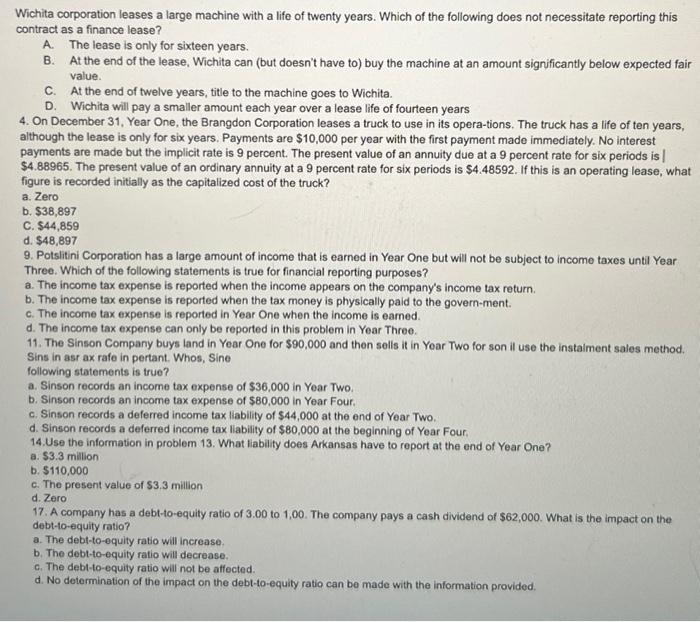

Wichita corporation leases a large machine with a life of twenty years. Which of the following does not necessitate reporting this contract as a finance lease? A. The lease is only for sixteen years. B. At the end of the lease, Wichita can (but doesn't have to) buy the machine at an amount significantly below expected fair value. C. At the end of twelve years, title to the machine goes to Wichita. D. Wichita will pay a smaller amount each year over a lease life of fourteen years 4. On December 31, Year One, the Brangdon Corporation leases a truck to use in its opera-tions. The truck has a life of ten years, although the lease is only for six years. Payments are $10,000 per year with the first payment made immediately. No interest payments are made but the implicit rate is 9 percent. The present value of an annuity due at a 9 percent rate for six periods is 1 $4.88965. The present value of an ordinary annuity at a 9 percent rate for six periods is $4.48592. If this is an operating lease, what figure is recorded initially as the capitalized cost of the truck? a. Zero b. $38,897 c. $44,859 d. $48,897 9. Potslitini Corporation has a large amount of income that is earned in Year One but will not be subject to income taxes until Year Three. Which of the following statements is true for financial reporting purposes? a. The income tax expense is reported when the income appears on the company's income tax return. b. The income tax expense is reported when the tax money is physically paid to the govern-ment. c. The income tax expense is reported in Year One when the income is earned. d. The income tax expense can only be reported in this problem in Year Three. 11. The Sinson Company buys land in Year One for $90,000 and then sells it in Yoar Two for son il use the instalment sales method. Sins in asr ax rafe in pertant. Whos, Sine following statements is true? a. Sinson records an income tax expense of $36,000 in Year Two. b. Sinson records an income tax expense of $80,000 in Year Four. c. Sinson records a deferred income tax liability of $44,000 at the end of Year Two. d. Sinson records a deferred income tax liability of $80,000 at the beginning of Year Four. 14.Use the information in problem 13. What liability does Arkansas have to report at the end of Year One? a. $3.3 million b. $110,000 c. The present value of $3.3 million d. Zero 17. A company has a debt-to-equity ratio of 3.00 to 1,00 . The company pays a cash dividend of $62,000. What is the impact on the debt-10-equity ratio? a. The debt-to-equity ratio will increase. b. The debt-to-equity ratio will decrease. c. The debt-to-equity ratio will not be affected. d. No determination of the impact on the debt-to-equity ratio can be made with the information provided