Answered step by step

Verified Expert Solution

Question

1 Approved Answer

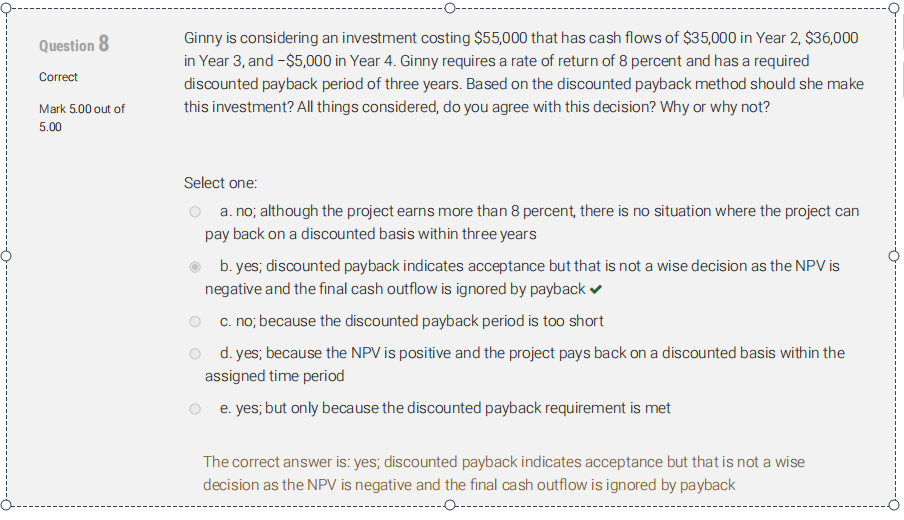

why the answer is not D? should the Npv =-55000+35000/1.08+36000/1.08 2 +-5000/1.08 3 =4302.44? Question 8 Correct Ginny is considering an investment costing $55,000 that

why the answer is not D? should the Npv =-55000+35000/1.08+36000/1.082+-5000/1.083=4302.44?

Question 8 Correct Ginny is considering an investment costing $55,000 that has cash flows of $35,000 in Year 2, $36,000 in Year 3, and -$5,000 in Year 4. Ginny requires a rate of return of 8 percent and has a required discounted payback period of three years. Based on the discounted payback method should she make this investment? All things considered, do you agree with this decision? Why or why not? Mark 5.00 out of 5.00 Select one: a. no; although the project earns more than 8 percent, there is no situation where the project can pay back on a discounted basis within three years b.yes; discounted payback indicates acceptance but that is not a wise decision as the NPV is negative and the final cash outflow is ignored by payback c. no; because the discounted payback period is too short d. yes; because the NPV is positive and the project pays back on a discounted basis within the assigned time period e. yes; but only because the discounted payback requirement is met The correct answer is:yes; discounted payback indicates acceptance but that is not a wise decision as the NPV is negative and the final cash outflow is ignored by paybackStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started