Answered step by step

Verified Expert Solution

Question

1 Approved Answer

why issue junior debt? Why might there be a covenant preventing the firm from rasing new debt with equal senority to existing debt? Myopic Investment

why issue junior debt? Why might there be a covenant preventing the firm from rasing new debt with equal senority to existing debt?

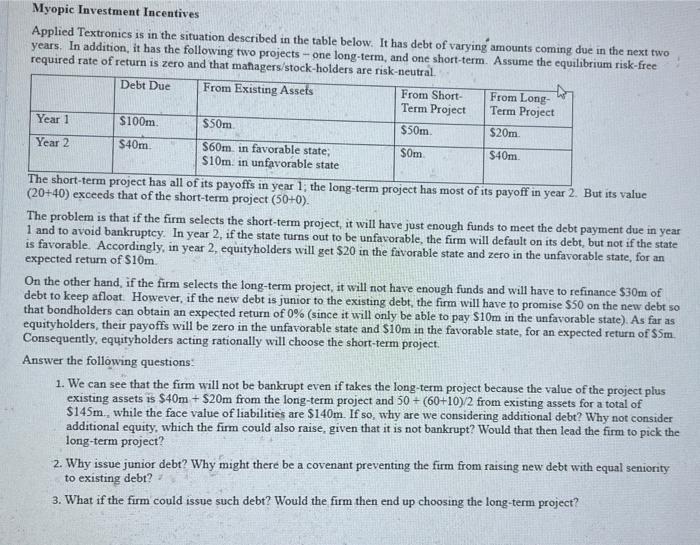

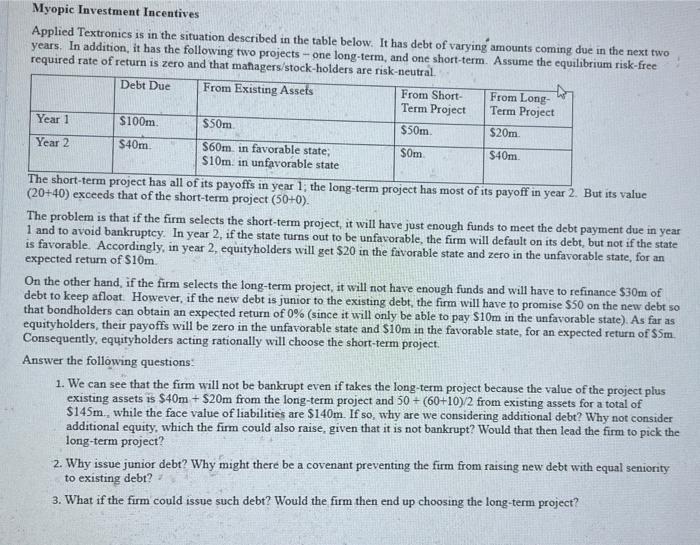

Myopic Investment Incentives Applied Textronics is in the situation described in the table below. It has debt of varying amounts coming due in the next two years. In addition, it has the following two projects - one long-term, and one short-term. Assume the equilibrium risk-free required rate of return is zero and that mafiagers/stock-holders are risk-neitral (20+40) exceedis thect nas all of its payoffs in year 1 ; the long-term project has most of its payoff in year 2 . But its value The problem is that if the firm selects the short-term project, it will have just enough funds to meet the debt payment due in year 1 and to avoid bankruptcy. In year 2 , if the state turns out to be unfavorable, the firm will default on its debt, but not if the state is favorable. Accordingly, in year 2 , equityholders will get $20 in the favorable state and zero in the unfavorable state, for an expected return of $10m. On the other hand, if the firm selects the long-term project, it will not have enough funds and will have to refinance $30m of debt to keep afloat. However, if the new debt is junior to the existing debt, the firm will have to promise $50 on the new debt so that bondholders can obtain an expected return of 0% (since it will only be able to pay $10m in the unfavorable state). As far as equityholders, their payoffs will be zero in the unfavorable state and $10m in the favorable state, for an expected return of $5m. Consequently, equityholders acting rationally will choose the short-term project. Answer the following questions: 1. We can see that the firm will not be bankrupt even if takes the long-term project because the value of the project plus existing assets is $40m+$20m from the long-term project and 50+(60+10)/2 from existing assets for a total of $145m. while the face value of liabilities are $140m. If so, why are we considering additional debt? Why not consider additional equity, which the firm could also raise, given that it is not bankrupt? Would that then lead the firm to pick the long-term project? 2. Why issue junior debt? Why might there be a covenant preventing the firm from raising new debt with equal seniority to existing debt? 3. What if the firm could issue such debt? Would the firm then end up choosing the long-term project

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started