Question

Wiggum and Terwilliger are partners in a business in which profits and losses are shared equally. Wiggum's capital account has a $64 000 balance

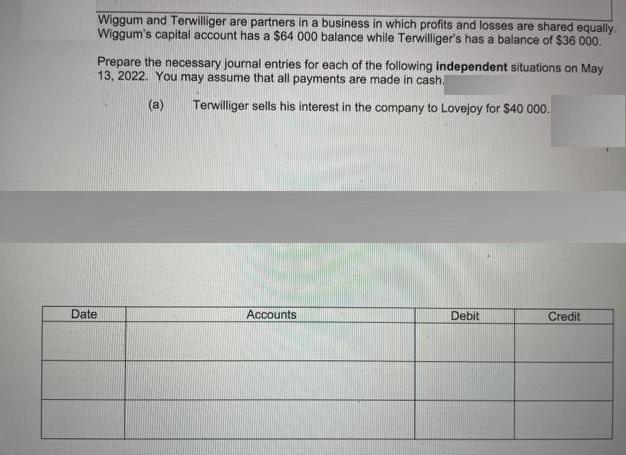

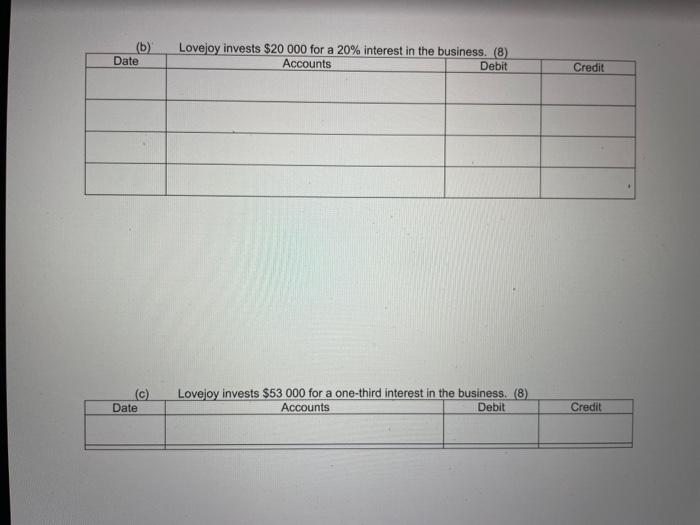

Wiggum and Terwilliger are partners in a business in which profits and losses are shared equally. Wiggum's capital account has a $64 000 balance while Terwilliger's has a balance of $36 000. Prepare the necessary journal entries for each of the following independent situations on May 13, 2022. You may assume that all payments are made in cash. (a) Terwilliger sells his interest in the company to Lovejoy for $40 000. Date Accounts Debit Credit (b) Date (c) Date Lovejoy invests $20 000 for a 20% interest in the business. (8) Accounts Debit Lovejoy invests $53 000 for a one-third interest in the business. (8) Accounts Debit Credit Credit

Step by Step Solution

3.34 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION 583 Determine the largest allowable value of up if ou 10 MPa and Tw14 MPa I ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Advanced Accounting

Authors: Floyd A. Beams, Joseph H. Anthony, Bruce Bettinghaus, Kenneth Smith

11th Edition

978-0132568968, 9780132568968

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App