Answered step by step

Verified Expert Solution

Question

1 Approved Answer

why is the revised selling price deducted from the cost price in the working? Could you simply explain and highlight the double entries please Note

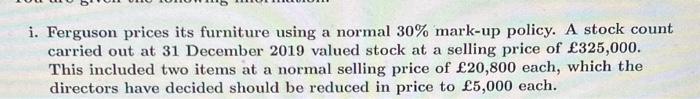

why is the revised selling price deducted from the cost price in the working? Could you simply explain and highlight the double entries please

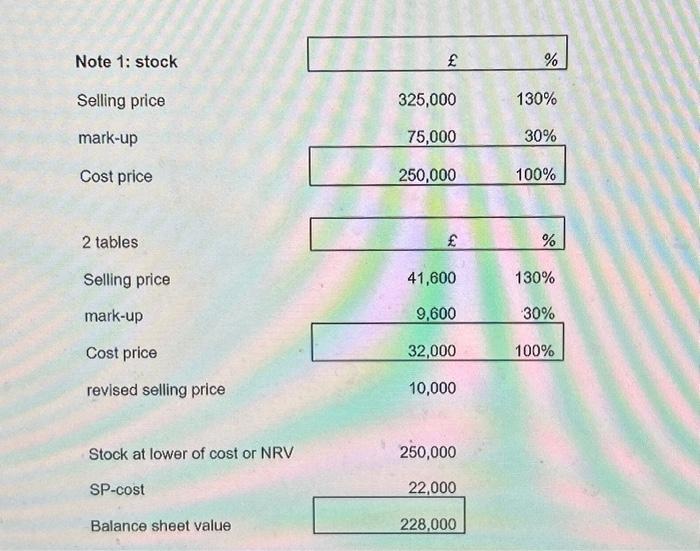

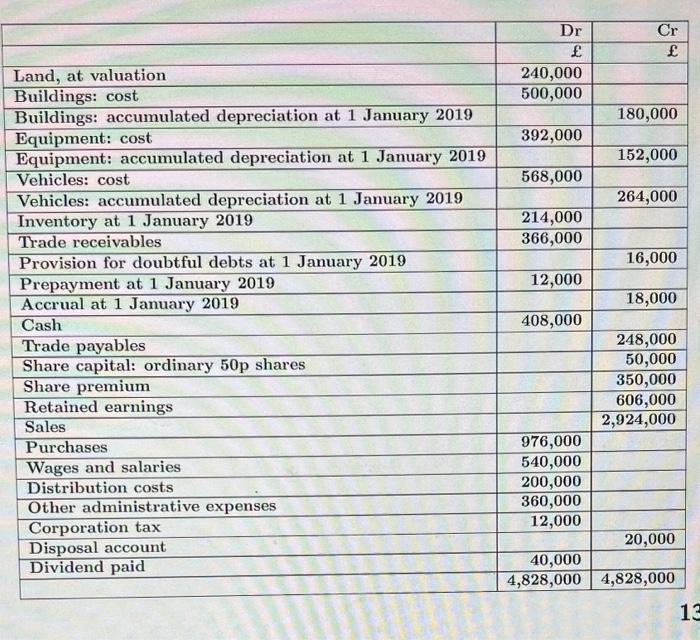

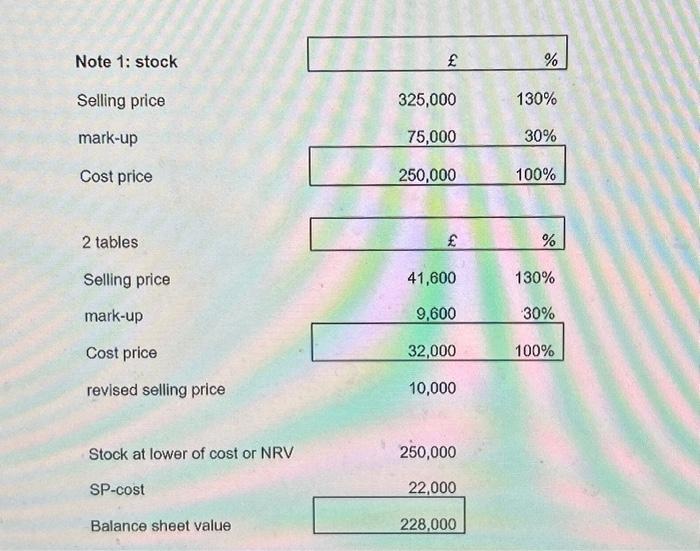

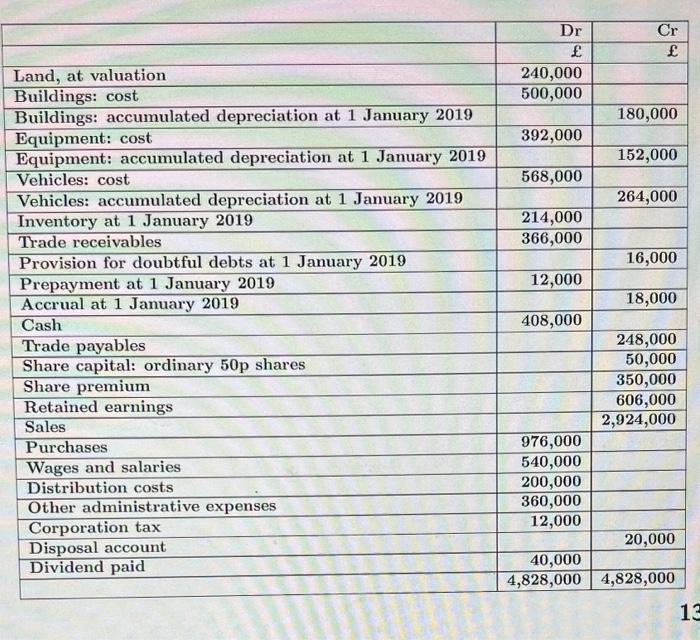

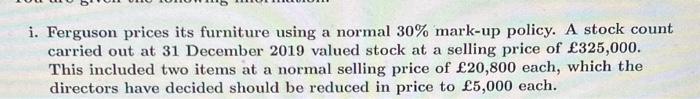

Note 1: stock Selling price mark-up Cost price 2 tables Selling price mark-up Cost price revised selling price Stock at lower of cost or NRV SP-cost Balance sheet value \begin{tabular}{|rr|} \hline & % \\ \hline 325,000 & 130% \\ 75,000 & 30% \\ \hline 250,000 & 100% \\ \hline \end{tabular} \begin{tabular}{|rr|} \hline & % \\ \hline 41,600 & 130% \\ 9,600 & 30% \\ \hline 32,000 & 100% \\ \hline 10,000 & \\ \hline \end{tabular} 250,00022,000228,000 \begin{tabular}{|l|r|r|} \hline & Dr & Cr \\ \hline & & \\ \hline Land, at valuation & 240,000 & \\ \hline Buildings: cost & 500,000 & \\ \hline Buildings: accumulated depreciation at 1 January 2019 & & 180,000 \\ \hline Equipment: cost & 392,000 & \\ \hline