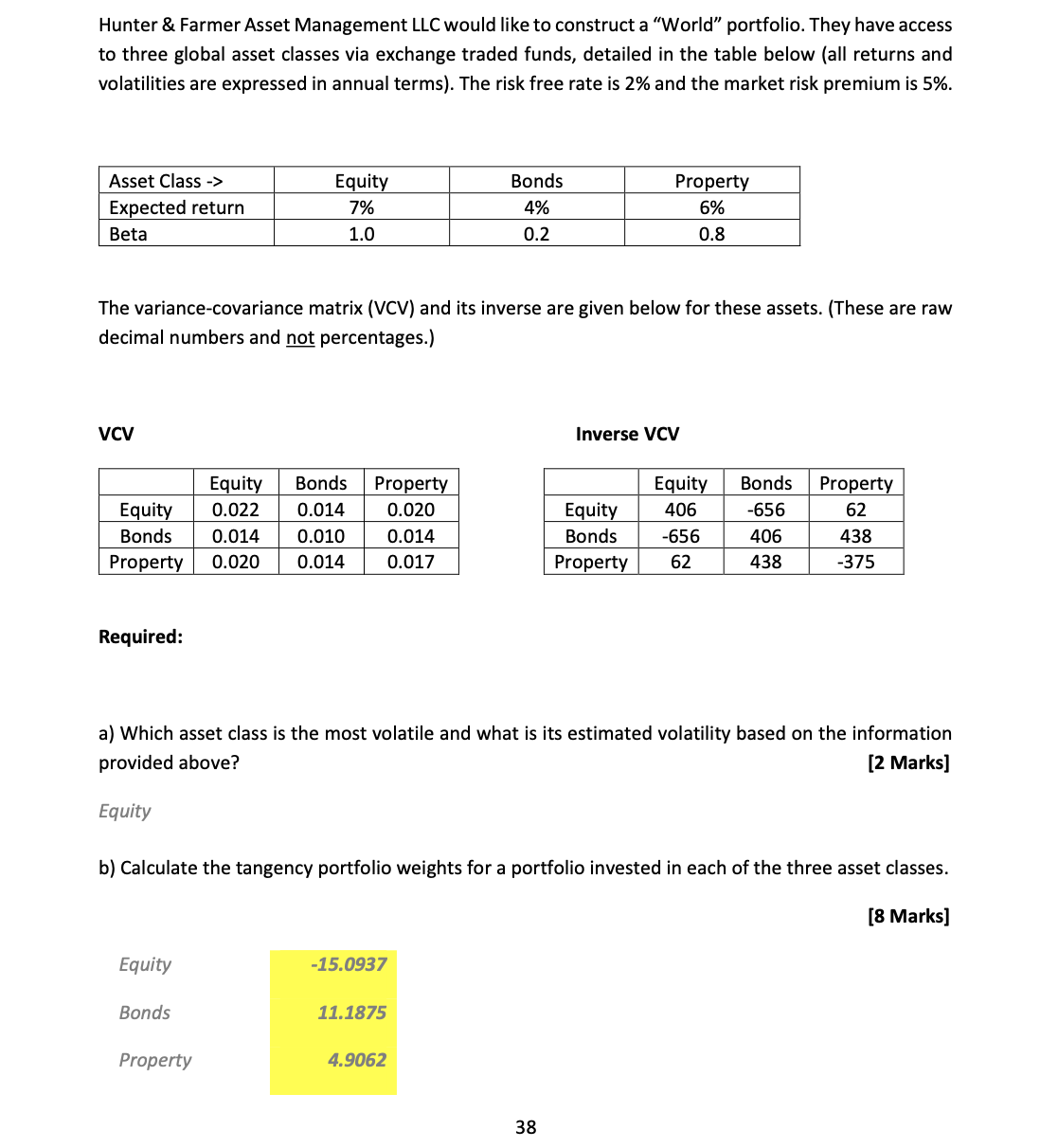

Hunter & Farmer Asset Management LLC would like to construct a "World portfolio. They have access to three global asset classes via exchange traded funds, detailed in the table below (all returns and volatilities are expressed in annual terms). The risk free rate is 2% and the market risk premium is 5%. Asset Class -> Expected return Beta Equity 7% 1.0 Bonds 4% 0.2 Property 6% 0.8 The variance-covariance matrix (VCV) and its inverse are given below for these assets. (These are raw decimal numbers and not percentages.) VCV Inverse VCV Equity Bonds Property Equity 0.022 0.014 0.020 Bonds 0.014 0.010 0.014 Property 0.020 0.014 0.017 Equity Bonds Property Equity 406 -656 62 Bonds -656 406 438 Property 62 438 -375 Required: a) Which asset class is the most volatile and what is its estimated volatility based on the information provided above? [2 marks] Equity b) Calculate the tangency portfolio weights for a portfolio invested in each of the three asset classes. [8 Marks] Equity -15.0937 Bonds 11.1875 Property 4.9062 38 Hunter & Farmer Asset Management LLC would like to construct a "World portfolio. They have access to three global asset classes via exchange traded funds, detailed in the table below (all returns and volatilities are expressed in annual terms). The risk free rate is 2% and the market risk premium is 5%. Asset Class -> Expected return Beta Equity 7% 1.0 Bonds 4% 0.2 Property 6% 0.8 The variance-covariance matrix (VCV) and its inverse are given below for these assets. (These are raw decimal numbers and not percentages.) VCV Inverse VCV Equity Bonds Property Equity 0.022 0.014 0.020 Bonds 0.014 0.010 0.014 Property 0.020 0.014 0.017 Equity Bonds Property Equity 406 -656 62 Bonds -656 406 438 Property 62 438 -375 Required: a) Which asset class is the most volatile and what is its estimated volatility based on the information provided above? [2 marks] Equity b) Calculate the tangency portfolio weights for a portfolio invested in each of the three asset classes. [8 Marks] Equity -15.0937 Bonds 11.1875 Property 4.9062 38