Answered step by step

Verified Expert Solution

Question

1 Approved Answer

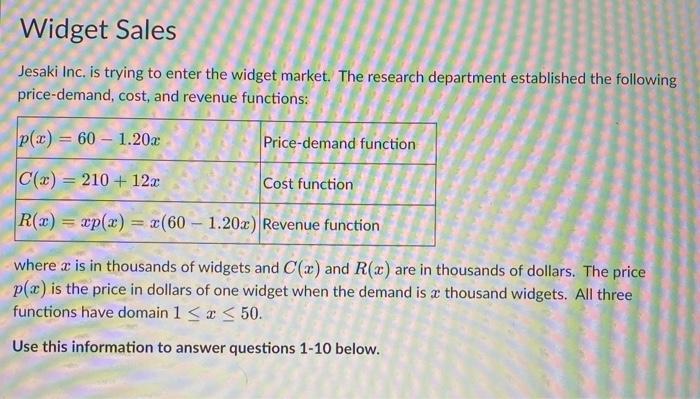

Widget Sales Jesaki Inc. is trying to enter the widget market. The research department established the following price-demand, cost, and revenue functions: p(x) =

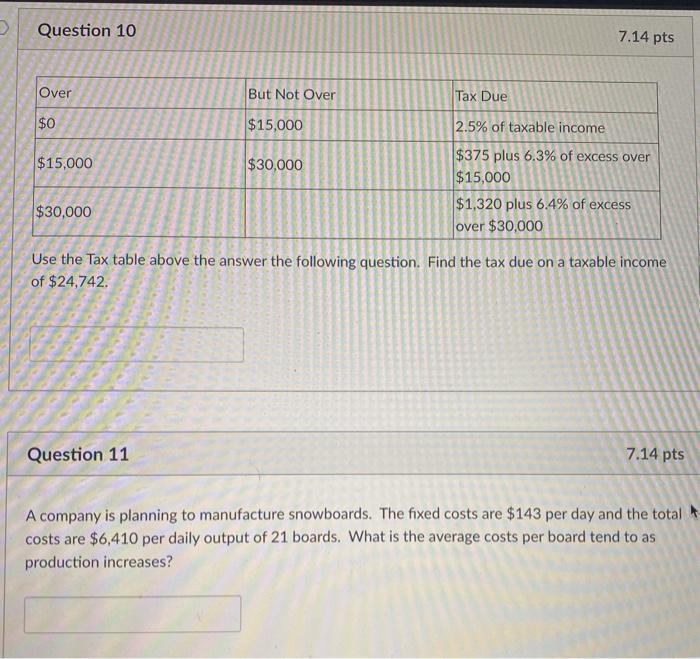

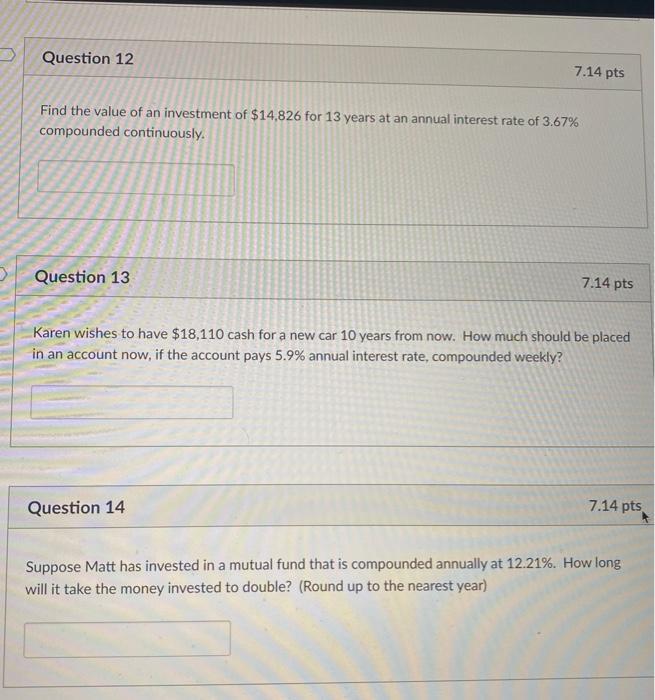

Widget Sales Jesaki Inc. is trying to enter the widget market. The research department established the following price-demand, cost, and revenue functions: p(x) = 60 - 1.20x C(x) = 210 + 12x Cost function R(x) = xp(x) = x(60 - 1.20x) Revenue function where x is in thousands of widgets and C(x) and R(x) are in thousands of dollars. The price p(x) is the price in dollars of one widget when the demand is a thousand widgets. All three functions have domain 1 x 50. Use this information to answer questions 1-10 below. Price-demand function D Question 10 Over $0 $15,000 $30,000 But Not Over $15,000 Question 11 $30,000 Tax Due 7.14 pts 2.5% of taxable income $375 plus 6.3% of excess over $15,000 $1,320 plus 6.4% of excess over $30,000 Use the Tax table above the answer the following question. Find the tax due on a taxable income of $24,742. 7.14 pts A company is planning to manufacture snowboards. The fixed costs are $143 per day and the total costs are $6,410 per daily output of 21 boards. What is the average costs per board tend to as production increases? Question 12 Find the value of an investment of $14,826 for 13 years at an annual interest rate of 3.67% compounded continuously. Question 13 7.14 pts Question 14 7.14 pts Karen wishes to have $18,110 cash for a new car 10 years from now. How much should be placed in an account now, if the account pays 5.9% annual interest rate, compounded weekly? 7.14 pts Suppose Matt has invested in a mutual fund that is compounded annually at 12.21%. How long will it take the money invested to double? (Round up to the nearest year)

Step by Step Solution

★★★★★

3.54 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

solution 10 The tax due on a taxable income of 24742 can be calculated using the tax table given The taxable income of 24742 falls into the third brac...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started