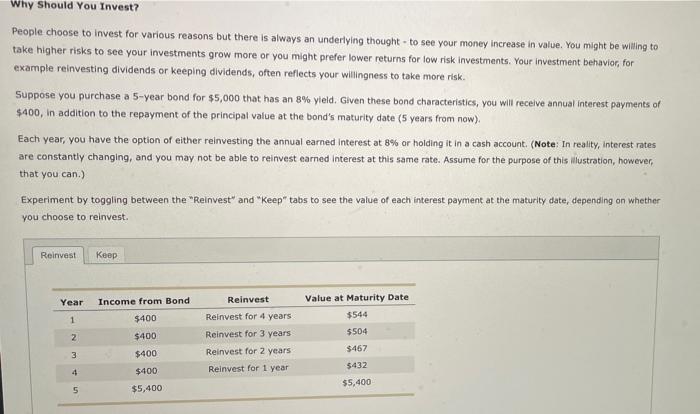

Why Should You Invest? People choose to invest for various reasons but there is always an underlying thought to see your money increase in value. You might be willing to take higher risks to see your investments grow more or you might prefer lower returns for low risk investments. Your investment behavior, for example reinvesting dividends or keeping dividends, often reflects your willingness to take more risk Suppose you purchase a 5-year bond for $5,000 that has an 8% yield. Given these bond characteristics, you will receive annual interest payments of $400, in addition to the repayment of the principal value at the bond's maturity date (5 years from now). Each year, you have the option of either reinvesting the annual earned Interest at 8% or holding it in a cash account. (Note: In reality, Interest rates are constantly changing, and you may not be able to reinvest earned Interest at this same rate. Assume for the purpose of this lllustration, however that you can.) Experiment by toggling between the "Reinvest" and "Keep" tabs to see the value of each interest payment at the maturity date, depending on whether you choose to reinvest. Reinvest Keep Year Reinvest Income from Bond $400 Value at Maturity Date $544 1 $504 2 $400 Reinvest for 4 years Reinvest for 3 years Reinvest for 2 years Reinvest for 1 year $467 3 $400 5432 4 $400 $5,400 5 $5,400 Note: You will be granted a point for any answer you give as there are no right or wrong answers. However, you must answer every question to receive full credit. If none of the offered answer choices is an exact fit, choose the one that most closely reflects your situation or opinion. Based on what you learned from the table, which of the following would you choose to do with your interest payments? Keep all interest payments, because the total increase in interest from reinvesting isn't significant enough. Reinvest the first interest payment, because that yields the most interest-on-interest, and keep the others. Reinvest all interest payments. Reinvest interest payments in the years when you could afford it