Answered step by step

Verified Expert Solution

Question

1 Approved Answer

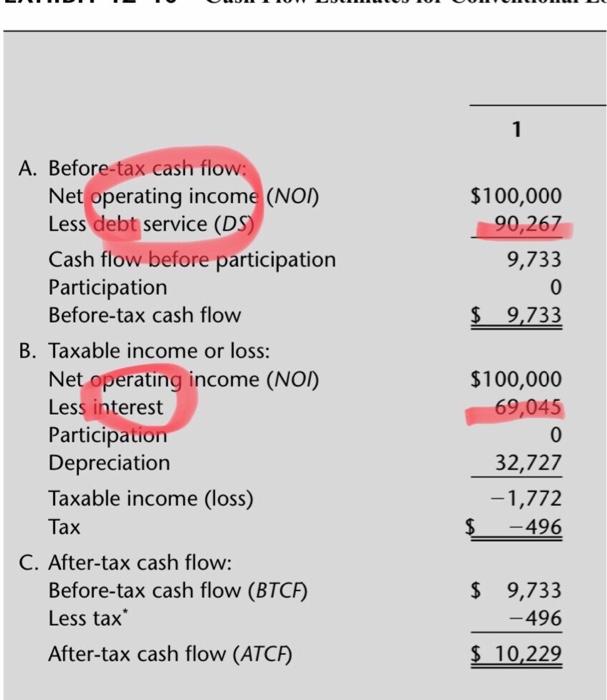

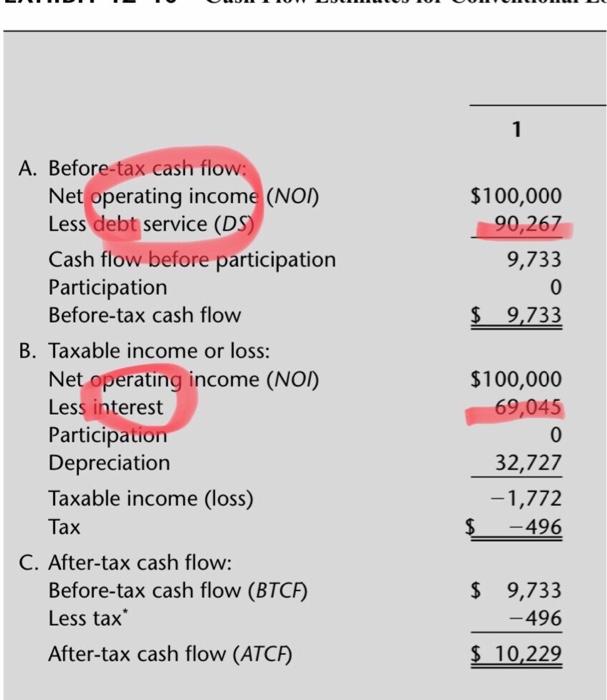

why the interest for this loan in year1 is 69045 no 70000*10%=70000???? Please explain it. Thankyou! To illustrate a participation loan, we assume that an

why the interest for this loan in year1 is 69045 no 70000*10%=70000????

To illustrate a participation loan, we assume that an apartment project that an investor is considering for purchase is projected to have NOI of $100,000 during the first year. After that the NOI is projected to increase 3 percent per year. The property can be purchased for $1 million. This price includes a building value of $900,000, which will be depreciated over 27.5 years. The property value is projected to increase 3 percent per year over a five-year holding period. The investor is in the 28 percent tax bracket for ordinary income and capital gains. The lender has offered the following alternatives: - A conventional, fixed rate, constant payment loan for $700,000 at a 10 percent interest rate (with monthly payments) over a 15 -year term. 1 A. Before-tax cash flow: Net operating income (NOI) Less debt service (DS) Cash flow before participation Participation Before-tax cash flow $100,00090,2679,7330$9,733 B. Taxable income or loss: Net operating income (NOI) Less interest Participation Depreciation Taxable income (loss) Tax $100,00069,045032,7271,772$496 C. After-tax cash flow: Before-tax cash flow (BTCF) $9,733 Less tax After-tax cash flow (ATCF) 496$10,229 Please explain it. Thankyou!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started