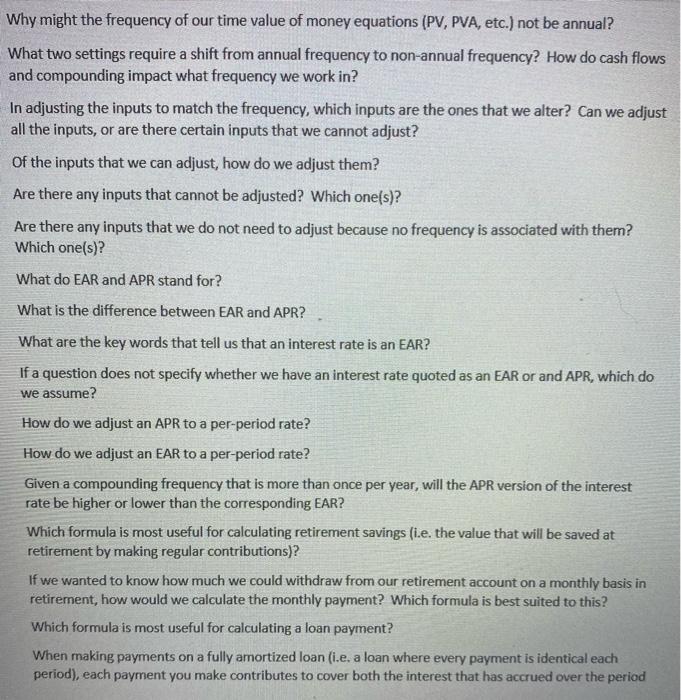

Why might the frequency of our time value of money equations (PV, PVA, etc.) not be annual? What two settings require a shift from annual frequency to non-annual frequency? How do cash flows and compounding impact what frequency we work in? In adjusting the inputs to match the frequency, which inputs are the ones that we alter? Can we adjust all the inputs, or are there certain inputs that we cannot adjust? of the inputs that we can adjust, how do we adjust them? Are there any inputs that cannot be adjusted? Which one(s)? Are there any inputs that we do not need to adjust because no frequency is associated with them? Which one(s)? What do EAR and APR stand for? What is the difference between EAR and APR? What are the key words that tell us that an interest rate is an EAR? If a question does not specify whether we have an interest rate quoted as an EAR or and APR, which do we assume? How do we adjust an APR to a per-period rate? How do we adjust an EAR to a per-period rate? Given a compounding frequency that is more than once per year, will the APR version of the interest rate be higher or lower than the corresponding EAR? Which formula is most useful for calculating retirement savings (i.e. the value that will be saved at retirement by making regular contributions)? If we wanted to know how much we could withdraw from our retirement account on a monthly basis in retirement, how would we calculate the monthly payment? Which formula is best suited to this? Which formula is most useful for calculating a loan payment? When making payments on a fully amortized loan (i.e. a loan where every payment is identical each period), each payment you make contributes to cover both the interest that has accrued over the period Why might the frequency of our time value of money equations (PV, PVA, etc.) not be annual? What two settings require a shift from annual frequency to non-annual frequency? How do cash flows and compounding impact what frequency we work in? In adjusting the inputs to match the frequency, which inputs are the ones that we alter? Can we adjust all the inputs, or are there certain inputs that we cannot adjust? of the inputs that we can adjust, how do we adjust them? Are there any inputs that cannot be adjusted? Which one(s)? Are there any inputs that we do not need to adjust because no frequency is associated with them? Which one(s)? What do EAR and APR stand for? What is the difference between EAR and APR? What are the key words that tell us that an interest rate is an EAR? If a question does not specify whether we have an interest rate quoted as an EAR or and APR, which do we assume? How do we adjust an APR to a per-period rate? How do we adjust an EAR to a per-period rate? Given a compounding frequency that is more than once per year, will the APR version of the interest rate be higher or lower than the corresponding EAR? Which formula is most useful for calculating retirement savings (i.e. the value that will be saved at retirement by making regular contributions)? If we wanted to know how much we could withdraw from our retirement account on a monthly basis in retirement, how would we calculate the monthly payment? Which formula is best suited to this? Which formula is most useful for calculating a loan payment? When making payments on a fully amortized loan (i.e. a loan where every payment is identical each period), each payment you make contributes to cover both the interest that has accrued over the period