Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Why we use Ru formula without tax here while the tax shield next period have tax? Could we use Ru = B/S*Rs*(1-t) + S/B*Rs to

Why we use Ru formula without tax here while the tax shield next period have tax? Could we use Ru = B/S*Rs*(1-t) + S/B*Rs to solve this question? If yes then what different between use Ru formula with and without tax? Which on correct?

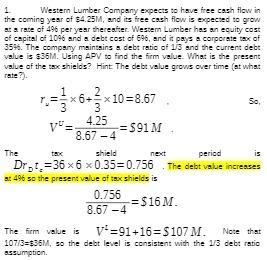

1 Western Lumber Company expects to have free cash flow in the coming year of $4.25M, and its free cash flow is expected to grow at a rate of 496 per year thereafter. Westem Lumber has an equity cost of capital of 1096 and a debt cost of 696, and it pays a corporate tax of 3596. The company maintains a debt ratio of 1/3 and the current debt value is $36M. Using APV to find the firm value. What is the present value of the tax shields? Hint The debt value grows over time (at what x6+x10=8.67 4.25 8.67-4 shield v = -=$91 M The period Drot, 36 x 6 x 0.35=0.756. The debt value increases at 496 so the present value of tax shields is 0.756 8.67-4 next So, -= $16 M. The firm value is V=91+16=$107 M. Note that 107/3=$36M, so the debt level is consistent with the 1/3 debt ratio assumption.

Step by Step Solution

★★★★★

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

In the given scenario the formula Ru BS Rs 1 t SB Rs is not applicable This formula appears to be an ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started