Answered step by step

Verified Expert Solution

Question

1 Approved Answer

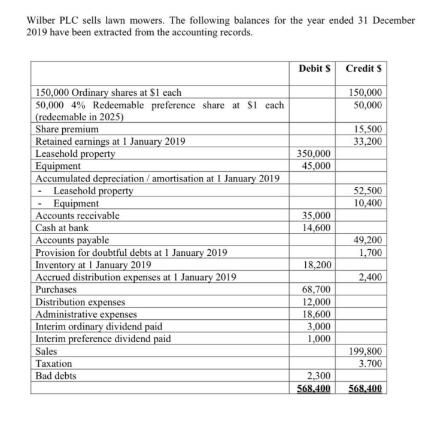

Wilber PLC sells lawn mowers. The following balances for the year ended 31 December 2019 have been extracted from the accounting records. 150,000 Ordinary

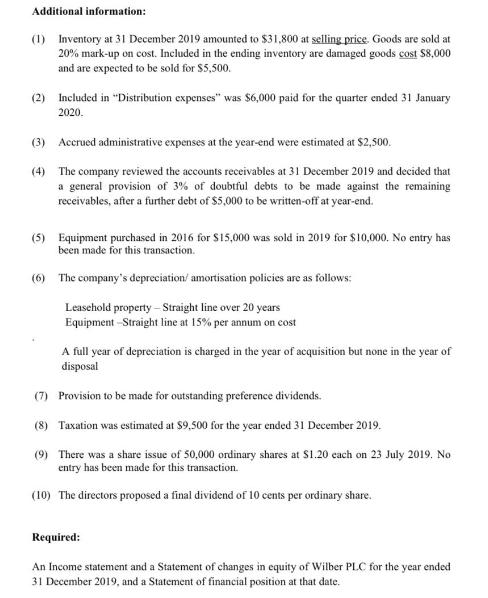

Wilber PLC sells lawn mowers. The following balances for the year ended 31 December 2019 have been extracted from the accounting records. 150,000 Ordinary shares at $1 each 50,000 4% Redeemable preference share at $1 each (redeemable in 2025) Share premium Retained earnings at 1 January 2019 Leasehold property Equipment Accumulated depreciation / amortisation at 1 January 2019 - Leasehold property Equipment Accounts receivable Cash at bank Accounts payable Provision for doubtful debts at 1 January 2019 Inventory at 1 January 2019 Accrued distribution expenses at 1 January 2019 Purchases Distribution expenses Administrative expenses Interim ordinary dividend paid Interim preference dividend paid Sales Taxation Bad debts Debit S Credit S 150,000 50,000 350,000 45,000 35,000 14,600 18,200 68,700 12,000 18,600 3,000 1,000 2,300 568.400 15,500 33,200 52,500 10,400 49,200 1,700 2,400 199,800 3.700 568,400 Additional information: (1) Inventory at 31 December 2019 amounted to $31,800 at selling price. Goods are sold at 20% mark-up on cost. Included in the ending inventory are damaged goods cost $8,000 and are expected to be sold for $5,500. (2) Included in "Distribution expenses" was $6,000 paid for the quarter ended 31 January 2020. (3) Accrued administrative expenses at the year-end were estimated at $2,500. (4) The company reviewed the accounts receivables at 31 December 2019 and decided that a general provision of 3% of doubtful debts to be made against the remaining receivables, after a further debt of $5,000 to be written-off at year-end. (5) Equipment purchased in 2016 for $15,000 was sold in 2019 for $10,000. No entry has been made for this transaction. (6) The company's depreciation/ amortisation policies are as follows: Leasehold property - Straight line over 20 years Equipment -Straight line at 15% per annum on cost A full year of depreciation is charged in the year of acquisition but none in the year of disposal (7) Provision to be made for outstanding preference dividends. (8) Taxation was estimated at $9,500 for the year ended 31 December 2019. (9) There was a share issue of 50,000 ordinary shares at $1.20 each on 23 July 2019. No entry has been made for this transaction. (10) The directors proposed a final dividend of 10 cents per ordinary share. Required: An Income statement and a Statement of changes in equity of Wilber PLC for the year ended 31 December 2019, and a Statement of financial position at that date.

Step by Step Solution

★★★★★

3.45 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Based on the given information lets prepare the income statement statement of changes in equity and the statement of financial position for Wilber PLC for the year ended 31 December 2019 Income Statem...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started