Equipment: accumulated depreciation at 1 January 2019 & & 152,000 \\ \hline Vehicles: cost & 568,000 & \\ \hline Vehicles: accumulated depreciation at 1 January 2019 & & 264,000 \\ \hline Inventory at 1 January 2019 & 214,000 & \\ \hline Trade receivables & 366,000 & \\ \hline Provision for doubtful debts at 1 January 2019 & & 16,000 \\ \hline Prepayment at 1 January 2019 & 12,000 & \\ \hline Accrual at 1 January 2019 & & 18,000 \\ \hline Cash & 408,000 & \\ \hline Trade payables & & 248,000 \\ \hline Share capital: ordinary 50p shares & & 50,000 \\ \hline Share premium & & 350,000 \\ \hline Retained earnings & & 606,000 \\ \hline Sales & & 2,924,000 \\ \hline Purchases & 976,000 & \\ \hline Wages and salaries & 540,000 & \\ \hline Distribution costs & 200,000 & \\ \hline Other administrative expenses & 360,000 & \\ \hline Corporation tax & 12,000 & \\ \hline Disposal account & 4,828,000 & 4,828,000 \\ \hline Dividend paid & & \\ \hline & & 20,000 \\ \hline \end{tabular} i. Ferguson prices its furniture using a normal 30% mark-up policy. A stock count carried out at 31 December 2019 valued stock at a selling price of 325,000. This included two items at a normal selling price of 20,800 each, which the directors have decided should be reduced in price to 5,000 each

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started