Answered step by step

Verified Expert Solution

Question

1 Approved Answer

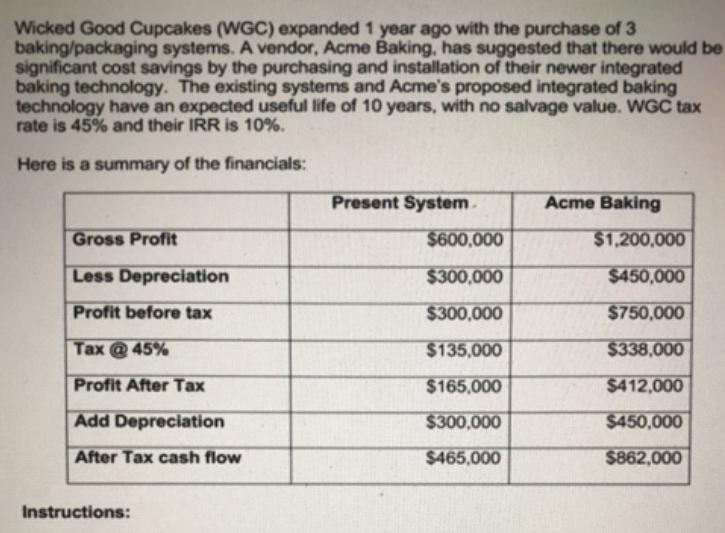

Wicked Good Cupcakes (WGC) expanded 1 year ago with the purchase of 3 baking/packaging systems. A vendor, Acme Baking, has suggested that there would

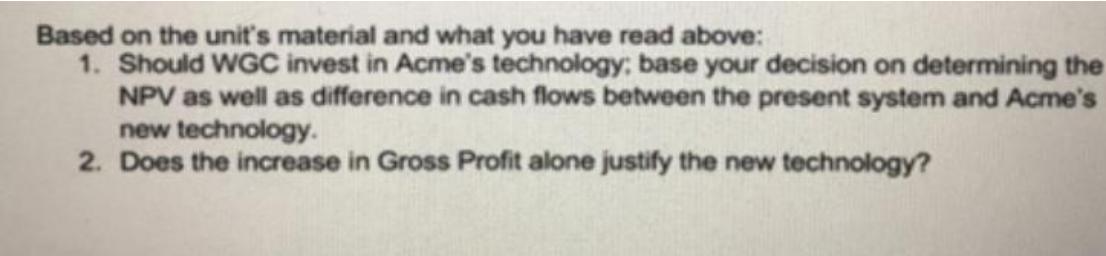

Wicked Good Cupcakes (WGC) expanded 1 year ago with the purchase of 3 baking/packaging systems. A vendor, Acme Baking, has suggested that there would be significant cost savings by the purchasing and installation of their newer integrated baking technology. The existing systems and Acme's proposed integrated baking technology have an expected useful life of 10 years, with no salvage value. WGC tax rate is 45% and their IRR is 10%. Here is a summary of the financials: Gross Profit Less Depreciation Profit before tax Tax@45% Profit After Tax Add Depreciation After Tax cash flow Instructions: Present System. $600,000 $300,000 $300,000 $135,000 $165,000 $300,000 $465,000 Acme Baking $1,200,000 $450,000 $750,000 $338,000 $412,000 $450,000 $862,000 Based on the unit's material and what you have read above: 1. Should WGC invest in Acme's technology; base your decision on determining the NPV as well as difference in cash flows between the present system and Acme's new technology. 2. Does the increase in Gross Profit alone justify the new technology?

Step by Step Solution

★★★★★

3.47 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

1 To determine if WGC should invest in Acmes new technology we need to calculate the NPV and compare ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started